Investors who choose to pay higher fees for active managers should always make sure that that extra cost doesn’t go wasted and actually brings added value to their portfolio.

Increasingly under scrutiny, active managers must prove their worth not only by being able to match the return of a benchmark, which any passive fund can do, but by showing that they can beat it time and time again.

Performance exceeding the index is measured by alpha, a parameter that shows how much of a fund’s return is down to the manager’s stockpicking rather than the index growing on its own. Managers consistently keeping a high alpha are those that give investors the most bang for their buck.

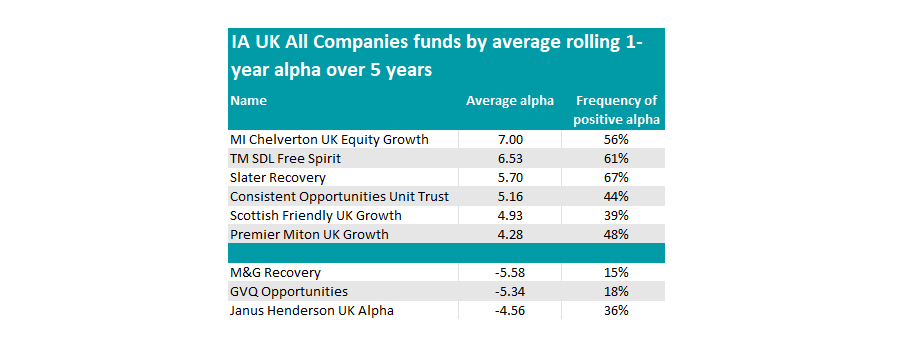

In this new series, we analyse funds in each Investment Association sector by their average 12-month alpha score measured every month since the beginning of 2018 to the end of 2023 – this means that the outcomes are independent of when money was added to the fund, showing which active managers have delivered for investors at any given point in the timeframe in consideration.

We begin with the IA UK All Companies sector and only consider funds with a complete track record. We have run the data against the fund’s own benchmark.

The first manager to stand out was James Baker, who runs the £636.3m MI Chelverton UK Equity Growth fund. He focuses on small and mid-cap companies – the sector where active managers tend to be most successful. Baker has proved his worth by adding an average 7% return on top of his benchmark – the highest figure among all funds in the list.

This fund launched in October 2014 and has been one of the best-performing funds in both the IA UK All Companies sector over the long term.

Baker, who has specialised in this area of the market for over 30 years and is appreciated for his strong stock-picking abilities, is complemented by Edward Booth, who was appointed as co-manager in 2017 and Henry Botting, who joined in 2022.

This fund, as well as the other two in the top three, are benchmarked against their own peer group, the IA UK All Companies sector. For the purposes of this study, this does make it easier for them to come out on top, as the sector has made a lower return than the most common benchmark in the sector: the FTSE All-Share index.

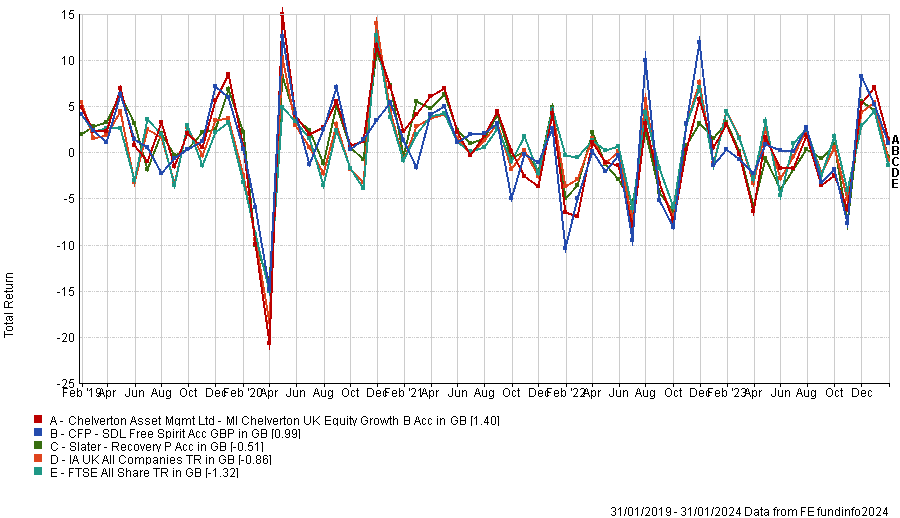

However, all three did manage to prove their worth against FTSE All Share too, as the line chart below shows.

Rolling performance of funds vs benchmarks over 5yrs

Source: FE Analytics

In second place is another small-cap strategy, the £69.4m CFP SDL Free Spirit fund, which is led by a team made up of Chloe Smith, David Beggs, Eric Burns and FE fundinfo Alpha Manager Keith Ashworth-Lord. They take high-conviction positions in a concentrated portfolio of just 25 names.

Ashworth-Lord is the longest tenured, having been a named manager since 2021, with the others joining in 2022. Before this, the fund was run from 2019-2021 by Andrew Vaughan and before that Rosemary Banyard. Over the entire period, with all the manager changes, the fund’s average alpha was 6.5.

Concluding the top three, with an alpha of 5.7, was veteran fund manager Mark Slater, with the £256.7m Slater Recovery fund.

The strategy is 8.9% invested in companies with a market cap greater than £5bn, 17.2% in companies of between £1bn and £5bn and the remaining three quarters in smaller companies.

Slater Recovery had a positive alpha in 41 of the 61 periods covered in this analysis. That’s the highest percentage (67%) among the funds that made it to this list, but not the highest in absolute terms (that merit goes to Oisin O’Leary and Sam Glover of the New Capital Dynamic UK Equity fund, who added alpha 90% of the time over five years, but with a lower average of 2.7).

Source: FinXL

Among funds which use the FTSE All Share as their benchmark, the £13.5m Consistent Opportunities Unit Trust came out tops with an average alpha of 5.2.

It has been managed by Jay Patel and Nicholas Pritchard since April 2018, who are therefore responsible for the alpha generated by the fund in 58 out of the total 61 rolling periods in consideration. The previous manager was Sean Ashfield.

The strategy was closely followed by Colin McLean’s £19.2m Scottish Friendly UK Growth (with an average alpha of 4.9), and not too far behind are Benji Dawes and Jon Hudson with the Premier Miton UK Growth fund (4.3).

The £171m Premier Miton fund aims to grow capital through companies across the market-cap spectrum, with holdings selection based on stock-specific research on quality, growth potential and valuation.

Finally, the worst average alpha in the sector was that of M&G Recovery (-5.6), whose primary manager, Michael Stiasny, has only been responsible for running the fund since January 2021.

Before that, it had been managed by Tom Dobell for the 20 years leading up to December 2020, when he left the firm after the fund couldn’t recover from a long bout of underperformance, as illustrated below.

Performance of fund vs sector and index in the last 10 years of Dobell’s management

Source: FE Analytics

With a similar average alpha, GVQ Opportunities (-5.3) and Janus Henderson UK Alpha (-4.6) concluded the bottom-three list.