Fund managers are at their most bullish since November 2021 in anticipation of imminent rate cuts. Equity allocations have hit their highest levels since January 2022 while cash allocations at 4% are down to a three-year low, the latest Bank of America Global Fund Manager Survey found.

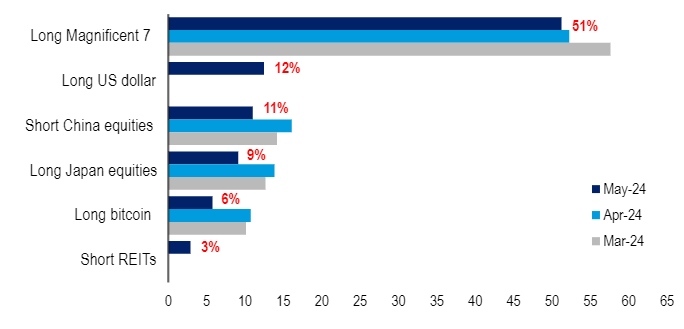

The most crowded trade by far is going long the Magnificent Seven (cited by 51% of respondents). Fund managers are overweight US large-cap growth stocks and technology in general, with 38% of respondents saying they expect large-cap growth to continue leading the US bull market.

Fund managers’ views of the most crowded trades

Source: BofA Fund Manager Survey

A minority (16%) expect US equity market leadership to rotate towards large-cap value, while 14% are banking on small-cap value and 13% favour small-cap growth stocks.

Fund managers have also gone overweight European equities.

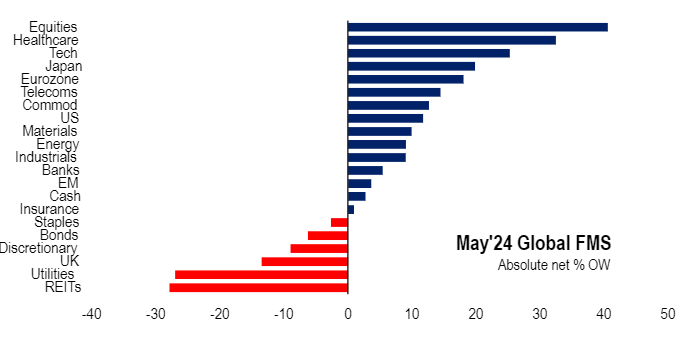

Looking at sectors, fund managers are overweight healthcare as well as technology, while May saw a modest rotation into staples from industrials.

Managers are overweight equities, healthcare and tech

Source: BofA Fund Manager Survey

Net percentage of fund managers who are overweight equities

Source: BofA Fund Manager Survey

On the other side of the table, allocations to real estate are at their lowest since June 2009.

Managers are also underweight utilities, Chinese and UK equities, and bonds. Almost half (47%) of global fund managers expect bond yields to fall due to interest rate cuts.

The vast majority (82%) of fund managers polled expect the US Federal Reserve to cut rates in the second half of this year, while 78% are anticipating two or more cuts during the next 12 months.

Soft landing remains the consensus forecast (56%), while almost a third (31%) predict no landing and just 11% anticipate a hard landing.

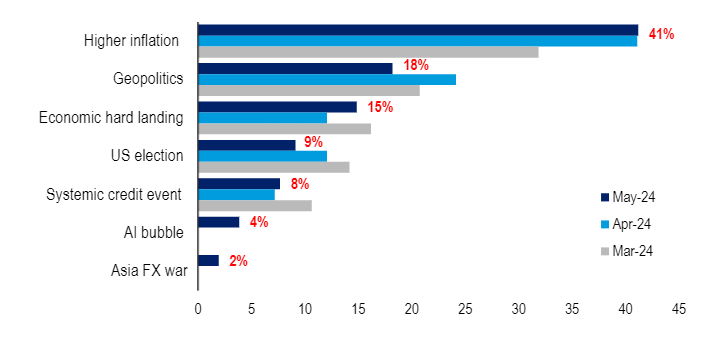

The greatest risk that fund managers foresee is higher inflation, which concerns 41% of respondents, followed by geopolitics (18%). Fund managers are at their most overweight commodities since April 2023, reflecting these two tail risks.

Fund managers’ perceptions of the biggest tail risk

Source: BofA Fund Manager Survey

Global growth expectations have fallen for the first time since November 2023 with a net 9% of managers anticipating that the global economy will weaken during the next 12 months. By contrast, just last month, a net 11% of managers said the economy would strengthen.

Nonetheless, fund managers remain bullish overall. BofA measures sentiment by looking at allocations to stocks and cash as well as economic growth expectations and on that basis, confidence is high, as the chart below shows.

Fund manager sentiment most bullish since November 2021

Source: BofA Fund Manager Survey