Many investors wait until a fund is running a decent amount of money before putting their own in – preferring the perceived safety of investing alongside plenty of others – but there are relatively small funds out there with strong ratings.

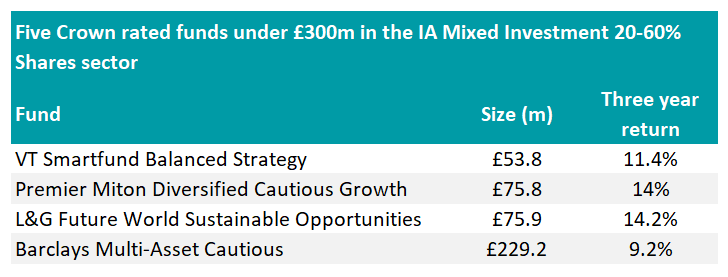

Here, Trustnet looks at funds in the IA Mixed Investment 20-60% Shares sector (formerly known as the ‘cautious’ sector) that have less than £300m in assets under management (AUM) but hold the top FE fundinfo Crown rating of five.

Only the top 10% of the thousands of funds monitored by FE fundinfo are awarded a five Crown rating, so only a limited number of portfolios make the top spot. The methodology evaluates each fund on alpha, volatility and consistently strong performance to help investors make good investment decisions.

Source: FE Analytics

The smallest IA Mixed Investment 20-60% Shares fund to make it onto the list is VT Smartfund Balanced Strategy. This £54m portfolio is up 45.1% since launching in 2015, beating the sector by 11.4% over this period.

It’s ultimate goal is to “provide a balance of income and capital growth over the medium to long term”, which it achieves by investing in a mix of equity funds and fixed interest securities globally – the various investment managers currently have around 48.2% in equities and 40.9% in bonds.

VT Smartfund Balanced Strategy is not easily accessible to retail investors, but there is the option to apply for shares directly through Value-Trac.

A more readily available cautious fund that met the criteria is Premier Miton Diversified Cautious Growth. This £76m portfolio has a smaller allocation to fixed income (38.4%) and equities (35.8%), but gives investors exposure to other areas such as alternatives and property, which jointly account for almost a fifth (19.7%) of all holdings.

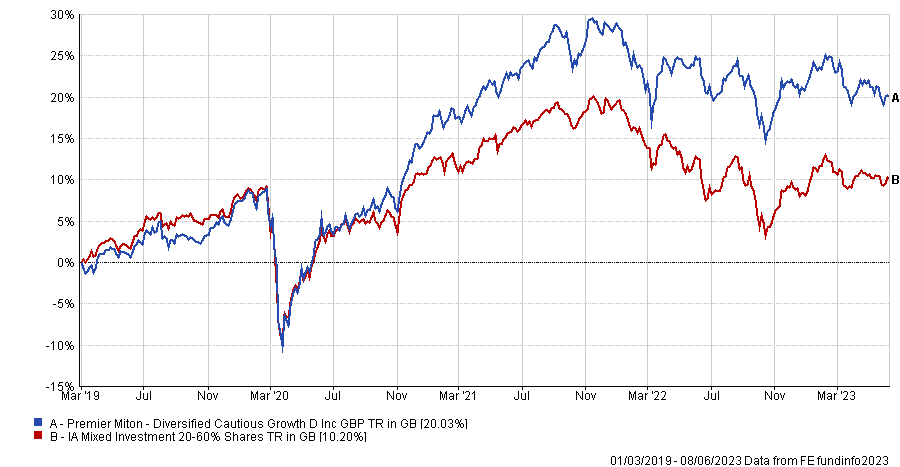

It’s up 20% since Neil Birrell launched the fund in 2019, soaring 9.8 percentage points ahead of its peer group over the period.

Total return of fund vs sector since launch

Source: FE Analytics

Birrell manages all five of the firms Diversified fund range, with the oldest – Premier Miton Diversified Growth – making a top quartile return of 118.2% since launching in 2011.

Analysts at RSMR said that Birrell’s proven track record makes him a safe pair of hands, with Premier Miton Diversified Cautious Growth considered a good choice for investors seeking a multi-asset approach.

“The asset allocation parameters are very flexible, enabling the management team to respond quickly to changing market conditions and this flexibility has proved effective in helping the funds to remain competitive over some difficult market environments,” they added.

“We believe the Premier Miton Diversified funds are a good choice for an investor seeking a genuine multi-asset proposition that has the capability to generate some competitive risk adjusted returns over differing market cycles.”

Another strategy making the cut in this research is the £76m L&G Future World Sustainable Opportunities fund, which more than doubled the return of the sector since launching in 2018, climbing 17.8%.

It also has the added appeal of FE fundinfo Alpha manager Colin Reedie running the fund. Not only was the fund awarded five Crowns, but Reedie’s Alpha manager status means he himself has proven to consistently outperform over the long term.

Reedie currently manages five funds for the firm, but this portfolio in particular uses environmental, social and governance (ESG) considerations to find sustainable assets that “will shape both the investment industry and society for years to come”.

Total return of fund vs sector since launch

Source: FE Analytics

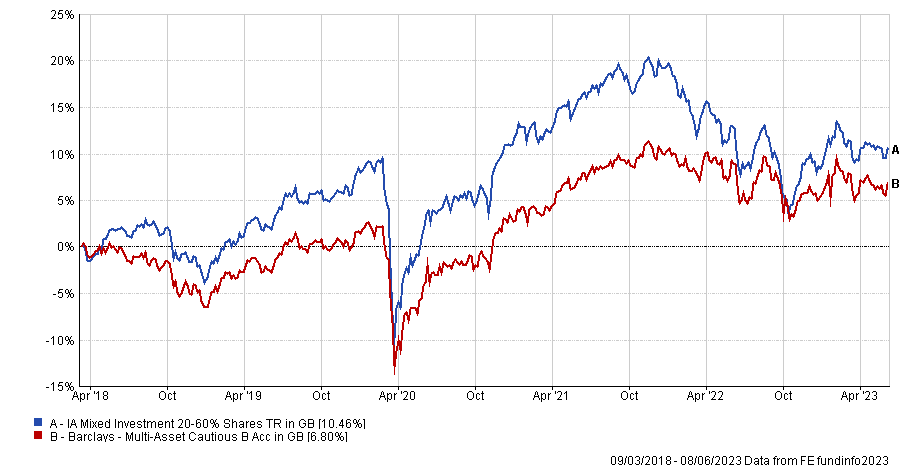

The only other small fund to get five Crowns in the IA Mixed Investment 20-60% Shares sector was Barclays Multi-Asset Cautious. This £229m portfolio climbed 10.5% since launching in 2018, beating sector’s average of 6.8% over the period.

It gets its exposure to equities (36.3%) and bonds (33.8%) by investing in other funds, with Janus Henderson UK Absolute Return and BlackRock Global Event Driven taking the top 18.9% of the portfolio.

Total return of fund vs sector since launch

Source: FE Analytics