Investors lost money in almost every part of the market in April, data from FE fundinfo shows, with the UK and some emerging markets being among the few highlights.

Below, Trustnet looks at the performance of global markets from multiple viewpoints to see where the biggest losses – and the handful of gains – were made last month.

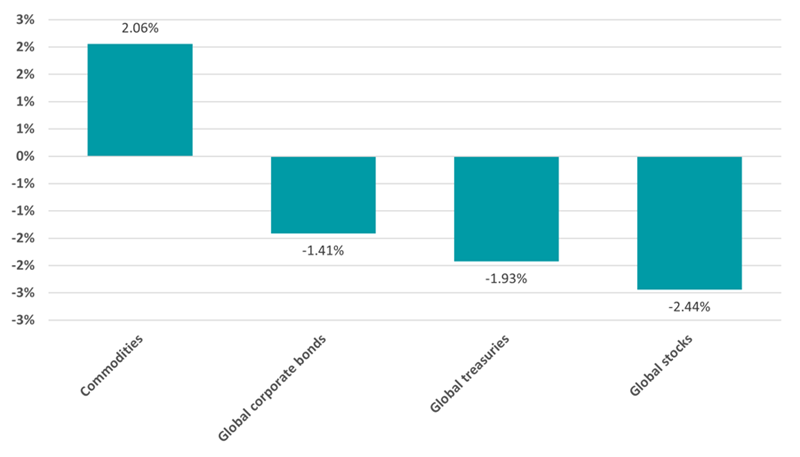

Performance of asset classes in Apr 2024

Source: FinXL

Starting with asset classes, global equities fell 2.4% over the course of the month – ending a winning streak that had seen them rally more than 9% in the opening quarter of 2024. The decline has been partly attributed to concerns that the Federal Reverse will not cut interest rates as expected, following signs that US inflation is stickier than thought.

Worries about interest rates were also reflected in falling bond prices during April, with both the global government and corporate bond indices declining. The broad commodities index, on the other hand, climbed.

Performance of investment factors in Apr 2024

20240501_april_in_charts_2

Source: FinXL

There was also a turnaround in the investment factors that led the market. While small-cap stocks continued to struggle in April, the momentum style went from being the first quarter’s best performers (rising 22% in Q1) to shedding 3% last month. Meanwhile, growth stocks underperformed value.

Over the course of the first quarter, there had been warnings that strong momentum rallies often end in painful corrections. While the momentum style is some way off being in correction territory, market commentators have pointed out that investors could continue to be wary of stocks that are trading on lofty valuations while uncertainty persists over interest rates.

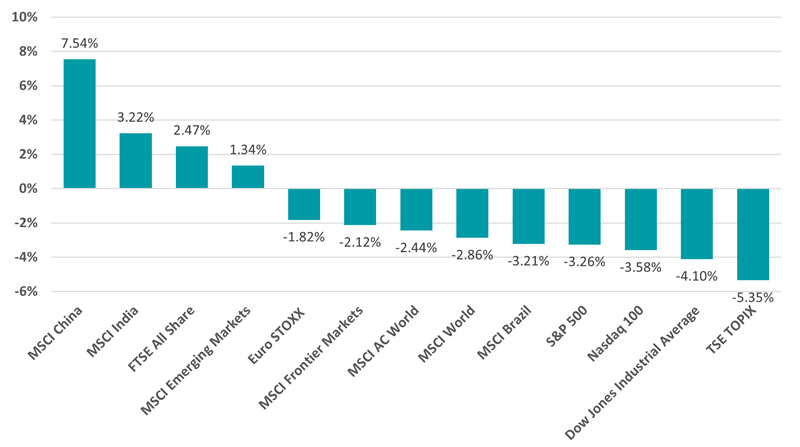

Performance by country in Apr 2024

Source: FinXL

On a geographical basis, the likes of Japan and the US – which had been the top performers previously – were hit with the heaviest losses. China and India rallied hard, boosting the broader emerging markets index, while the UK posted positive returns as investors favoured more value areas of the market and remained positive on the prospect for the Bank of England to cut rates.

