Investors who want consistent return from their bond funds should consider sterling corporate bonds, which have one of the best track records for rolling returns of the past decade, Trustnet research has found.

In this study we look at monthly rolling returns calculated for the previous three-year periods over the past decade, focusing on those that have managed to retain a top-quartile position in their respective sectors for longer than other strategies.

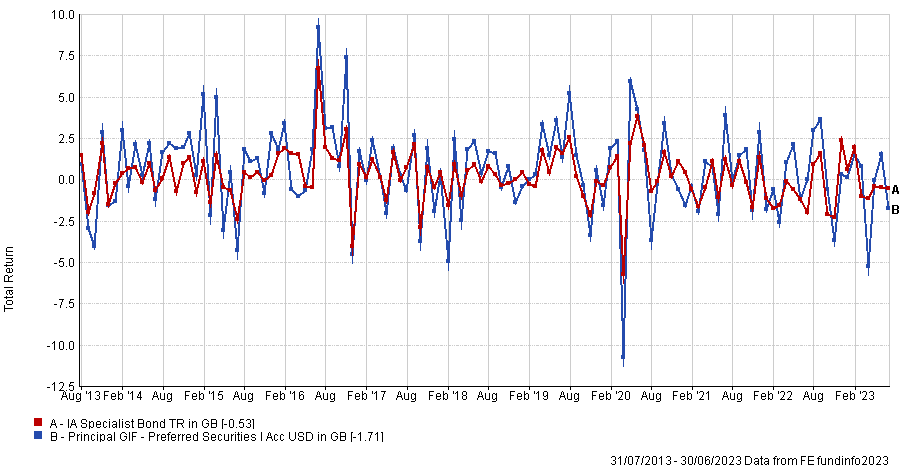

Sterling corporate bond funds constituted one third of the whole table, but in a list heavily populated by UK fixed income, the asset class didn’t manage to gain first position in the list, which was snatched by the US-focused Principal GIF Preferred Securities.

Monthly rolling returns of fund over 10yrs against sector

Source: FE Analytics

This $3.8bn FE fundinfo four-Crown rated fund is led by L. Phillip Jacoby and Mark Lieb, who base their strategy on investment-grade US-debt securities.

It is the only IA Specialist Bond fund in the list and it stayed in the first quartile of its sector for 88.3% of the past 10 years.

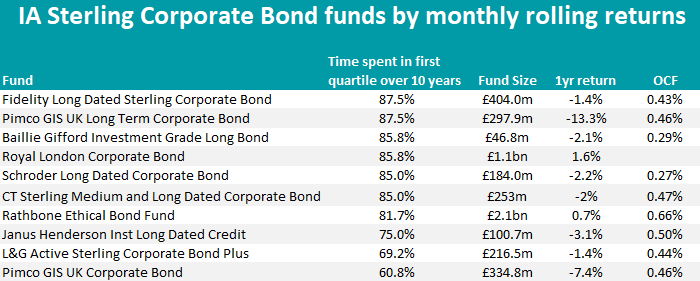

The second-best result was 87.5%, which was matched exactly by four different portfolios. To break down this crowded second position, we start with IA Sterling Corporate Bond funds Fidelity Long Dated Sterling Corporate Bond and Pimco GIS UK Long Term Corporate Bond.

Source: FinXL

In the former strategy, emphasis is put on bottom-up issuer selection and diversity through the asymmetric nature of corporate bond returns, with the manager Ian Robert Fishwick retaining a degree of flexibility to invest in out-of-index strategies to add performance.

The latter, led by Ketish Pothalingam, combines global top-down views on the macroeconomic environment with bottom-up security analysis.

Together with other eight IA Sterling Corporate Bond funds, they make up close to one third of the whole list. Other names include Baillie Gifford Investment Grade Long Bond, Royal London Corporate Bond, Schroder Long Dated Corporate Bond and CT Sterling Medium and Long Dated Corporate Bond.

