Ruffer, Worldwide Healthcare and JP Morgan Global Income & Growth are among the best options for investors putting their pensions into investment trusts, according to IFAs.

There are typically two stages to pensions: the accumulation (or wealth building) phase where those yet to reach retirement are trying to increase their pot as much as possible; and the withdrawal phase for people who have finished work and are relying on their savings for income.

This tax year, savers can put up to £60,000 into a self-invested personal pension (SIPP), an increase on the £40,000 available 12 months ago, and can carry forward any unused allowances over the past three years.

As such, now may be a good time to consider what to buy. Below, financial advisers give their favourite investment trusts for each of the two stages of pensions.

The accumulation/wealth building phase

People with a long time horizon until retirement can consider taking more risk and investing in trusts that should grow over the long term, even if they experience short-term wobbles.

As such, Philippa Maffioli, senior investment manager of Blyth-Richmond Investment Managers, said growth and diversification during this period are crucial.

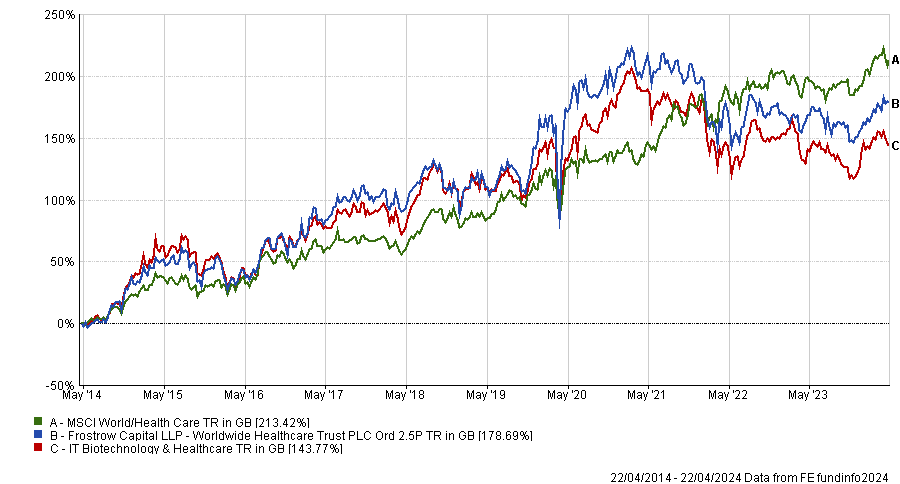

She suggested Worldwide Healthcare Trust, which gives investors exposure to pharmaceutical, biotechnology and other related healthcare companies ranging from multinational brands to unquoted companies.

Performance of trust vs sector and benchmark over 10yrs

Source: FE Analytics

“The fund is managed by OrbiMed Capital which was founded in 1989 and has become the largest healthcare investment firm in the world. The team is actively looking at nearly 1,000 companies and works to identify sources of outperformance, as well as those with underappreciated products in the pipeline with high quality management teams and strong financial resources,” she said.

Another option with a broader remit is Monks Investment Trust, managed by Spencer Adair and Malcolm MacColl from Baillie Gifford.

Performance of trust vs sector and benchmark over 10yrs

Source: FE Analytics

“Their aim is to focus on global companies from a range of profiles with above average earnings growth, which they expect to hold for around five years,” Maffioli said, although noting that they “address issues head on and aren’t afraid to take a critical look at their portfolio when necessary”.

For those unwilling to take such big bets on styles or themes, Chancery Lane chief executive Doug Brodie suggested trusts with long track records of outperformance such as Lowland, Murray International and City of London, which he said have “handsomely” beaten the FTSE All Share over 20 years. However, it is worth noting that Murray International is a global portfolio while the other two are UK focused.

Performance of trusts vs FTSE All Share index over 20yrs

Source: FE Analytics

“Investment trusts may not have the sales and marketing budgets of pension companies so investors have to look a bit harder. A quick look at the long-term returns will show folk there’s a good reason that institutional investors are big investors in trusts,” Brodie said.

For more tactical investors, Paul Chilver, associate and financial planning manager of Birkett Long IFA, suggested concentrating on trusts currently on a discount – of which there are many.

