‘Patience is a virtue’ is a common enough saying, but when it comes to investing the cliché holds merit, according to a new report by Alliance Trust.

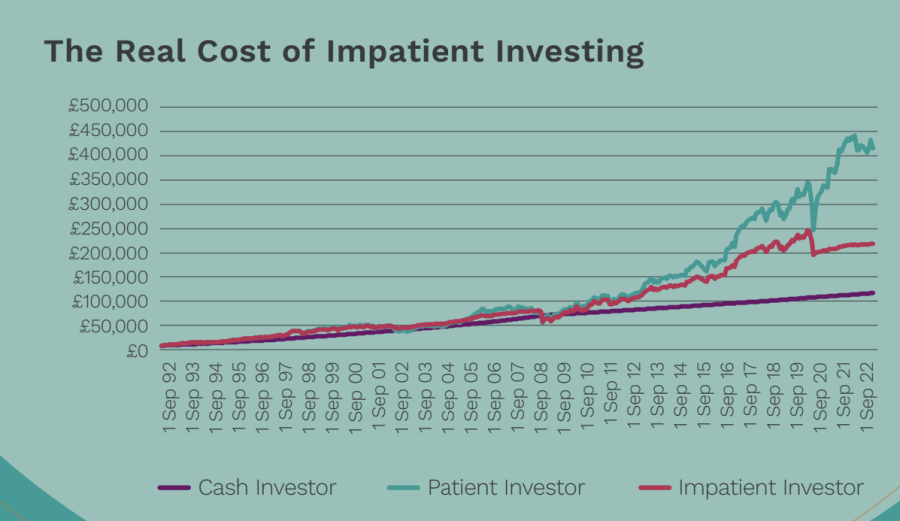

Over 30 years, the average patient investor has made £192,000 more than its impatient counterpart simply by keeping calm and carrying on.

In the historical model run by Alliance Trust, two investors locked away £10,000 in 1992 and reinvested 10% of the average national salary every month until today.

But they reacted differently to the Dotcom Bubble, the Global Financial Crisis, the Covid pandemic as well as shorter periods of volatility. One investor sold 25% of their share whenever the market dipped 5% in a single day, effectively crystallising their losses, while the other held their nerve.

By 2022, the impatient investor had accumulated £218,000, as opposed to the £410,000 made by the patient investor, as the graph below shows.

Source: Alliance Trust

Mark Atkinson, head of marketing and investor relations at Alliance Trust, said investors should have confidence in the market, even during financial storms.

“In the past few weeks there has been even more chaos in the markets and the dramatic headlines may well prompt a crisis of confidence for investors. Holding your nerve is key; the best investment is one which is left alone for as long as possible. Patience will pay off; trust the market to outperform cash in the long run, as it always has.”

Women seem to be better than men at this. Of the 730 investors interviewed by Alliance Trust, 48% of men admitted having sold investments at a loss when they’ve gone down in value to try to avoid losing more money, versus 38% of women.

Similarly, 17% of men stopped their regular investment payments because the markets dropped and 24% reduced them, but this is only true for 12% and 21% of women, respectively.

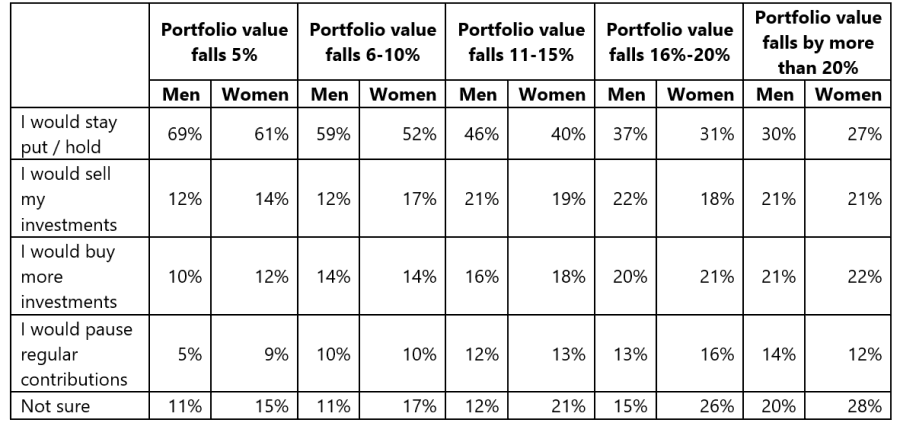

Yet despite this, when it comes to the future though, men were more confident in their ability to hold their nerve, as the table below shows.

Asked to make predictions as to how they would react to losses, more men than women claimed they would stay put rather than sell, despite this not being borne out in past behaviour, the report highlighted.

Source: Alliance Trust

However, women are still behind when it comes to the amount of money they put into markets, with more than half who do invest (54%) holding less than £20,000, compared to 37% of men. Contrastingly, 39% of men have more than £50,000, while just 28% of women can say the same.

“Despite being less likely to invest, women are proving to be better investors; their behaviour implies a steady long-term investment strategy, without knee-jerk reactions or impatient decisions. This is likely to result in much better financial performance,” said Atkinson.