It is an exciting time for value investors as rising inflation and interest rates has turned the tide against growth stocks around the world. Although the economics are different, Japan has also gone through the same transition, albeit without the rising rates itself.

While the oft-forgotten market has caused investors to scratch their heads for decades, the past 10 years has been relatively fruitful as prime minister Shinzo Abe started (and his successors have continued) to focus on stimulating economic growth and improving corporate governance, while battling against an ageing population.

Although some may think of the country as the tech capital of the world (perhaps outside of Silicon Valley), it is not just a market known for robots and artificial intelligence. Indeed, the $5trn market has much more to offer.

This has been proven this year through the turnaround in fortunes of the £1.2bn Man GLG Japan Core Alpha fund, a value strategy that has had a tough few years but bounced back in 2021 and so far this year.

The fund suffered during Covid. Asked by Trustnet about the patchy returns of 2019/2020, manager Jeff Atherton pinned it down to “the fact that we have had a technology boom and bubble, which is hopefully now bursting” and also blames holdings in autos, energy, chemicals and steel at a time when the world stood still.

As a result of the poor run, some of its medium-term numbers look weak – over five years, the fund ranked in the third quartile in its IA Japan sector.

Performance of the fund over 5yrs vs the sector and benchmark

Source: FE Analytics

But after those dark moments, the fund has achieved an impressive comeback, especially since Atherton, who has been a co-manager since 2011, and Adrian Edwards, who joined in 2014, took on larger roles in 2021 when veteran managers Stephen Harker and Neil Edwards retired.

Since then, the fund is up 10.3%, while the sector lost 11.6%. However, performance has been convincing over 10 years too, showing the long-term success of the strategy, as illustrated by the chart below.

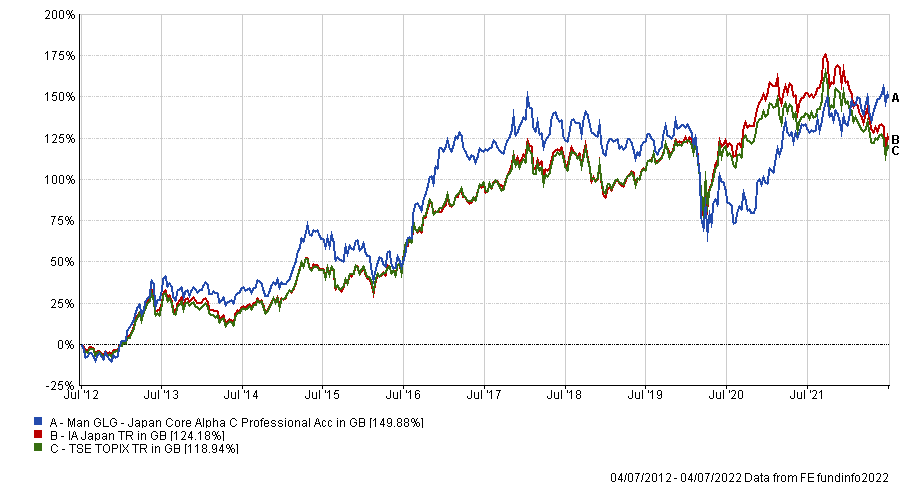

Performance of the fund over 10yrs vs the sector and benchmark

Source: FE Analytics

The fund has benefited from the boom in value stocks over the past 18 months but some may wonder whether they are too late to get in, or whether they should even consider selling after such a strong run.

Ryan Hughes, head of investment partnerships at AJ Bell, is convinced that the fund will continue to do well, if value is confirmed as the winning style in the coming months. All the more so since the fund has “a clear process”, he said.

“The Man GLG Japan Core Alpha fund has a very strong value bias and this has been the main driver of relative returns over the years. The fund underperformed significantly when value was out of favour but has captured the recent change in sentiment very strongly which has gone a long way to improving relative returns”.

However, AJ Bell removed it from its favourite fund list, “as we felt the proposition was weaker without the input of these two long standing managers [Harker and Edwards]. As yet, we have not looked to reintroduce the fund to our buy list.”

For Emma Wall, head of investment analysis and research at Hargreaves Lansdown, understanding this style bias is key to analysing the portfolio and expectations for returns.

“Over the past decade, growth-style investing has gone through extended periods of extreme outperformance – which has meant value-style funds such as Man GLG have struggled,” she said.

“Conversely, more recently value has outperformed, providing a tailwind for the portfolio, which coupled with strong stock selection has delivered for clients through 2021 and year to date.”

She praised the managers’ ability to add alpha and for her it is one to hold, but she also suggested to “make sure your horizon is long term and consider the style implications of the fund – so ensure your portfolio has a mix of styles, as well as geographies and assets”.

Dzmitry Lipski, head of funds research at interactive investor, is not a fan, however. “We don’t recommend Man GLG Japan Core Alpha – the fund employs very distinctive large-cap, value approach that benefited from the recent style rotation and therefore delivered strong results,” he said.

Picking up on Wall’s advice to diversify, he added: “Investors holding Man GLG Japan Core Alpha fund can diversify their exposure by holding Jupiter Japan Income Fund, which was added to ii’s Super 60 list as core option in January this year.”

The Jupiter fund combines growth and income, is an all-cap portfolio and currently yields 2.4%. Man GLG Japan Core Alpha currently yields 2.2% with an ongoing charge figure of 0.9%.

Meanwhile, in a recent feature, head of fund research at Quilter Cheviot, Nick Wood suggested investors might want to look at M&G Japan.

As part of his perfect portfolio for value investors, that value will continue to dominate in the medium term and that the fund was a “hidden gem”. Indeed, the equity fund remained in the top quartile of its sector UT Japan over 10 years and as well as over shorter and medium terms.