There is a compelling case for buying bonds for the first time in more than a decade as interest rates have risen to combat higher inflation.

Rising rates have a knock-on effect on all yielding assets. For bonds, the more return savers can get through holding their savings in cash, the higher the yield they will demand from bonds. As such, bond prices fall as investors sell out to safer areas, increasing the relative payout.

Earlier this month, Jason Hollands, managing director of Bestinvest, said: “In the midst of the most aggressive cycle of interest rates rises in decades, we are now in a vastly different environment from the one that investors have been used to since the global financial crisis. Bonds are now offering yields that are worth considering again as a component of private investment portfolios.”

Some may ask whether now is the time to buy or whether there are better yields on the horizon, but it seems that investors have believed the latter rather than the former. Indeed, bond funds have largely been more sold than bought over the past six months, according to the latest fund flow data from FE Analytics.

In this series we look at the most bought and sold funds over the first half of the year. For this article we capped the limit at £100m.

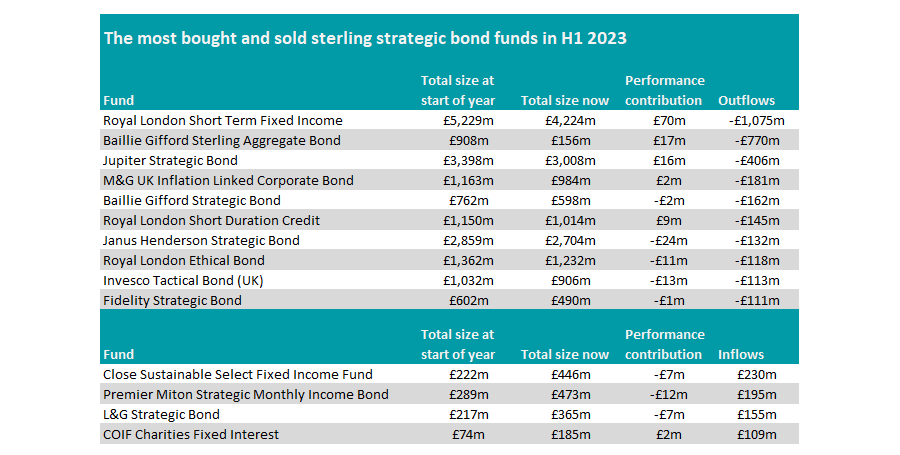

In the IA Sterling Strategic Bond sector, there were more funds with £100m of outflows between January and June than inflows.

The most sold fund over this period was Royal London Short Term Fixed Income. Investors withdrew around £1bn from the fund, which now has assets under management (AUM) of £4.2bn.

Short duration bonds are preferred when interest rates are rising because they have less interest rate risk and can be reinvested sooner at higher rates, optimising returns.

However, according to a report by Natixis earlier this week, 56% of experts surveyed think long-duration bonds will outperform short-duration bonds by the end of 2023 as interest rate expectations start to cool on lowering inflation figures.

Baillie Gifford Sterling Aggregate Bond was second, with £770m leaving the fund with an AUM of £156m, while Jupiter Strategic Bond was third, with a £406m withdrawal taking total assets to £3bn. Both funds made a positive return over the period.

Source: FE Analytics

Conversely, there were just four funds that received more than £100m: Close Sustainable Select Fixed Income, Premier Miton Strategic Monthly Income Bond, L&G Strategic Bond and COIF Charities Fixed Interest.

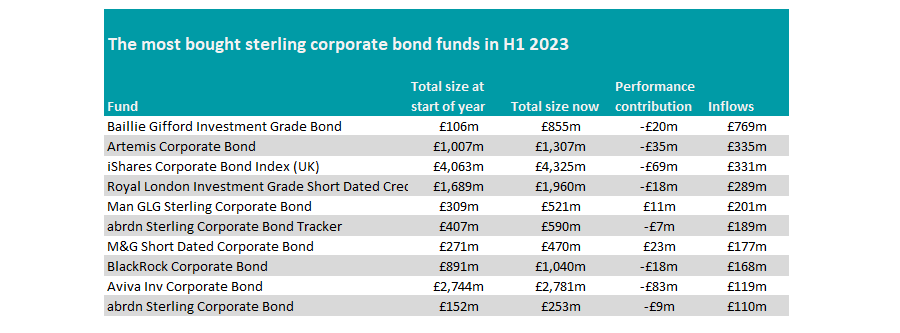

Turning to the IA Sterling Corporate Bond Sector, Baillie Gifford Investment Grade Bond tops the list, taking in a net £769m in new money over the first half of 2023, with the majority of this added in April.

