There are “just a handful of gems” that can be found in the absolute return space with some hard work but most of it is “not fit for purpose”, according to Square Mile Investment Consulting & Research portfolio manager Charles Hovenden.

There was a time when absolute return strategies were favourites with investors and advisers. As recently as 2016, the IA Targeted Absolute Return sector was the best-selling retail fund sector with net inflows of £5.1bn.

Yet, it has fallen out of favour in recent years as the equity market bull run continued apace and returns from the sector failed to satisfy investors.

And if recent performance is to be considered, then criticism of the sector seems to be justified.

“If you’re investing in absolute return funds, you don’t mind the fact that in a year like 2017 and 2019, when the markets are up 20 per cent and your fund is up, you know, 5-6 per cent,” said Hovenden (pictured).

“But what you do mind about is having had fairly ordinary results when the market sells off, you get caught and you lose money.”

While it would be unreasonable to expect absolute return strategies to track equity indices, it has become difficult to find funds that deliver on their name.

“Here [in the absolute return sector] you’ve got such a diverse sector that you are looking for needles in the haystack. Okay, there are some gems in here, but you’ve got to find them,” said the Square Mile portfolio manager.

“You’ve just got to do the work on it: know what you’re looking for and screen on that basis. They’re there but there’s a very small number of them.”

What all investors should begin with when looking at the sector is asking themselves ‘Why do I want an absolute return fund?’, said Hovenden.

“Well, number one, you want to make sure your capital is largely protected when markets sell off,” he said. “That’s the whole basis of them.

“So, how do you find those funds? Well, first you look at the downturns in markets. You look at the first quarter of 2020, you look at the final quarter of 2018 or indeed the whole of 2018; you look at the down years.

“And if you do that work, it’s not difficult.”

Source: FE Analytics

Hovenden noted that just 16 funds in the IA Targeted Absolute Return sector made a positive return during 2018 when global equity markets fell by around 7 per cent.

And during the first quarter of this year just 23 funds were in positive territory when global equity markets lost around 20 per cent.

Source: FE Analytics

Even if a threshold for acceptable losses were set at 3 per cent, only 17 more funds would not have disappointed investors, the Square Mile portfolio manager added. In addition, 28 funds in the sector – around one-quarter – lost their investors more than 10 per cent.

With such a narrow set of funds delivering acceptable performance, Hovenden said investors may be better off selling a fund if it fails to satisfy their reason for holding it.

“What is critical [to remember] in this sector, is [that it is] the most important for fund selection,” he explained. “There are a handful – just literally a handful – of gems in the sector. The rest of it, frankly, is not fit for purpose in my judgement.”

Even after having done the homework on performance, it is important understand the reason that funds have outperformed and to take that into consideration.

“It’s pretty easy to get down to a shortlist of things you think that’s worth a look,” he said. “But then you have to go a step further and make sure these funds don’t have a short bias, because if they’ve got a short bias of course they’re going to make money.

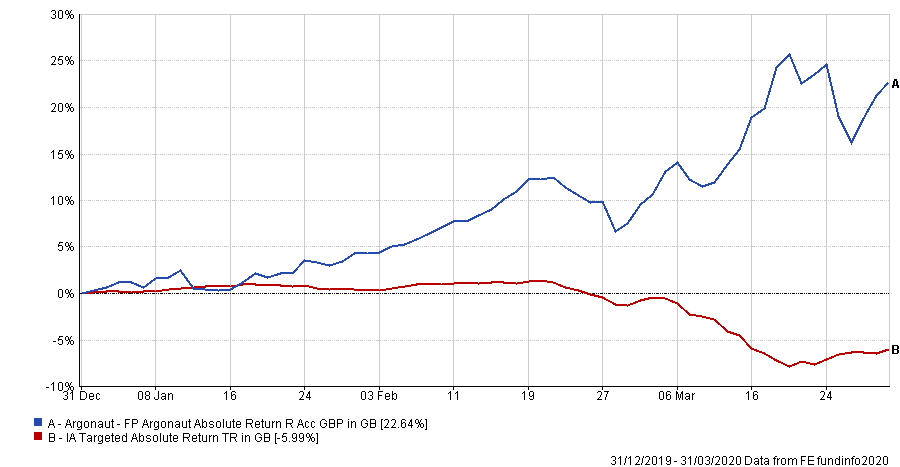

“I’ve no axe to grind, [but] if you look at what was the best performing fund in in the absolute return space in the first quarter of 2020 it was the Argonaut Absolute Return fund. It was up 22 per cent.”

Performance of fund YTD

Source: FE Analytics

Hovenden continued: “Unsurprisingly, we’ve had some calls like, ‘Hey guys, we saw this fund. It looks really good. Why aren’t you covering this sort of thing?’

“Well, if you do a scrap of work on that, you can you can see, actually, in 2018 it was the third worst-performing fund. It was down 12 per cent. And if you go back a couple of years to 2016, it was down 26 per cent. In fact, it only got back above its high watermark, I think, in February or March this year.”

The FP Argonaut Absolute Return fund has been one of the standout performers this year, however, manager Barry Norris recently noted that the ‘absolute return’ label “means different things to different people”.

“Yet, when we delivered a negative return in positive months, people kind of think we’re idiots.”

Nevertheless, there can be a place for absolute return strategies in investors' portfolio, Hovenden conceded, particularly when it comes to balancing a portfolio.

He explained: “In the old days a balanced portfolio was consistent: you had equities and then to get the balance you had bonds. Bonds used to be uncorrelated.

“The trouble is now after 10 years of QE [quantitative easing] and zero interest rates is that there’s no return on bonds and the asymmetry of potential returns in bond markets is completely the wrong way around.

“You have a phrase called ‘risk-free return’. Well, it’s the other way around for bonds, it’s ‘return-free risk’.”