Funds with a bias to Polish stocks, the headline-grabbing artificial intelligence revolution and European equities have been leading the bull run that start in the fourth quarter of 2022, Trustnet research shows.

Markets might have sold off aggressively over most of 2022 as central banks hiked interest rates to curb soaring inflation, but they have advanced this year when it looked like progress was being made in this battle.

Indeed, the US was recently called to be in another bull market because the S&P 500 is up 24.1% total return since mid-October (a 20% rise is the traditional definition of a bull market). The Euro STOXX is up 27.6% over the same time while Japan’s Topix has gained 22.7%.

Price return of main markets since Oct 2022

Source: FE Analytics. Total return in local currencies between 14 Oct 2022 and 20 Jun 2023

However, the jury is still out on if this marks the start of another bull market or if it is just an extended bear market rally. After all, genuine bull markets rarely start in the midst of a hiking cycle or before a recession – as many fear the world is still at risk of.

Tom Stevenson, investment director, personal investing at Fidelity International, said: “The measurement of bull markets is more art than science. On plenty of occasions, markets have enjoyed a rally of 20% or more before reverting to their previous downward path.

“The stock market bear is a wily beast and enjoys pulling wishful thinkers into its embrace with this kind of sucker’s rally. This time around there are more reasons than ever to question whether this is the start of a sustainable bull market or another false dawn.”

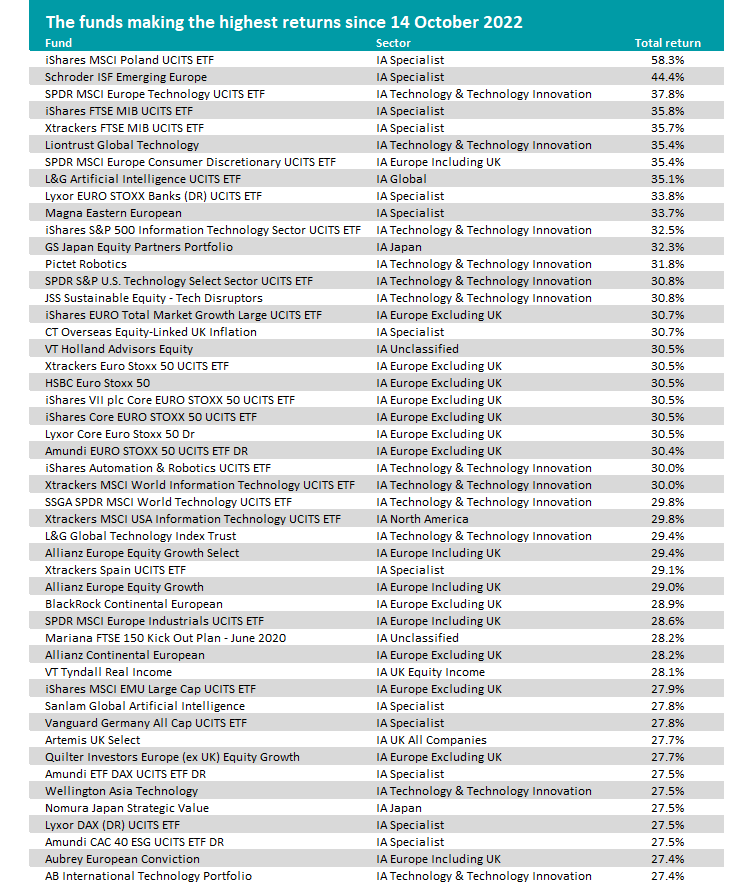

A look at the 50 best-performing funds in the Investment Association universe shows a few clear trends.

Source: FE Analytics

The iShares MSCI Poland UCITS ETF sits at the top of the list with a 58.3% total return. This is the only fund in the Investment Association universe and its strong recent performance is likely down to a few reasons: Poland’s economy is strong, the country held interest rates in October and the market is relatively attractive valued after falling in 2022.