“Discounts are particularly attractive on UK-focused investment trusts and one suggestion for the accumulation stage of investment is the Mercantile Investment Trust managed by JPMorgan, which has been at a double-digit discount for many months despite very good short-term performance,” he said.

The decumulation/withdrawal phase

People already in retirement have to marry two competing issues. The first is to make sure that their investments continue to grow so they do not run out of cash, while the other is to withdraw money to help them make up the shortfall from a lack of earnings.

To balance this, Neil Mumford, chartered financial planner of Milestone Wealth Management, suggested the Scottish American Investment Company, known as SAINTS for short.

Performance of trust vs sector and benchmark over 10yrs

Source: FE Analytics

“This is my choice for someone looking at building either an income or growth portfolio and is a top five holding in my own SIPP. I am still accumulating but it will stay once I am drawing down,” he said.

“It is a truly diversified equity portfolio, spread equally between the US and Europe at around 35% each of the portfolio. Although it doesn’t have the highest yield at 2.9%, this dividend hero has increased its payouts by an average of 4.2% a year over the past five years and this dividend increase has not hampered its ability to grow capital – a total return of more than 170% over the past 10 years should please any investor.”

Now could also be a good time to get in as the share price is a “complete bargain”, trading at a discount of 10% to the trust’s net asset value.

More defensive investors might prefer the Personal Assets Trust or Ruffer Investment Company, said Maffioli, which both focus on capital preservation.

The former, managed by Sebastian Lyon and Charlotte Yonge, “offers global diversification across four asset classes and is a bedrock for lower risk and/or decumulating portfolios,” she said.

Ruffer meanwhile uses a “very disciplined approach”, aiming to maintain value over one year and grow capital incrementally over the longer term. “This means they would perceive a loss in line with the market as a failure,” Maffioli noted.

A trust for both?

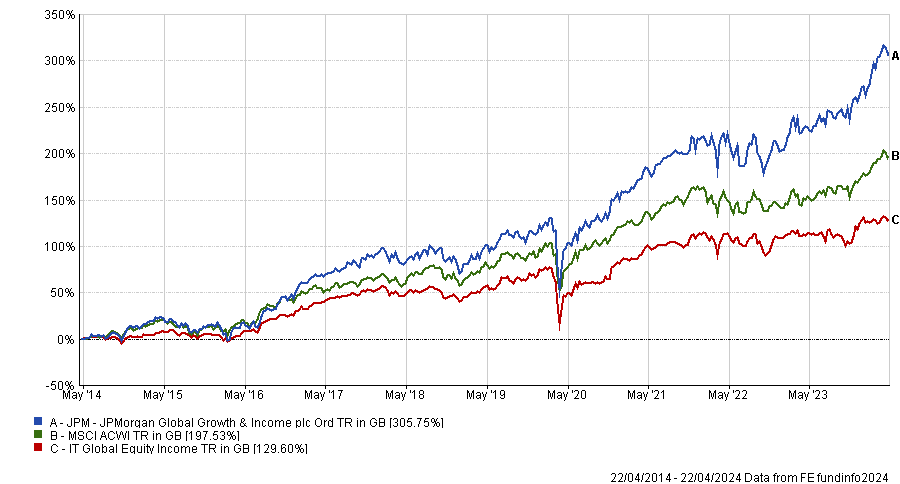

One trust that appeared in the recommendations for both phases was JPMorgan Global Growth & Income Trust. Mumford said it was a strong option for those looking to build their wealth, as it invests predominantly in the high-growth US market, which makes up two-thirds of the portfolio.

“It is a high conviction portfolio with 50 to 90 holdings, with the top 10 making up more than 40% of the portfolio. This has allowed it to outperform by some margin with a 305% return over the past 10 years,” he said.

Performance of trust vs sector and benchmark over 10yrs

Source: FE Analytics

It is one of the few trusts trading on a premium at present, but this should not concern long-term investors, Mumford noted, adding it is “ideal” for regular monthly investments.

Chilver meanwhile highlighted the trust for those in the decumulation stage of their pension, noting that its 3.4% yield makes it attractive, despite its high weighting to the typically lower yielding US market.