Ashoka WhiteOak Emerging Markets has approached Asia Dragon for a merger, as the investment trust seeks to expand following its launch last year.

This move may seem unconventional, as the £34.4m Ashoka WhiteOak Emerging Markets is significantly smaller than its acquisition target, whose assets under management soared to £607.6m after the merger with its stablemate abrdn New Dawn last year.

However, analysts at brokerage firm Numis believe this initiative makes sense as the Ashoka WhiteOak Emerging Markets needs to grow to become relevant to a wider investor base.

They said: “The management group has a strong following and has successfully grown Ashoka India through asset performance and issuance from £45.6m at launch to c.£380m net assets.

“In addition, it has started strongly with Ashoka WhiteOak Emerging Markets delivering NAV total returns of 14.7% versus a return of 9.5% from the MSCI Emerging Markets index since launch in May 2023.”

According to Martin Shenfield, chair of Ashoka WhiteOak Emerging Markets, 56% of shareholders in Asia Dragon support the initiative. Yet, he stressed that there has not been “any meaningful engagement” with the board of Asia Dragon.

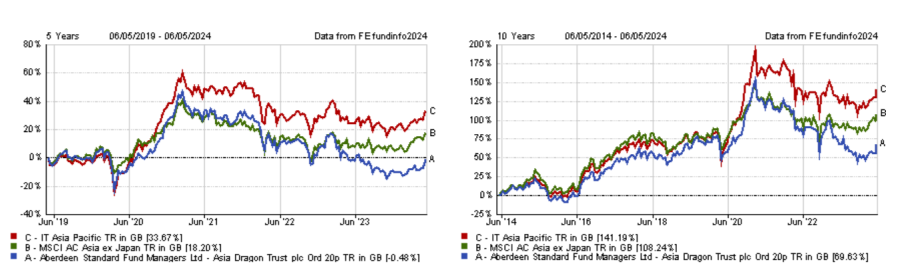

For the analysts at Numis, it is “easy” to understand why shareholders in Asia Dragon are interested in this offer when looking at the performance of the trust. It consistently ranks at the bottom of the IT Asia Pacific sector across all of the standard investment periods and also lags its benchmark.

Performance of investment trust over 5yrs and 10yrs vs sector and benchmark

Source: FE Analytics

They added: “It is also unusual to see an aggressive M&A approach as they have historically been hard to achieve, particularly for an equity investment company, which can mount the defence of returning capital at close to NAV.

“However, these proposals already include a 50% exit for Asia Dragon shareholders and the Ashoka WhiteOak Emerging Markets annual redemption facility means investors that wish to could exit in full at NAV less costs will be able to in December.”