The strength of the Polish stock market is also behind the strong performance of Schroder ISF Emerging Europe and Magna Eastern European as Poland is the largest geographic weighting in both portfolios.

Polish equities are a minor trend in the above list but a much bigger one of the wider European equity market.

European equities has been rallying hard recently for a number of reasons. The feared ‘European energy crisis’ was largely averted thanks to a mild winter and stocked-up gas tanks, leading to a stronger-than-expected economy, while the region’s companies tend to trade on more attractive valuations than the US.

Some funds investing in specific European markets can be found in the list of best performers, including Italy (iShares FTSE MIB UCITS ETF, Xtrackers FTSE MIB UCITS ETF), Spain (Xtrackers Spain UCITS ETF) and Germany (Vanguard Germany All Cap UCITS ETF).

European large-caps are also well-represented on the list, through the likes of Xtrackers Euro Stoxx 50 UCITS ETF, HSBC Euro Stoxx 50, iShares Core EURO STOXX 50 UCITS ETF, Lyxor Core Euro Stoxx 50 and Amundi EURO STOXX 50 UCITS ETF.

Only two UK equity funds are found in the 50 highest-returners since mid-October: VT Tyndall Real Income and Artemis UK Select.

But the most headline-grabbing theme on the above list is tech stocks, especially those with a connection to artificial intelligence (AI). Although tech was one of the most beat-up parts of the market in 2022, it has been surging more recently as investors get excited by the opportunities created by the rise in AI.

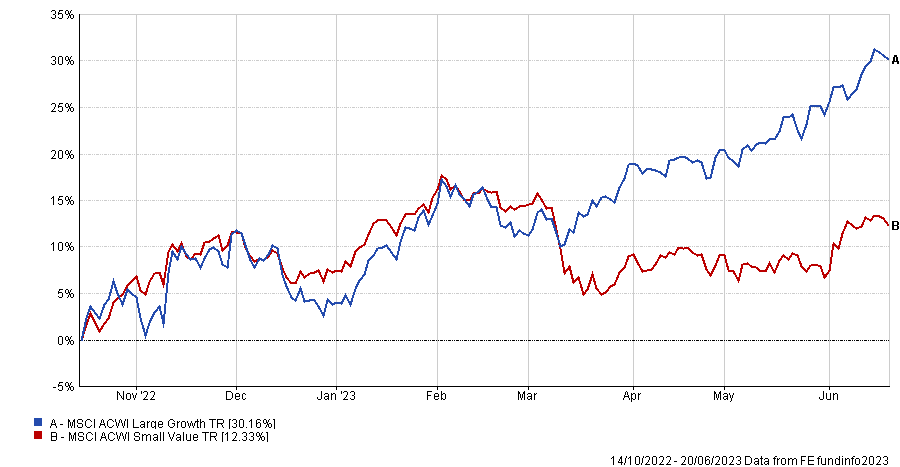

Performance of large-cap growth vs small-cap value since Oct 2022

Source: FE Analytics. Total return in local currencies between 14 Oct 2022 and 20 Jun 2023

Indeed, most of the gains in the S&P 500 this year have come from a narrow range of stocks, most of which are active in the AI space. This means the bull run is heavily biased towards large growth stocks, with little progress in value small-caps.

L&G Artificial Intelligence UCITS ETF, Pictet Robotics, iShares Automation & Robotics UCITS ETF and Sanlam Global Artificial Intelligence are funds that are directly tied to this theme while more generalist tech funds that have been performing strongly include Liontrust Global Technology, iShares S&P 500 Information Technology Sector UCITS ETF and AB International Technology Portfolio.

However, Fidelity’s Stevenson suggested that backing the winners of the recent bull run might not be the best course of action.

“Either this is a bear market rally that has overstayed its welcome and the technology leaders will be hardest hit in the correction. Or the bull really does have legs and the rest of the market has some catching up to do,” he finished.

“Either way, a broad-based approach - an actively managed fund that favours smaller value stocks, or an ETF tracking the equal-weighted index - looks like the safest option.”