The UK market has underperformed the rest of the world since 2016, when foreign investors started to feel that they did not need to look at the UK, given all the political uncertainly.

Fast-forward six years and the Liz Truss mini-Budget turned things sour, generating extreme volatility in the gilt market as well as, repeatedly, in the pound.

Given the above and the strength of the US market, the UK has been ignored and Peter Sleep, senior investment manager at 7IM, does not blame investors for that.

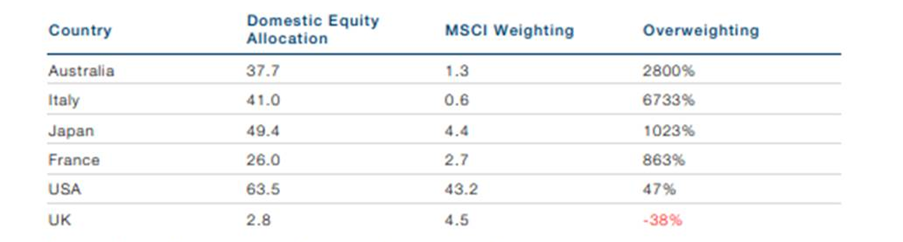

Developed markets domestic equity overweights

Source: Man GLG, Capital Markets Industry Taskforce. Data as at 31 December 2023.

Even UK institutions have been selling UK equities and are underinvested in the domestic market, of which they used to own more than 50% about 25 years ago, but now this has shrunk to 3%, as Sleep showed with the table above.

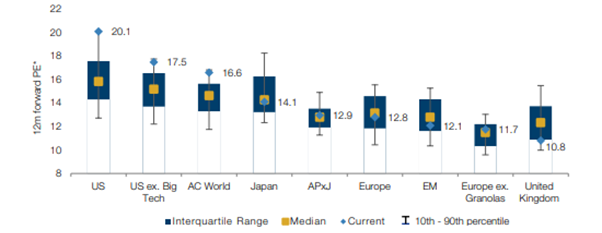

In the meantime, the market has also become cheaper than it has been in its history on a price-to-earnings (P/E) basis and versus its international competitors, as illustrated below.

Developed Equity Market Returns

Source: Man GLG, Goldman Sachs. Data as at 31 December 2023. *Range over last 20 years.

Sleep said: “Trying to predict a UK rally is futile, all you can do is do your research, form a judgment, invest and wait”.

“The Japanese market has been cheap for years but only now has started to rally. The UK looks cheap and could rally at any time.”

For those who are aiming to put that advice into practice, Sleep, who is to leave the firm next month, recommends three UK funds.

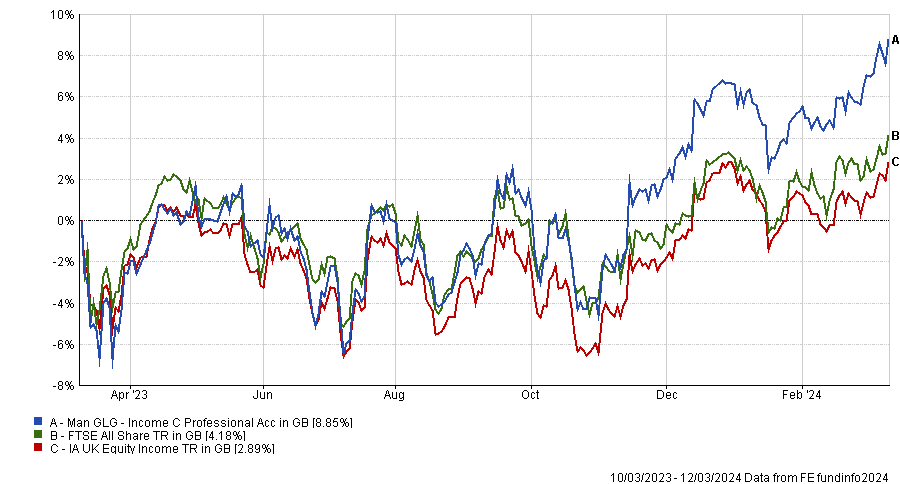

The first is the £1.5bn Man GLG Income fund run by FE fundinfo Alpha Manager Henry Dixon. While all three funds can be held alone or as part of a larger profile, having to pick one, Sleep would go for this one, given its value style, which he thinks is suited to today’s uncertain environment.