Active fund Artemis Corporate Bond was second, adding £335m in new money. Last week, manager Stephen Snowden said trying to predict what will happen with inflation and interest rates in the UK is a “mug’s game” but that as such he does not invest for one scenario over another – taking a more balanced approach to the portfolio.

“In such times I do not think you can invest for one scenario or the other with high conviction. As a consequence, we are modestly long duration. We have been adding a little to duration in recent weeks,” he said.

Source: FE Analytics

Passive tracker iShares Corporate Bond Index (UK) was third taking in £331m. Earlier this week, Paul Syms, head of EMEA ETF fixed income product management at Invesco, said there are good reasons for investors to own both active and passive bond funds in their portfolios.

By using an exchange-traded fund (ETF), investors can “achieve the interest rate risk or yield curve positioning that matches their needs”. However, “these choices aren’t without their own risks as, rather than relying on an active manager implementing their views, end investors need to ensure the ETFs in which they have invested continue to reflect their views throughout the economic cycle”, he added.

Source: FE Analytics

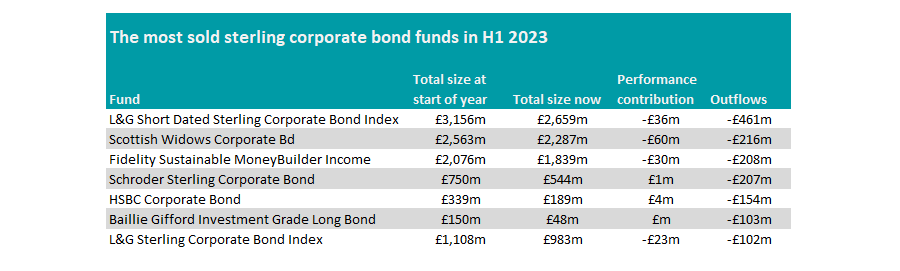

In the IA Sterling Corporate Bond sector, L&G Short Dated Sterling Corporate Bond Index was the most sold with £461m leaving the fund, continuing the trend of investors moving on from shorter duration assets.

Scottish Widows Corporate Bond, Fidelity Sustainable MoneyBuilder Income and Schroder Sterling Corporate Bond also had net withdrawals of more than £200m over the first half of the year.

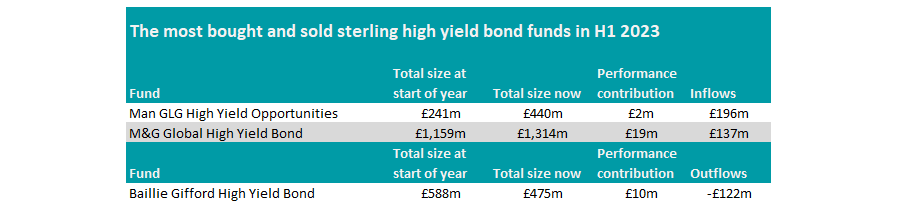

Finally, looking at the IA Sterling High Yield sector, there were only three funds to take in or lose more than £100m in flows.

Source: FE Analytics

Man GLG High Yield Opportunities and M&G Global High Yield Bond both added more than £100m to their AUMs while Baillie Gifford High Yield Bond suffered the highest redemptions (£122m).

Analysts at the BlackRock Investment Institute are underweight high yield bonds at present, noting that “spreads do not fully compensate for slower growth and tighter credit conditions we expect”, but take a neutral stance on investment grade corporate bonds.

However, Artemis fund manager Jack Holmes disagreed, noting that, at current valuations, “50% of the high yield market would need to default over the next five years in order for an investor to break even, assuming a recovery rate of 40%, which is slightly below the historical average”,