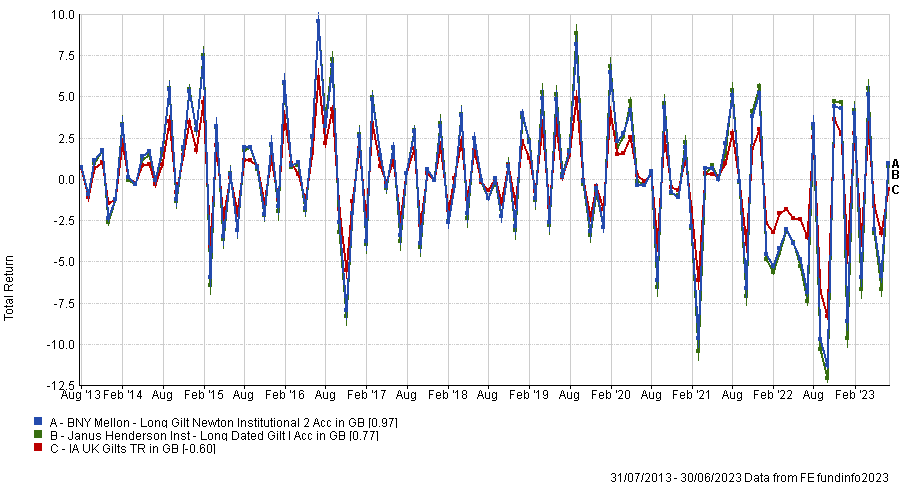

Still on a par in second position are two IA UK Gilts institutional funds, BNY Mellon Long Gilt and Janus Henderson Inst Long Dated Gilt.

Monthly rolling returns of funds over 10yrs against sector

Source: FE Analytics

BNY Mellon Index Linked Gilt and Insight UK Index Linked Bond (also institutional funds) are the only other two gilts strategies in the IA UK Index Linked Gilts sector to appear in the list.

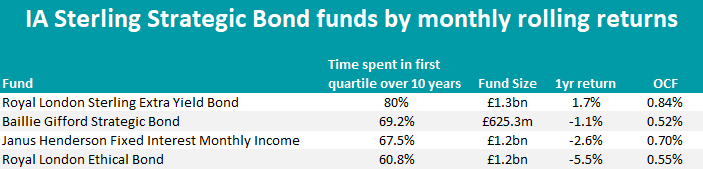

Among strategic funds, Royal London Sterling Extra Yield Bond, with its 80% of the past 10 years spent in the first quartile of its sector, distances the other strategies by some, as the table below shows.

Source: FinXL

It’s a FE fundinfo five-Crown rated portfolio aiming to achieve a gross redemption yield of 1.25x the gross redemption yield of the FTSE Actuaries British Government 15 Year Index.

Concluding the list of UK fixed-income funds is Schroder High Yield Opportunities, the only constituent of the IA Sterling High Yield sector with the requisites to enter the list. It retained a top-quartile performance 74.2% of the time in analysis.

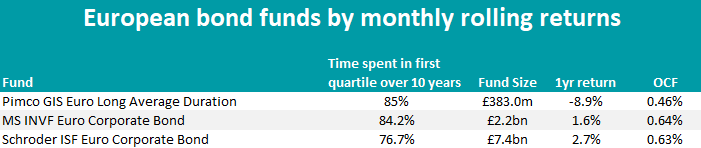

Elsewhere, Pimco GIS Euro Long Average Duration was the best European bond fund of the decade on a rolling returns basis, remaining in the top quartile of the IA EUR Mixed Bond sector 85% of the time. In May, it was heavily skewed towards government bonds (73.4% of the portfolio), and within that, France and Germany were the main contributors to total duration.

Within corporate bonds, MS INVF Euro Corporate Bond and Schroder ISF Euro Corporate Bond stood out; while in the government bond space, it was only trackers by iShares and Xtrackers to make the list.

Source: FinXL

Globally, Schroder ISF Global Corporate Bond and Pimco GIS Global Bond Ex US were the best choices in the IA Global Mixed Bond sector, with a 79.2% and 78.3% permanence in the first quartile, respectively. Colchester Global Real Return Bond is the only representative of the IA Global Inflation Linked Bond sector, having been among the top performers 65.8% of the past 10 years.

In the US, AXA World Funds US High Yield Bonds deserved a mention, with a top-quartile performance 67.5% of the time.

This article is part of an ongoing series on rolling returns. In the previous instalments, we covered: IA UK All Companies, IA European, IA Global, IA Smaller Companies and the IA Mixed Investment sectors.