The activist investor building a stake in Scottish Mortgage may well be aiming to stop the investment trust from pouring money into “bonkers ideas” but some analysts believe this could be the wrong move at the wrong time.

Elliott Investment Management, a prominent US investment firm known for its activist approach in influencing company management to unlock shareholder value, recently disclosed a 5% position in Scottish Mortgage.

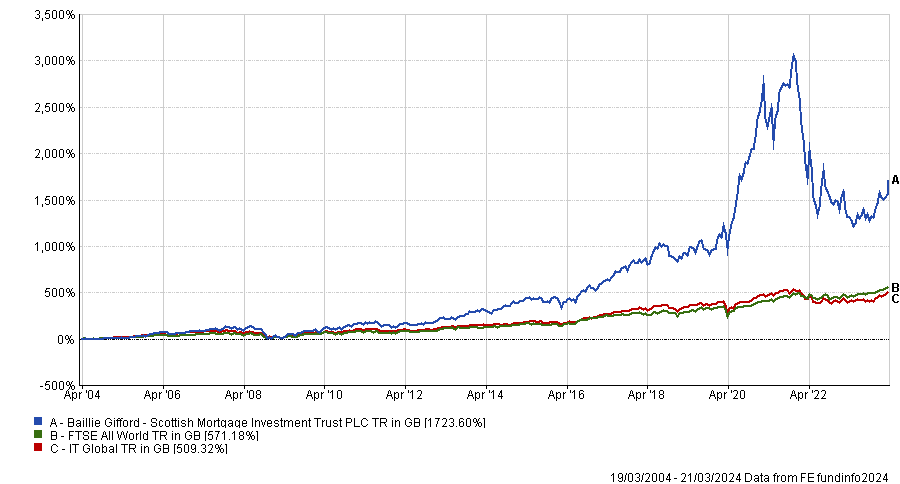

This has led to speculation about the firm’s intention for the investment. Scottish Mortgage has very strong long-term track record, but as can be seen in the chart below, has struggled in recent years as higher interest rates weighed on growth stocks.

Performance of Scottish Mortgage vs sector and index over 20yrs

Source: FE Analytics

The trust unveiled a massive share buyback plan to narrow the discount on 15 March 2024. Its share price leapt as a result, narrowing the discount to its underlying assets from circa 13-15% to 8%.

Of course, this could be the simple explanation for Elliott’s holding – to profit from a narrowing discount – but it may also have more activist designs.

Dan Coatsworth, investment analyst at AJ Bell, said: “Part of Scottish Mortgage’s share price weakness was down to the rising interest rate environment as that negatively affected valuations of companies where the story is more about future cash flow than jam today. But as the share price fell, there were also suggestions that Scottish Mortgage had been taking too many wild bets on blue-sky companies, ones that had an idea but were miles off making any money.

“It is feasible to suggest that Elliott could call on Scottish Mortgage to focus more on companies that already generate profit or at least have a growing revenue stream rather than simply a concept. That could spell an end to the bonkers ideas which Scottish Mortgage previously bought into, such as flying taxis and 3D-printed rockets. Having fewer unquoted stocks would mean in theory that its portfolio has more liquidity, should it need to exit any positions quickly.”

That said, Coatsworth suggested Scottish Mortgage and its manager Baillie Gifford would be reluctant to “fiddle” with an investment process that has successfully delivered for investors over the long run.

While critics might point out that this past performance was in an investment environment dominated by ultra-low interest rates, the trust can counter this with the argument that private valuations have come under pressure and this has created the opportunity to hunt for more bargains.

Meanwhile, some believe that private companies are becoming more confident about floating on a stock market – as demonstrated by the recent successful listing of social content website Reddit.

“Scottish Mortgage’s model is built around backing high-risk, early-stage ideas. If it reduced unquoted exposure and focused on more profitable businesses there is a danger it could get lost in the crowd of generic tech funds and trusts,” Coatsworth concluded.

“Perhaps what it needs to do is better communicate the risks associated with the trust and make it clear that it is prepared to make bold decisions in the hope of achieving outsized returns. Investors need to understand what they are buying, particularly as there is a fear that many don’t appreciate it could experience more setbacks than a bog-standard equity fund.”