When hunting for income, the dividend paid isn’t the only metric investors should consider. In Peel Hunt’s playbook for income investing, analysts Anthony Leatham, Markuz Jaffe and Thomas Pocock took many more metrics into account and selected trusts that combine the benefits of total return, fully covered and growing dividend streams as well as robust fundamentals.

Following last week’s collection of growth picks, below are Peel Hunt’s 2024 trusts for income seekers – beyond equity, they include infrastructure, renewables, shipping and real estate opportunities.

We begin with equity income and the JPMorgan Global Growth and Income trust, led by Heige Skibeli, James Cook and Tim Woodhouse.

The team invests with a global, unconstrained investment process and no income requirement on individual stock picks, enabling them to make investments in low- or non-yielding holdings such as high-growth defensive names and large-cap tech companies. Currently, the portfolio is overweight high-growth cyclicals and low-growth defensives, healthcare and defensive infrastructure.

Over the past five years, it has delivered an annualised return of 15.4% and now trades on a 1% premium.

Performance of fund vs sector and index over 5yrs

Source: FE Analytics

In the UK, Leatham chose Law Debenture, the top performer for five-year annualised returns (9%) in the IT UK Equity Income sector.

The portfolio, managed by James Henderson and Laura Foll, convinced for its “strong base of largely recurring revenues”, “robust” dividend cover and flexibility to allocate to lower-yielding investments.

“We see the equity portfolio as positively geared to an improving economic backdrop and expect the managers to make full use of the flexibility afforded by the income generation of the wholly owned Independent Professional Services business,” Leatham said.

“The trust also continues to build on its 44-year track record of maintaining or increasing dividends.” The current yield is 4.14%.

For investors attracted to income from Japanese companies, the recommendation is CC Japan Income & Growth, one of the best-performing trusts in its sector, currently trading on a 7% discount.

The company aims to make the most out of the corporate reforms in Japan that have been ongoing since 2015. The Peel Hunt team saw opportunities in the “attractive” Japanese market, which trades on a price-to-earnings discount to other developed markets and highlighted the fully covered yield of 2.8% offering a premium to the Topix index.

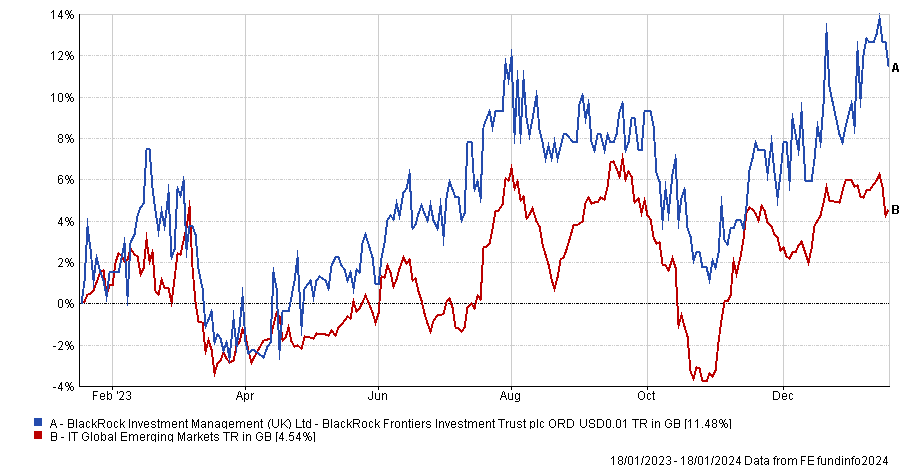

Finally, in Blackrock Frontiers Leatham and his team found “a unique source of return from frontier economies” at a 9% discount.

The trust’s investment process is focused both on bottom-up alpha generation and a macro-led asset allocation approach to regional investments, with Saudi Arabia being the trust’s current largest country exposure (16% of assets). The largest country overweights are the Philippines (+4 percentage points versus the index), Hungary (+4) and Colombia (+3). Recent performance has been “strong”, as illustrated below.

Performance of fund vs sector and index over 1yr

Source: FE Analytics

In the alternatives side of the universe, infrastructure is where Leatham identified the most opportunities, with real returns being “an important building block in portfolios”.

The first highlight was the BBGI Global Infrastructure investment company, which uses public-private partnerships as a source of income and currently trades on a 11% discount.

The strategy provides “strong underlying inflation linkage, a well-covered dividend and attractive dividend growth” by mainly investing in transport (53%) and healthcare (21%) businesses in Canada (35% of the portfolio), the UK (33%), continental Europe (12%), Australia (10%) and the US (10%).

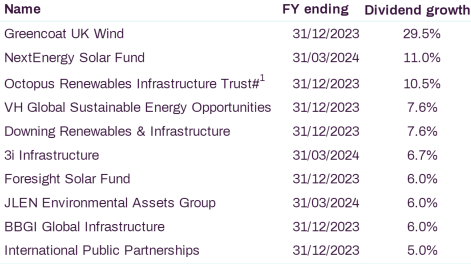

For digital infrastructure the team’s choice was Cordiant Digital Infrastructure, which has a bias towards Central Europe and communications towers, while in the renewable energy space, Greencoat UK Wind demonstrated “sustained momentum across several key metrics”, including the strongest dividend growth by far in the listed infrastructure space, as shown in the table below.

Both strategies were not immune to the broader de-rating of the listed alternative investments and started to buy back shares last year.

Top 10 listed infrastructure dividend growth

Source: Peel Hunt

Brick and mortar aficionados were pointed towards Empiric Student Property, with Leatham remaining constructive on the growth outlook for the purpose-built student accommodation sector, and towards Primary Health Properties, which stood out for its 27-year track record of consecutive dividend increases, recent rental growth, an attractive yield of 6.9%, and “consistently low-risk” cash flow profile.

Sequoia Economic Infrastructure, BioPharma Credit and Tufton Oceanic Assets were also recommended.