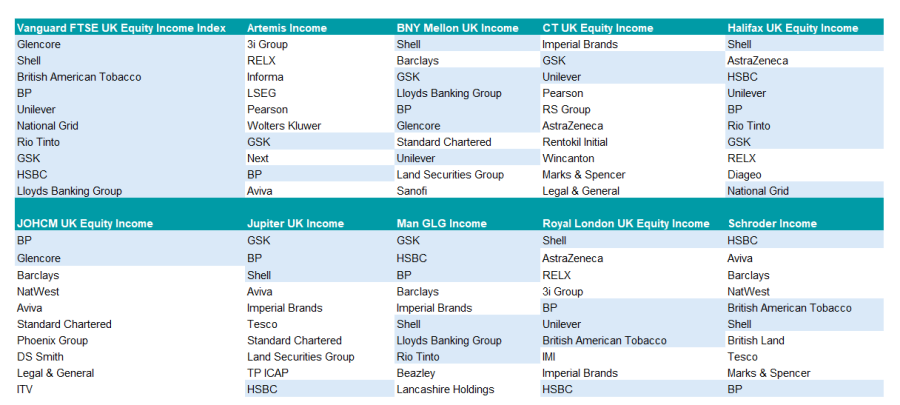

Several of the largest and most popular UK equity income funds hold the same stocks so investors who split their income portfolios between these funds might not be getting the diversification they are trying to achieve – depending on which funds they choose.

The IA UK Equity Income sector houses 10 funds with more than £1bn under management. One of these – the £1.2bn Vanguard FTSE UK Equity Income Index fund – is a passive tracker so Trustnet compared its top 10 holdings with those of the other nine funds.

Halifax UK Equity Income has the greatest overlap, with seven of the Vanguard tracker’s largest holdings amongst its own top 10, closely followed by BNY Mellon UK Income and Man GLG Income with six apiece.

Royal London UK Equity Income shares half of its top 10 stocks with the FTSE UK Equity Income Index. Four of Jupiter UK Income and Schroder Income's holdings overlapped.

At the other end of the spectrum, three funds share just two stocks with the Vanguard FTSE UK Equity Income Index’s top 10: Artemis Income, CT UK Equity Income and JOHCM UK Equity Income.

The most popular stock is BP; only CT UK Equity Income doesn’t have the oil giant in its top 10.

Shell and GSK are owned by seven of the 10 funds (including Vanguard), six hold HSBC and five have Unilever.

Beyond the index, several of these large funds’ highest conviction positions overlap with each other. Aviva, Barclays and Imperial Brands are owned by four of the funds, while AstraZeneca and Standard Chartered feature in three funds apiece.

Funds’ top 10 holdings

Sources: FE Analytics, funds’ factsheets

Market concentration forces large funds into the same stocks

One of the reasons that UK equity income funds’ holdings overlap is that the FTSE 100 is a highly concentrated market. Its top 10 holdings comprise almost half of its market capitalisation, while 57% of all dividends are paid by just 10 companies, according to Octopus Investments’ ‘Dividend Barometer’.

Sector concentration is significant too and can cause issues in times of market stress, such as the Covid-19 pandemic when oil companies slashed their dividends and banks were compelled to stop paying dividends completely.

AJ Bell investment director Russ Mould highlighted the UK market’s “hefty portion of earnings from unpredictable sectors such as miners and oil, and economically sensitive ones such as banks and consumer discretionary.”

Market concentration is even more of an issue for funds that have amassed a lot of assets – such as those in this study – which are compelled by their sheer size to channel assets towards the UK’s biggest companies.

Analysts at interactive investor, who added the £4.6bn Artemis Income fund to their Super 60 buy list this year, observed: “With its considerable size, the fund does not have the flexibility to invest significantly down the market-cap scale, but that has not hindered performance relative to the index over the medium term.”

The fund with the most differentiated holdings

Artemis Income had the most original line up from amongst the largest funds in the IA UK Equity Income sector. Four of its top 10 stocks were absent from its peers and from the FTSE UK Equity Income Index’s largest 10 positions.

FE fundinfo Alpha Manager Adrian Frost, Andy Marsh and Nick Shenton have struck out on their own by investing in Informa, LSEG, Wolters Kluwer and Next.

Managers who took bold off-benchmark bets

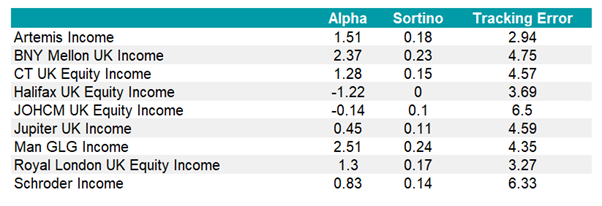

However, it was not the most actively-managed fund over the long term, according to the data.

Indeed, JOHCM UK Equity Income, led by Clive Beagles and James Lowen, came out on top with the highest tracking error over 10 years and 15 years, meaning that the managers deviated from their benchmark and took active bets.

It was followed by Schroder Income under Andrew Evans and Kevin Murphy. Both houses have a value investment style.

Funds’ tracking error, alpha and Sortino ratios over 10yrs

Source: FE Analytics, data to 22 April 2024

The least correlated fund to the benchmark

The 10 largest funds in the IA UK Equity Income sector are closely correlated, which is to be expected as they have similar mandates; although CT UK Equity Income stands apart in this regard.

The only fund not holding BP in its top 10, CT UK Equity Income was significantly less correlated than its peers to the Vanguard FTSE UK Equity Income Index fund during the past three years to 19 April 2024. Its correlation was 0.76 according to FE Analytics, whereas the next lowest was Royal London UK Equity Income at 0.87.