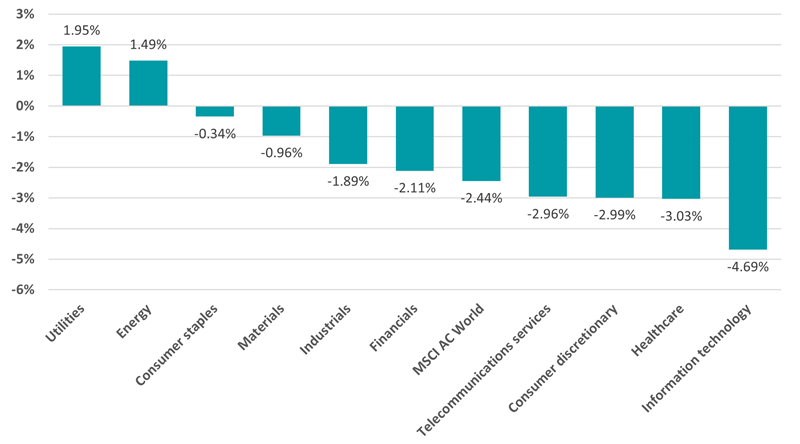

Performance of equity sectors in Apr 2024

Source: FinXL

With the momentum trade faltering, it should be no surprise to see that the global information technology sector made the biggest loss in April. US large-cap tech stocks regained their status as the market’s darlings recently after investors bet big on artificial intelligence but slipped amid interest rate worries.

Utilities and energy were the only parts of the market where positive returns were made.

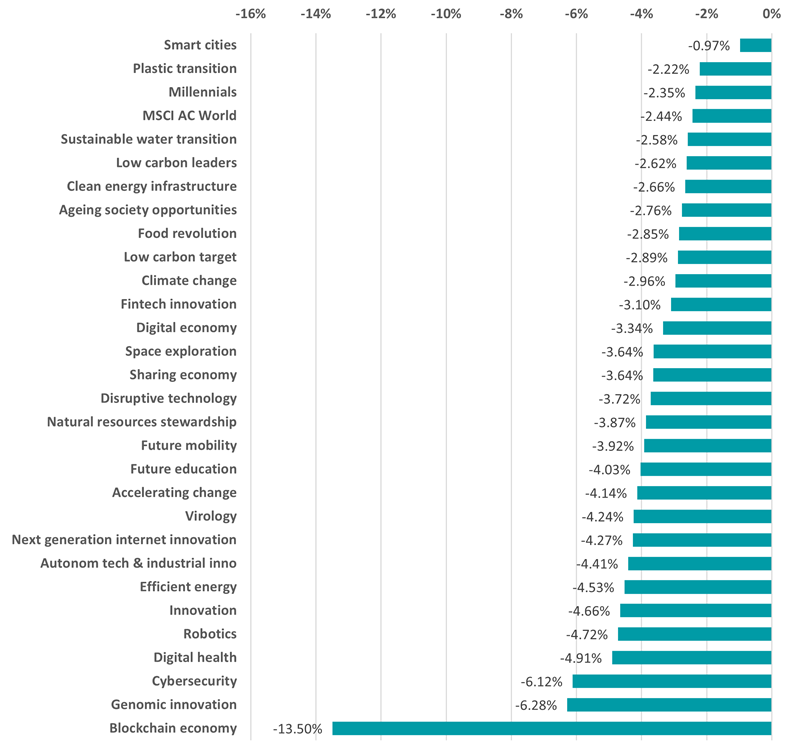

Performance of thematics in Apr 2024

Source: FinXL

April’s aversion to technology and growth stocks meant that every thematic index lost money. Stocks linked to the smart cities theme fared best as this area fell less than 1% but the blockchain economy theme tanked, with its index shedding 13.5%.

Performance of commodities in Apr 2024

Source: FinXL

As the chart above shows, many commodities rose in price last month with zinc leading the pack. Industrial metals such as zinc, copper, nickel, aluminium and lead are rising on the back of growing demand from China and supply constraints from miners.

