One-third of the funds that made the best returns of 2022 crashed into the bottom quartile of their sectors in 2023 after market leadership flipped once again, research by Trustnet shows.

The decade-long bull market that followed the 2008 global financial crisis was dominated by the growth investing style, especially tech stocks, but recent years have been more up and down.

Since the end of the Covid pandemic, inflation has spiked and central banks have been forced to hike interest rates. This broke the streak established by growth investing: in 2021 and 2022, value stocks – which had underperformed for a significant period – outpaced growth stocks by a wide margin.

However, Trustnet research found investors who backed the winning funds of 2022 would have been disappointed last year as growth stocks regained market leadership thanks to the artificial intelligence (AI) boom and signs that rate hikes have peaked.

Some 61.7% of the funds with first-quartile performance in 2022 went on to make third- or fourth-quartile returns in 2023 – meaning they underperformed their average peer – with 33.9% ending up in the bottom quartile. Just 18% of the funds in 2022’s top quartile held onto this position in 2023.

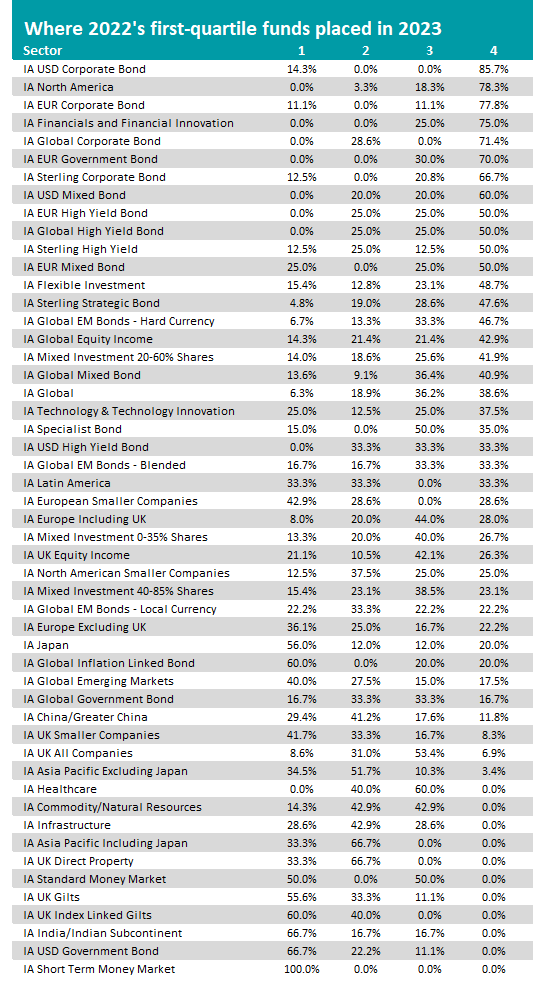

The table below shows where each sector’s first-quartile funds of 2022 ranked in 2023 following the latest shift in market dynamics (ranked according to the percentage that went into the bottom quartile) and some interesting points can be seen.

Source: FE Analytics

IA USD Corporate Bond is at the top of the list but this is a small and relatively niche sector. Six of the seven funds that were in 2022’s top quartile fell to the bottom of the peer group last year.

A more notable peer group is in second place – the IA North America sector is the third largest in the Investment Association universe with total assets under management of £81.7bn (according to the latest figures, dated October 2022).

Close to 80% of the sector’s 2022 first quartile dropped into the fourth quartile last year. Among these funds are value specialists (such as NB US Large Cap Value, T. Rowe Price US Large Cap Value Equity, Fidelity American Special Situations, BlackRock GF US Basic Value), equity income strategies (JPM US Equity Income, SSGA SPDR S&P US Dividend Aristocrats UCITS ETF, BNY Mellon US Equity Income) and sector-specific ETFs (iShares S&P 500 Financials Sector UCITS ETF, SSGA SPDR S&P U.S. Energy Select Sector UCITS ETF, SSGA SPDR S&P U.S. Health Care Select Sector UCITS ETF).

What’s more, not a single IA North America fund that made a top-quartile return in 2022 was able to hold onto this position in the following year, as the market swung from value/old economy/income stocks towards growth/new economy plays.

Other sectors were every fund left the top quartile include IA Financials and Financial Innovation, IA Healthcare and IA Global Corporate Bond.

The bulk of the sectors at the top of the list are dollar, euro or global fixed income peer groups, which tend to be off many investors’ radars but some mainstream sectors also witnessed a big jump from the top quartile to the bottom.

IA Sterling Corporate Bond saw three-quarters of 2022’s best funds slide to the bottom of the rankings last year. As would be expected given the moves in interest rates, many of these were short-dated funds such as L&G Short Dated Sterling Corporate Bond Index, iShares £ Corporate Bond 0-5yr UCITS ETF and Vanguard UK Short-Term Investment Grade Bond Index.

The top-quartile of the IA Flexible Investment sector also struggled with the likes of Trojan, NB Uncorrelated Strategies and M&G UK Income Distribution finding themselves in the fourth quartile last year.

It was also an uninspiring showing for the IA Global sector – the largest in the Investment Association universe – as just 6.3% of its first-quartile funds repeated their success in 2023. Almost 40% went from the top to bottom quartile over the two years in question, including Lindsell Train Global Equity, M&G Global Themes and JOHCM Global Opportunities.

However, it’s worth keeping in mind that two years is a short track record on which to assess funds’ performance – especially as movement between quartiles from year to year is the norm.

It is also interesting to note that many of the funds that went from the top to bottom quartile between 2022 and 2023 still rank well over the entire two-year period under consideration.

FE Analytics shows that, of the 303 funds that were in 2022’s top quartile but 2023’s bottom quartile, 146 made a first quartile return over the whole period. Another 105 are in the second quartile, 40 are in the third and just 12 are in the fourth quartile.