Managed by Jeremy Smith, co-head of UK equities at Columbia Threadneedle Investments (and by veteran manager Richard Colwell until his retirement in 2022), the £3.2bn fund pursues a contrarian, value-oriented strategy and focuses on both mid- and large-caps. Smith aims for above-market yields with dividend and capital growth.

Kamal Warraich, head of equity fund research at Canaccord Genuity Wealth Management, pointed out that “the contrarian approach has often led to significant sector biases” such as a zero weight to energy and banks, but a large overweight to industrials.

The best performers

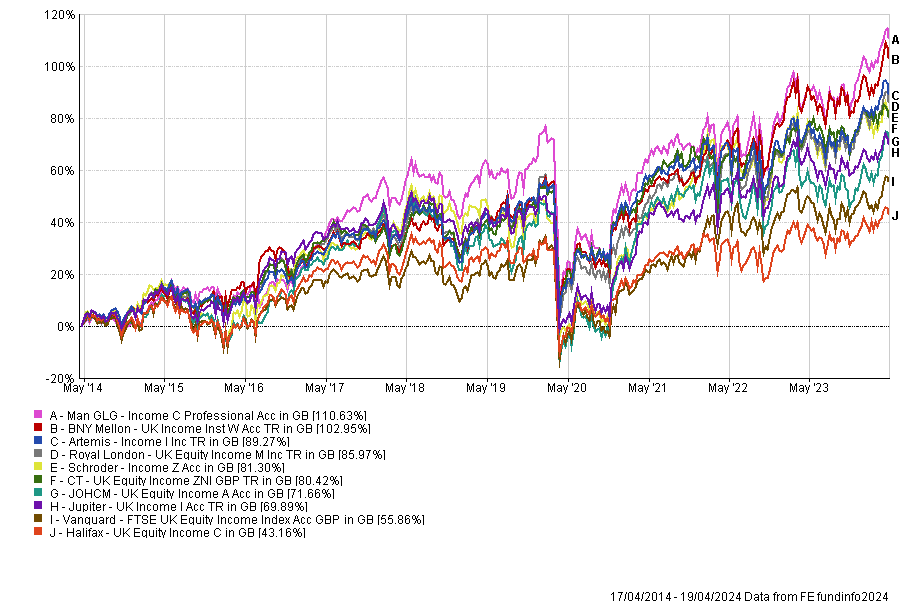

Despite the overlapping stock picks between some of the most popular funds, the outcomes experienced by investors diverged significantly over the long term.

The best performers were Man GLG Income and BNY Mellon UK Income, both of which have doubled their investors’ money over 10 years to 19 April 2024, up 110.6% and 103%, respectively.

Vanguard’s tracker delivered half of that and was the second-worst performer of the group, up 55.9%, while Halifax UK Equity Income brought up the rear with 43.2%.

Performance of funds over 10yrs

Source: FE Analytics

Paul Angell, head of investment research at AJ Bell, recommended Man GLG Income for ISA investors. “The manager has a preference for stocks which have strong potential for dividend growth (exceeding twice the market average) and bonds (max 20%) that on a relative basis appear more attractive than their company’s equity,” he explained. “In order to avoid value traps the manager additionally focuses on a firm’s cash, cash flow, and assets.” The £1.7bn fund has a yield of 5%.

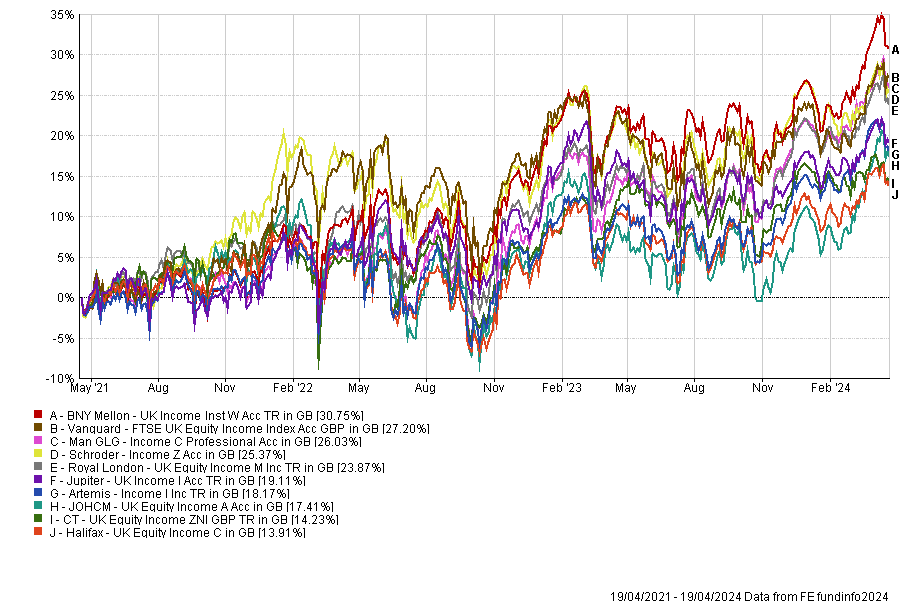

More recently however, Vanguard FTSE UK Equity Income Index has had its moment in the sun. The low-cost passive fund delivered the second-best returns of the group over three years, up 27.2%.

Performance of funds over 3yrs

Source: FE Analytics

BNY Mellon UK Income pulled ahead with 30.8% and had the highest alpha by a long way (5.1). Man GLG Income and Schroder Income returned 26% and 25.4%, respectively, with alpha scores of 3.33 and 3.35 over three years.