Investors face uncertain times, whether it be from war in Europe, inflation, rising interest rates, the lagging effects of the Covid pandemic or an as-yet-to-be-known upset waiting around the corner.

Perhaps nowhere embodies this uncertainty more than the emerging markets, which range China – one of the worst affected countries from Covid – to Russia – currently at war with Ukraine.

There are also areas that have avoided the worst of the chaos, including countries such as India and Korea as well as Latin America, which has boomed on the back of the surge in commodity prices.

In this series, Trustnet uses the upside capture ratio to identify the funds that have made the most money during the good times. We also take a look at the defensive portfolios that can protect during market shocks through the downside capture ratio.

Both scores are calculated against a relevant benchmark. Here we have chosen the MSCI Emerging Markets index. An upside capture score of greater than 100% mean a fund has made more than the market when it has been rising, while lower downside capture metrics mean a portfolio has fallen less during tougher times.

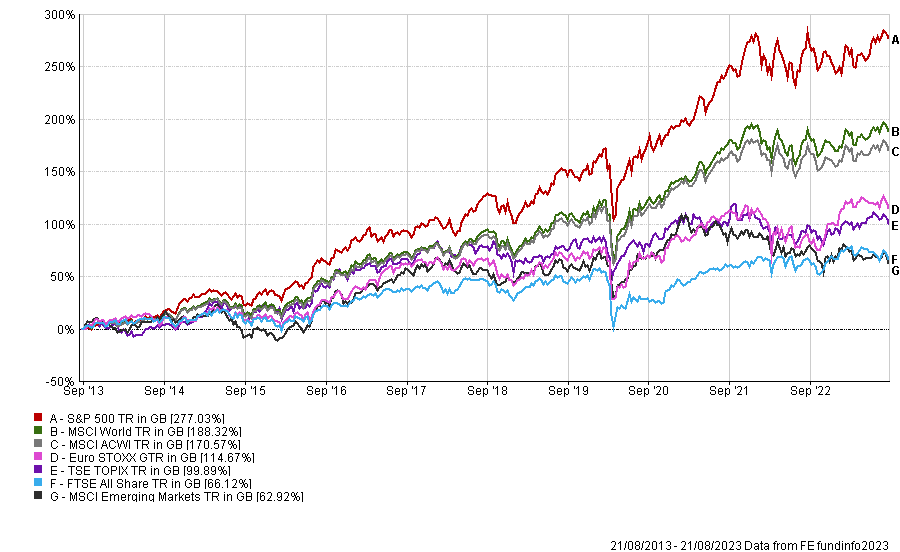

The emerging markets have underperformed their developed market peers over the past decade, making a paltry 62.9% – the US S&P 500 has made more than four times this.

Performance of indices over 10yrs

Source: FE Analytics

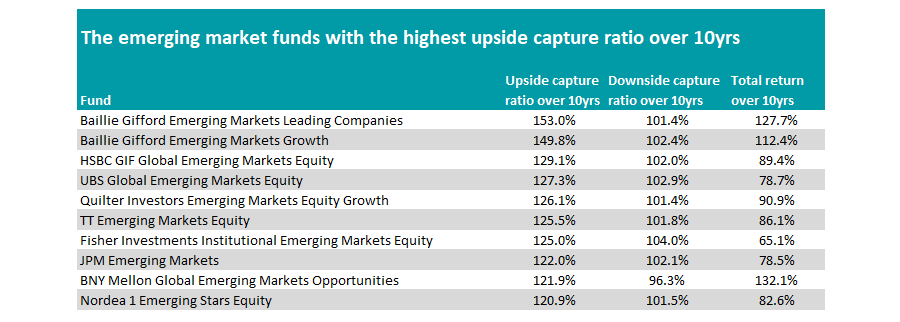

However, investors that wanted to make the best returns would have been better off searching for those that made the most of the good times, rather than trying to avoid losses.

Indeed, only one of the 10 funds with an upside capture ratio above 120% has failed to make above-average returns in the sector over the past 10 years.

Fisher Investments Institutional Emerging Markets Equity is the outlier, as it also has the highest downside capture ratio among the group. Its total return of 65.1% is higher than the benchmark but below the average peer in the IA Global Emerging Markets sector.

Source: FE Analytics

Baillie Gifford Emerging Markets Leading Companies has the highest upside capture ratio of 153% and over the past 10 years has made a top-quartile return of 127.7%, almost double the index.

Managed by Will Sutcliffe, Roderick Snell and FE fundinfo Alpha Manager Sophie Earnshaw, the fund employs Baillie Gifford’s high-growth approach to investing, with technology the largest part of the portfolio at 28.3%.

The top performer on the list however was BNY Mellon Global Emerging Markets Opportunities, which had an upside capture ratio of 121.9%, but also had a better downside capture ratio than the others (96.3%). It’s total return of 132.1% was the best in the sector, pipping the Baillie Gifford fund to top spot.

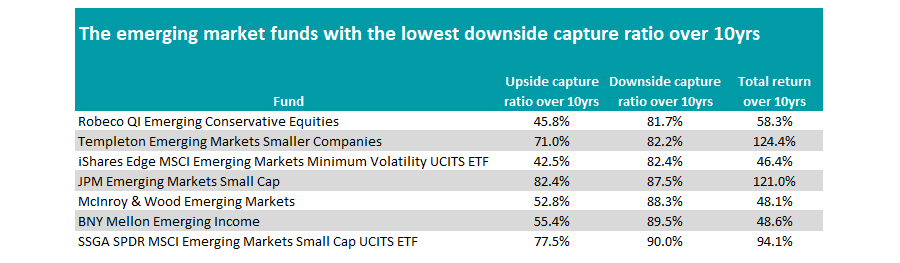

For investors that want a more cautious approach to the high-risk emerging markets, returns were less spectacular. Of the seven funds with a downside capture ratio of less than 90%, only three have made top-quartile returns.

Despite being known for more risk, smaller companies proved to be less risky than their large-cap peers over the past decade, with all three funds investing at the lower end of the market capitalisation spectrum.

Templeton Emerging Markets Smaller Companies was the top of the list. It has the second best downside capture ratio of 82.2%, which combined with its upside score of 71% gave it a total return of 124.4%.

Source: FE Analytics

JPM Emerging Markets Small Cap was next with a return of 121.0% while SSGA SPDR MSCI Emerging Markets Small Cap UCITS ETF made 94.1%.

Despite boasting the lowest downside capture ratio of 81.7%, Robeco QI Emerging Conservative Equities fund was unable to beat the average peer, with its low upside capture ratio (45.8%) hampering returns.