Investment companies struggled to entice new investors through share issuance in the first half of the year, according to research firm Numis Securities.

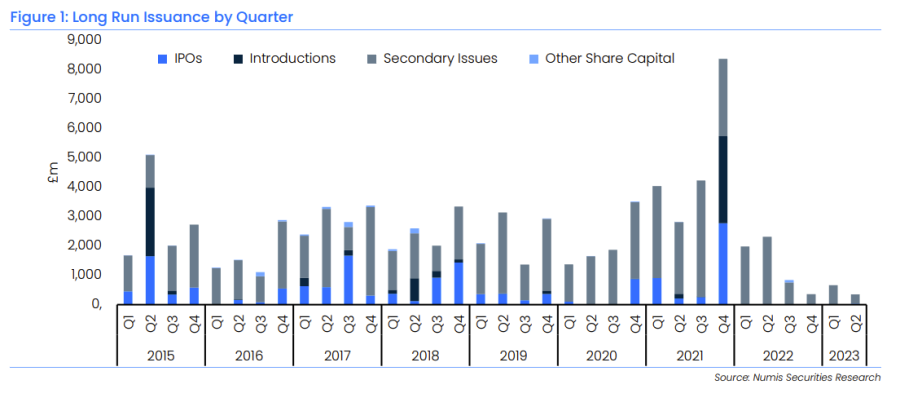

The £1bn worth of new shares issued in the first six months of 2023 was the lowest on record since the firm began collating data in 2010 and down 76% on the previous year. The second quarter of 2023 was also the slowest for issuance on record.

Macroeconomic uncertainty was to blame, according to head of investment company research Ewan Lovett-Turner and his team, as higher interest rates led to the further derating of alternative income strategies.

“The collapse of Silicon Valley Bank and Credit Suisse also did little to lift market sentiment,” they said.

However not all suffered. The uncertain market backdrop proved fruitful for BH Macro, which accounted for approximately a third of total issuance in the sector having raised £315m.

The trust was the best performer in the IT Hedge Funds sector last year, making a 20% gain, although it has lost 21.6% so far this year.

“It was amongst the largest issuers during 2022, in part driven by its stellar performance in a difficult environment. However, the February fundraising proved to be around the peak of performance,” the Numis analysts said.

The other large issue came from 3i Infrastructure, which raised £102m before the mass derating of companies across the equity and alternative sectors, which are currently trading at average discounts of 12% and 26% (ex 3i Group) respectively.

“This has resulted in lower issuance with the larger issues in the early part of the year and few funds being able to maintain a premium rating as the year has progressed,” the analysts said.

There was some good news for investors as the IPO market tentatively got off the ground, with the launch of two new trusts in the first half of the year. There were none in 2022.

Both were small, however, with Ashoka WhiteOak Emerging Markets and Onward Opportunities raising £31m and £13m at launch respectively, and the upcoming pipeline of new trusts is “weak”.

Guidance for share issuance over the remainder of the year is for another slow six months. Currently, only 22 trusts trade on a premium, just 6.5% of the entire universe, with the change in interest rates leading to many alternative income sectors, such as infrastructure and renewable energy companies, moving from premiums to discounts.

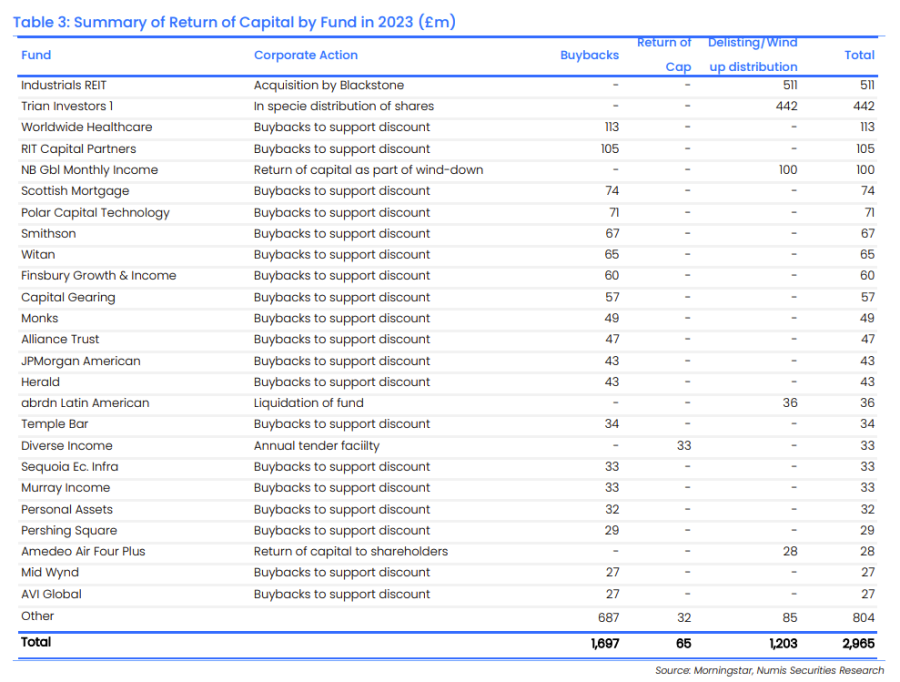

Boards are therefore more focused on reducing the discount than issuing shares, with Numis’ analysts highlighting buybacks, mergers and acquisitions (M&A) and asset sales as the main ways in which management teams are trying to deliver value for shareholders.

In the first half, around £3bn was paid back to investors, compared with £4.4bn for the entirety of the previous year, with the majority (£1.7bn) through share buybacks. It was the first time more capital was returned than raised since the records began in 2010.

Worldwide Healthcare (£113m) took back the most shares, followed RIT Capital Partners (£105m) and Scottish Mortgage (£74m), the latter of which had topped the list in each of the past three years.

“It is positive to see an increase in buybacks in the face of widening discounts, particularly from a wider range of asset classes. However, we expect boards are also going to have to think creatively to seek to manage discounts, potentially through asset sales to demonstrate value and generate cash,” the Numis report said.

“Boards that show strong capital discipline and a focus on share price returns are likely to be rewarded over the medium term. In contrast, boards that are slow to react to the new environment are likely to face increased pressure from shareholders.”

It also highlighted a rise in shareholder engagement, particularly in relation to issues around diversity and tenure of board members, as well as a pick-up in M&A activity.

“We see M&A being a potential catalyst for wholesale re-ratings in sectors such as infrastructure, if private buyers see value in public markets,” the analysts said.