Investors celebrated lower inflation figures from the US, but this wasn’t enough to spark enthusiasm at Waverton for head of multi-asset James Mee and Matthew Parkinson, deputy manager of the Waverton multi-asset funds, who have kept defensive throughout their managed portfolios.

A possibly stickier inflation than the market expects prompted them to remain underweight equities and to maintain a longer duration in fixed income than they’ve ever had.

Data shows headline inflation coming down back towards 2% at a fairly rapid pace, particularly in the US, the managers said. But this is largely due to the year-on-year benefits that we have at the moment, due to weaker oil prices and an improvement in our supply chains, which were driving inflation last year.

“We won’t be feeling these tailwinds anymore going forward. Rents are a very material part of headline inflation at the moment – we think they're coming down year on year, but that will be a slow grind lower. Service inflation is notoriously sticky, however,” said Mee.

“While headline inflation might come down pretty rapidly, core inflation, driven by service inflation (in turn driven by low wage growth), could well remain well above 2%. The Fed will probably maintain rates at a pretty high level for the time being. The only way they can get prices down is to be demand destructive. That is how monetary policy works.”

On this backdrop, the team didn’t change its risk-off policy that began two years ago.

“Back at the end of 2021, we were taking risk off the table, so we were very well positioned through the first half of 2022. Since then, we've remained cautiously positioned,” Mee said.

In the Waverton Multi Asset Income fund, which is in the IA Mixed Investment 20-60% Shares sector and can only invest up to 60% in equities, the team are currently running about 47% in equity. The typical range through Covid has been as low as 41% and as high as 59%, with 50% being considered the midpoint, the managers explained.

They also remained on the cautious side in their fixed income allocation, running a longer duration than they’ve had since the inception of the fund nine years ago, as well as in treasuries and gilts.

On the LF Waverton Portfolio fund, where a neutral equity weighting would be 75%, they are slightly underweight at 73% at the moment, again with a preference for fixed income.

Part of their cautious position also includes an 18% allocation to alternatives, 90% of which is in real assets. Here, Waverton also has a dedicated fund, Waverton Real Assets, investing in property infrastructure, asset finance, commodities and specialist lending, areas in which the managers find “extraordinary value” as the markets disproportionately hit these names by rising their discount rate as gilt yields have risen.

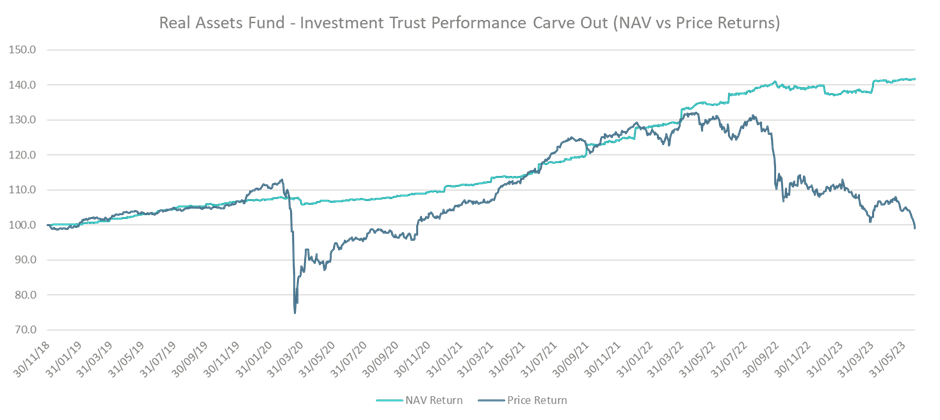

Source: Waverton

Over the last 12 months, the fund lost 12%, which the managers explained using the chart above, showing the derating in share price versus net asset value (NAV) for the listed investment company and real estate investment trust (REIT) exposure within the real assets fund.

“This aggregate exposure took a further leg down in June as gilt yields rose in response to the higher than expected UK inflation print,” said Parkinson.

“While we are cognisant it is possible that there may be weakness in certain NAVs across the sector to come, we do believe the market has over-discounted the potential falls, providing a very attractive opportunity set from here.”

But while they remain “positive on many of the opportunities in the listed investment company and UK REIT market”, the managers decided to diversify that risk more globally and through the introduction of direct real asset fixed income exposure, leaving the investment company and REIT exposure of the fund at 45% versus the 65% it was 18 months ago.

On top of that, the managers reduced their property exposure to seek more global opportunities (with global now at 40.9%) by reducing the exposure to the UK from 30% to 20%.

The portfolio has also suffered from the malaise in UK stocks, in particular the FTSE 250, given the funds listing exposure is primarily to the UK, but, while the managers asked themselves whether sentiment towards the UK can get much worse, they said that passive selling of the UK REIT market and FTSE 250 may reverse, which would also be supportive of their strategy.