“Dixon has a value style where he looks for companies valued below the replacement cost of their assets or companies with undervalued cashflows,” Sleep said.

“At present he owns lots of unloved UK house builders who have been battered by higher interest rates and the quiet UK property market.”

The fund has been the top performer of its sector over 10 years, but falls to the third over three years and the second over 12 months. It fell to the 15th place over five years, still comfortably in the first quartile of performance in the 72-strong IA UK Equity Income sector.

Performance of fund against sector and index over 1yr

Source: FE Analytics

The second fund was the £533.5m Schroder Prime UK Equity fund, co-managed by Sue Noffke, Andy Simpson and Matthew Bennison.

It’s a lower-volatility strategy for slightly more conservative FTSE investors, designed to “never deviate far from the FTSE All Share benchmark”.

Over the past 10 years, it managed to stay within five percentage points of the index, even at times when the rest of the sector deviated.

“The fund seeks to add a small amount of value over the benchmark every year without shooting the lights out,” said Sleep.

“The team will own many of the FTSE stalwarts such as Shell, BP and Unilever as well as slightly smaller stocks that her researchers recommend such as [pet supplies retailer] Pets at Home.”

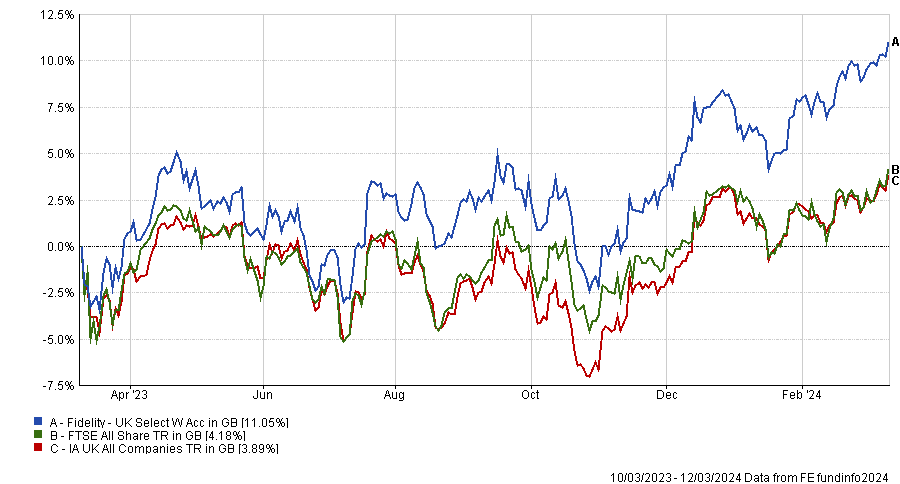

Finally, the investment manager chose Fidelity UK Select, whose manager, Aruna Karunathilake, has a growth style where he tries to find stocks with great franchises, good balance sheets and that are capable of growing at above market rates.

“His style takes him into faster-growing companies such as the accounting software company Sage Group, the credit-rating agency Experian and Howden Joinery,” said Sleep., who noted that he does not tend to own the larger FTSE stalwarts.

Performance of fund against sector and index over 1yr Source: FE Analytics

Source: FE Analytics

“All these managers do detailed research, get to know their companies and hold them for the long term, which is the only way to outperform,” he said.

“As an investor, I want balanced, predictable funds so that when I see on the news or read about the FTSE, I have an idea of the direction of my fund. The FTSE equity market bounces around enough for me and I certainly do not want to own funds that are all over the place.”