Peter Rutter, head of equities at Royal London Asset Management (RLAM) and an FE fundinfo Alpha Manager, is leaving to start his own business. Four RLAM equity fund managers are joining him: Alpha Managers Nico de Walden and James Clarke, along with Chris Parr and Will Kenney.

Piers Hillier, RLAM’s chief investment officer, will take over from Rutter at the helm of the global equity team. In this capacity, he will be supported by three senior colleagues: Matt Burgess, head of quant strategies; Richard Marwood, co-head of UK equities; and Mike Fox, head of sustainable.

Rutter, Clarke and Kenney manage the £4.9bn Royal London Global Equity Diversified fund and the £803m Royal London Global Equity Select fund. Both funds have generated top-quartile returns over one, three and five years. They have FE fundinfo Crown Ratings of four and five, respectively, in recognition of their high alpha, low volatility and consistently strong performance.

De Walden manages the £1.2bn Royal London Global Equity Income fund, which is a top-quartile performer over one and three years with a five-crown rating (the top score), while his £1.2bn UK Equity Income fund is top quartile over one, three and five years with a four-crown rating. He also runs the Royal London £1.3bn UK Dividend Growth fund, which is a top-quartile performer over one and five years but second quartile over three years.

Parr runs the £369m Royal London US Growth Trust, another fund that is top quartile over one, three and five years, as well as RLAM’s US equity strategy.

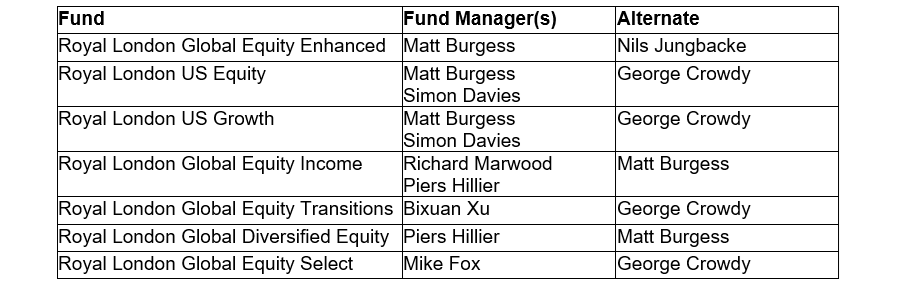

RLAM announced leadership changes to some of its funds as a result of the departures.

Hillier will take over the popular Global Equity Diversified fund from Rutter, Clarke and Kenney, with Burgess as his deputy. The Global Equity Select fund has been handed to Fox, with George Crowdy as back-up. A full list of manager changes is below.

Hans Georgeson, RLAM’s chief executive, said: “We remain committed to offering a first class equity capability and will continue to invest in the team. Piers brings huge experience to the leadership of our global equities capability, supported by an extremely talented team that also bring many years of expertise in equity markets.”