Exchange-traded funds (ETFs) are struggling to beat their peers in several of the Investment Association’s key sectors, research by Trustnet suggests.

Active investing has endured several hard years after managers were blindsided by events such as the Covid-19 pandemic and surging inflation. However, things might be looking better in 2023 as a limited number of ETFs are making top-quartile returns versus their active peers.

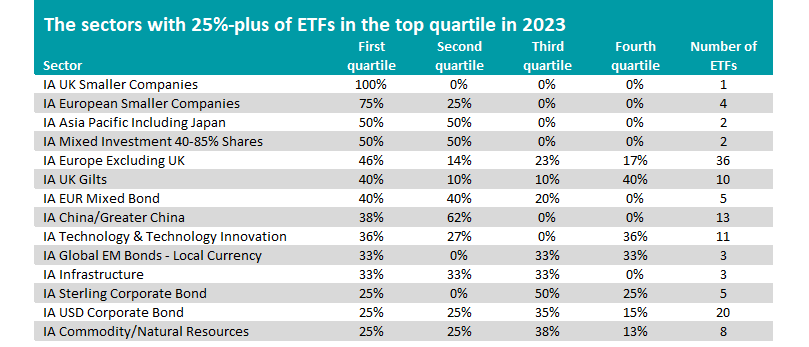

In this article, we took the quartile rankings of each ETF in the Investment Association universe and looked for the peer groups with the largest proportion making top-quartile gains.

There is only one sector where 100% of its ETFs are in its first quartile this year – IA UK Smaller Companies.

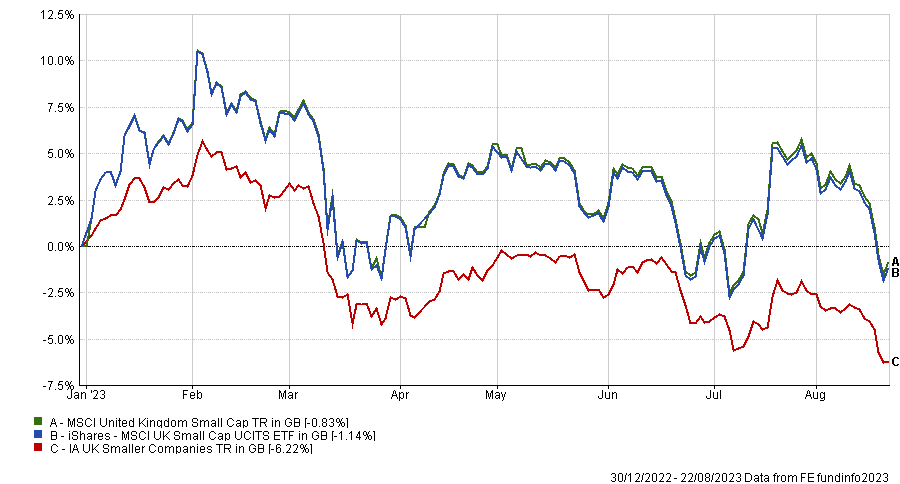

Admittedly, the sector only has one ETF and iShares MSCI UK Small Cap UCITS ETF made a 1.1% loss over the period under consideration, but this is significantly better than the 6.2% fall from its average peer.

Performance of ETF vs sector and index in 2023

Source: FE Analytics

The IA European Smaller Companies has 75% of its four ETFs in the top quartile: iShares EURO STOXX Small UCITS ETF GBP, iShares MSCI EMU Small Cap UCITS ETF EUR and SSGA SPDR MSCI Europe Small Cap Value Weighted UCITS ETF. The fourth ETF is in the second quartile.

Two sectors (IA Asia Pacific Including Japan and IA Mixed Investment 40-85% Shares) each have 50% of their ETFs in their first quartiles this year. But they are home to only two ETFs each.

IA Europe Excluding UK is the first peer group with plenty of ETFs in it – 36. Of these, 16 (or 46%) are in the top quartile.

This year is proving to be a strong one for European stocks and this is reflected in the returns made by the peer’s passives. The best performing ETF is iShares Core EURO STOXX 50 UCITS ETF GBP with a 12.5% total return, followed by Xtrackers Euro Stoxx 50 UCITS ETF 1D GBP (up 12.2%) and Lyxor Core MSCI EMU (DR) UCITS ETF D EUR (up 11.3%); the sector has made just 5.4% over the same period.

Source: FE Analytics

The table above shows all the sectors where 25% or more of ETFs have made top-quartile returns over 2023 so far. The IA Technology & Technology Innovation sector is another notable one, as tech stocks have led the market this year and the average fund in this peer group is up more than 20%.

The four ETFs in the sector’s first quartile are all comfortably ahead of this. iShares S&P 500 Information Technology Sector UCITS ETF GBP has made 30.8%, SSGA SPDR S&P US Communication Services Select Sector UCITS ETF GBP made 28.7%, SSGA SPDR S&P U.S. Technology Select Sector UCITS ETF is up 27.7% and Xtrackers MSCI World Information Technology UCITS ETF 1C USD is up 26.5%.

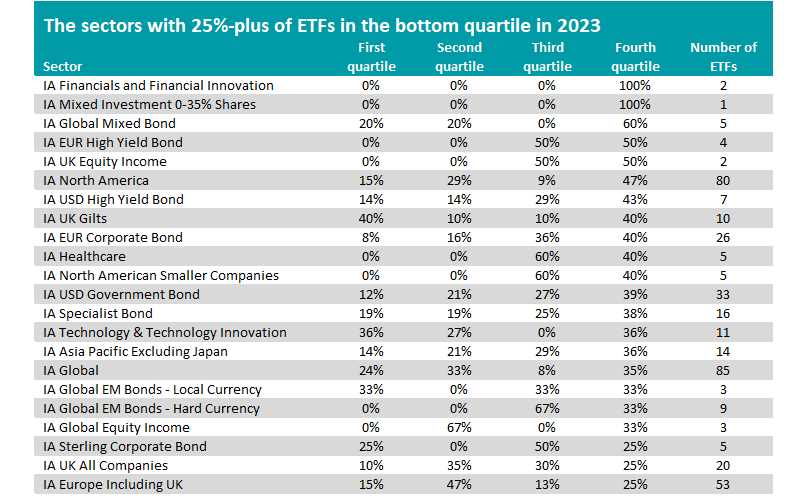

IA Global is another worth highlighting, given it is the largest in the Investment Association universe. It counts 85 ETFs among its ranks but only 24% of these have achieved top-quartile returns over the year to date, so just missed out on being included in the table. However, 35% are in the bottom quartile.

Source: FE Analytics

This puts the IA Global sector on our second table, which shows the peer groups where 25% or more of ETFs are in the bottom quartile this year.

What’s immediately clear is that there are more in this table than in the first – just 14 sectors have a high share of ETFs in the top quartile but there are 23 sectors highlighted for bottom-quartile performance.

This second table also includes more notable sectors alongside IA Global.

IA Technology & Technology Innovation appears again as 36% of its ETFs are in the fourth quartile. This is the same proportion as in the first quartile.

One eye-catching entry is the IA North America sector, which has 47% of its 80 ETFs in the bottom quartile this year.

US equities are frequently held up as an example of a market where active managers struggle to outperform the market, but this year might be one of the exceptions. Just 15% of the IA North America sector’s ETFs are in the top quartile this year, mainly those that focus on tech stocks.