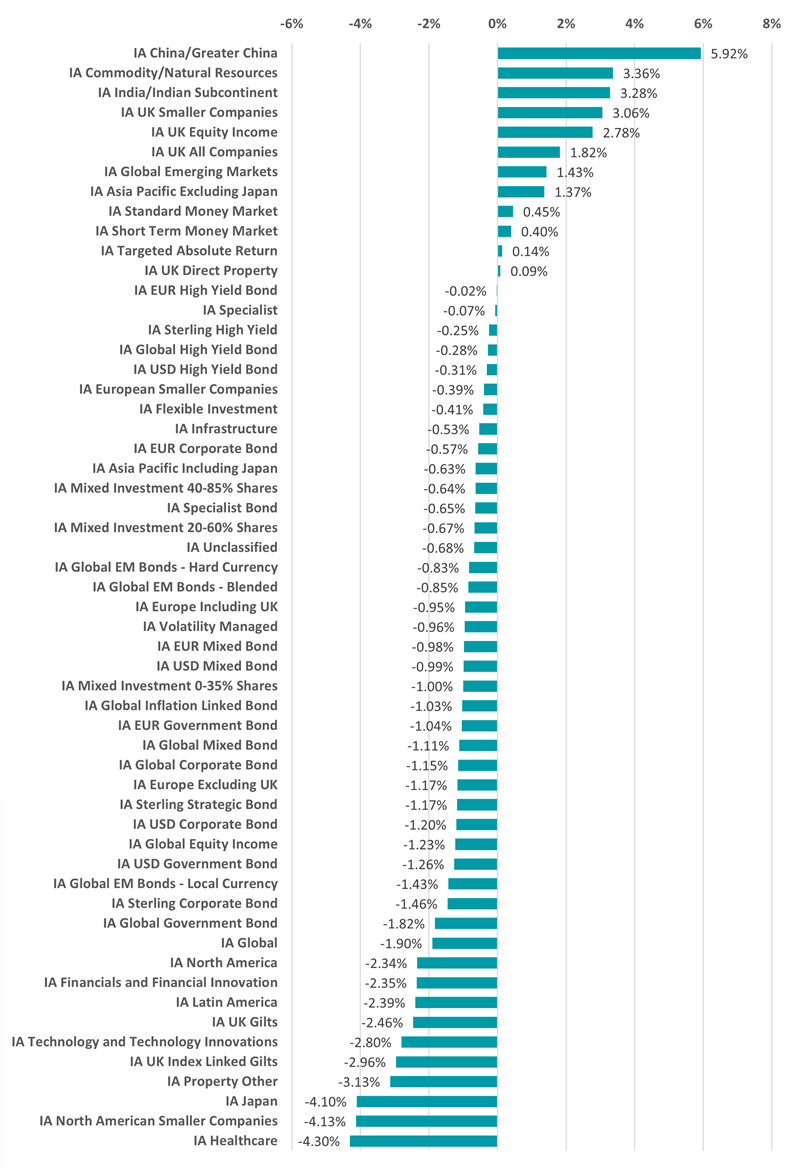

Performance of Investment Association sectors in Apr 2024

Source: FinXL

Given all of the above, it’s clear why the best performing Investment Association sectors last month were IA China/Greater China, IA Commodity/Natural Resources and IA India/Indian Subcontinent. The three UK equity sectors followed close behind.

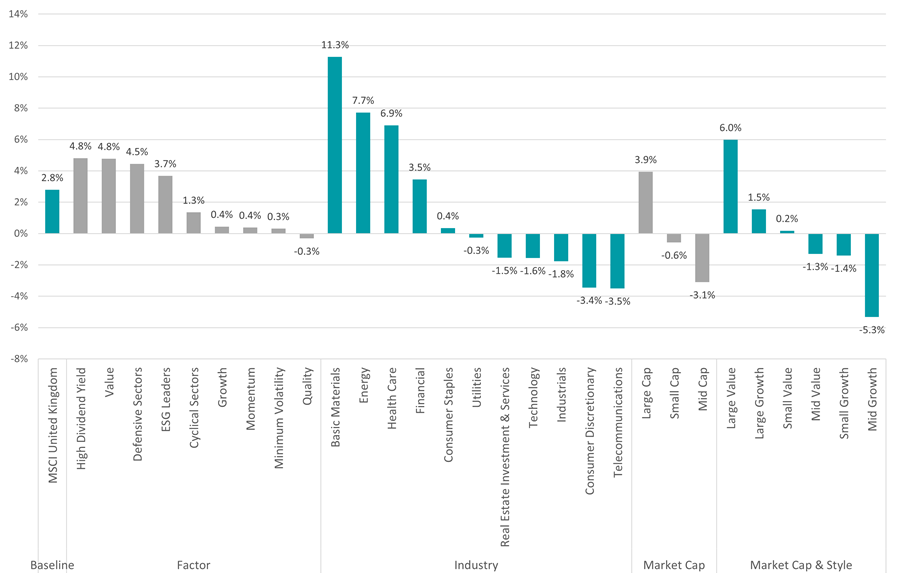

Performance of UK equity market in Apr 2024

Source: FinXL

With the UK being notable for its performance in April, the above chart goes into more detail about what drove the domestic market.

High dividend and value stocks were the best performers and outpaced the growth and momentum parts of the market by a significant margin. Some of the UK market’s dominant sectors such as basic materials and energy are home to these kinds of stocks, meaning the UK benefitted from investors turned away from growth areas like tech stocks.