Investors have until the end of the week to ensure they have used up as much of the £20,000 ISA allowance as they can before this year’s deadline. But once the cash is in, knowing what to do with it is the next biggest issue.

For some – particularly those in retirement – one option is to use the money to supplement any income, such as a pension.

Below experts give their options for investors who want to take more risk through equity income (stocks), as well as those who want a lower-risk option through fixed income (bonds).

Stocks

Nick Wood, head of fund research at Quilter Cheviot, suggested investors who want equity exposure consider JPMorgan Global Growth & Income trust.

“For income investors, one of the main challenges when investing in equities is not to be too skewed away from higher growth companies that often don’t pay a dividend and towards more mature businesses that have may exhibit lower growth,” he said.

JPMorgan Global Growth & Income trust invests without specifically seeking a higher income profile, but utilises the investment trust structure to pay out a 4% dividend yield out of a combination of both income and capital appreciation.

“This has resulted in a fairly balanced portfolio in terms of style. This in turn has seen the underlying portfolio outperforming its global index each of the last five calendar years, a period in which the market has seen a number of changes in leadership in terms of style,” he said.

The £2.6bn trust has a FE fundinfo Crown Rating of five and is managed by FE fundinfo Alpha Managers Timothy Woodhouse and Helge Skibeli alongside Rajesh Tanna.

JPMorgan Global Growth & Income has a yield of 3.2% at present and is on a small premium to net asset value (NAV) of 1.3%. It has been the best performer in the IT Global Equity Income sector over one, three, five and 10 years.

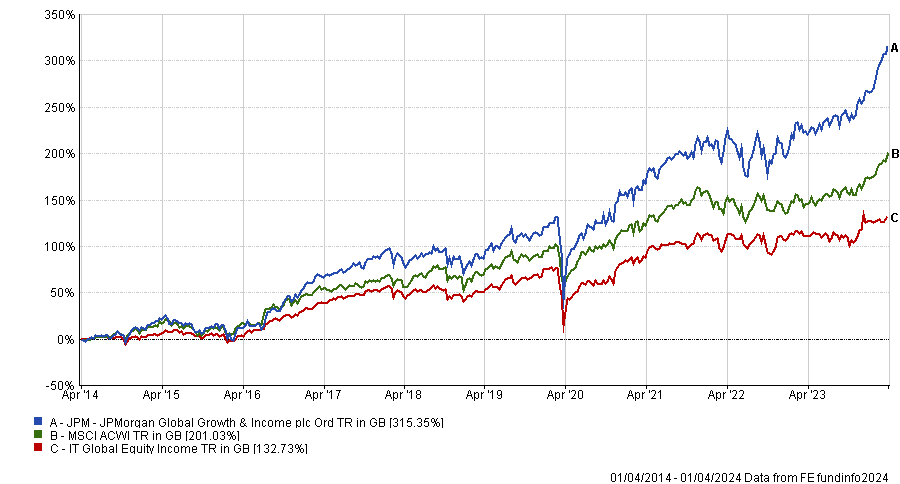

Performance of trust vs sector and benchmark over 10yrs

Source: FE Analytics

Another fund run by an Alpha Manager worthy of consideration is Man GLG Income, according to Paul Angell, head of investment research at AJ Bell.

Manager Henry Dixon seeks out undervalued and unloved companies through identifying two types of stocks: those trading below their replacement cost and those where the market appears to be undervaluing profit streams.

“Given the focus on generating income, all stocks held must have a yield in line with the market. The manager also has a preference for stocks which have strong potential for dividend growth (exceeding twice the market average) and bonds (max 20%) that on a relative basis appear more attractive than their company’s equity. In order to avoid value traps the manager additionally focuses on a firm’s cash, cash flow, and assets,” said Angell.

The £1.5bn fund has a yield of 5% and has been the best performer in the IA UK Equity Income sector over the past decade, doubling investors’ money over this time.

Performance of trust vs sector and benchmark over 10yrs

Source: FE Analytics

Bonds

Turning to fixed income, Gavin Haynes, co-founder of Fairview Investing, highlighted the £2bn Rathbone Ethical Bond fund managed by Bryn Jones, which currently has a yield of 4.9%.

It has been a top-quartile performer over one, five and 10 years, making the third-highest return in the IA Sterling Corporate Bond sector over the decade.

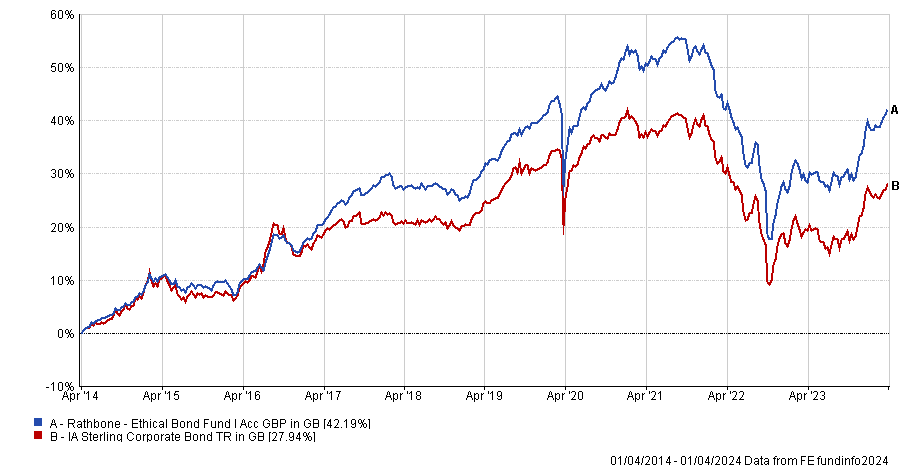

Performance of trust vs sector and benchmark over 10yrs

Source: FE Analytics

“This fund is invested in sterling investment grade corporate bonds with a key objective to provide an attractive level of income. It follows a thematic top-down process with a strong negative and positive [environmental, social and governance] ESG screening process, after which the team carry out credit analysis to find the bonds that offer the best opportunities,” said Haynes.

“It has a significant weighting in the bonds of banks and other financial companies which appear to offer compelling yields and should benefit when interest rates fall. Jones has established an impressive long-term track record.”

Angell meanwhile suggested M&G Emerging Markets Bond, headed by Alpha Manager Claudia Calich, as his preferred bond pick.

“This emerging market debt fund has a neutral weighting of two-third government bonds, issued in either developed market or local currencies, and one-third corporate bonds, issued solely in developed market currencies,” said Angell.

Its long-term performance has been “very impressive”, outperforming its composite index in all but two calendar year since its 2013 launch. It has been the best performer in the IA Global EM Bonds – Blended sector over 10 years, making 88.8%.

“The neutral split across government and corporate bonds, as well as developed market and emerging market currencies, results in a diversified portfolio by risk factors,” said Angell.

“The team’s bottom-up credit selection tends to then generate a higher yield than the composite index, given the team’s preference for both high yield issuers as well as peripheral country bonds.”