For mainstream investors, exposure to developing economies will often be gained through a global emerging markets or an Asia ex-Japan fund.

However, investors may be bullish or bearish on certain countries and may want to buy the markets they like and peel off those they are uncomfortable with.

Alternatively, they could add single country funds to their global emerging markets exposure to express their views.

Below, Trustnet asks emerging markets fund managers what country they would choose if they could only invest in one market.

India

Rob Brewis, fund manager at Aubrey Capital Management and Rajiv Jain, chief investment officer at GQG Partners chose India as it benefits from several tailwinds such as demography, urbanisation and geopolitics.

Brewis noted that India has one of the most youthful population in the world but that its population growth is slowing, enabling GDP per capita to accelerate, leading to faster income growth and consumption.

He added: “Urban job creation will lead to acceleration in urbanisation from very low levels (30%) with a boom in housing construction inevitable. This will also allow the agricultural sector to modernise and productivity to surge.”

India has also been through a decade of reforms that have led to infrastructure development and the removal of many of the hurdles to investment in India. It is also benefitting from the rising tension between China and the West.

Jain said: “India is implementing pro-business policies and reducing red tape, through policies such as the 2016 Insolvency and Bankruptcy Code, or the more recently announced National Monetization Pipeline, whereby the government will monetize key state-owned assets and use the proceeds to fund infrastructure development across the country.

“Contrast this with those of China, where the government has been consolidating power and policy implementation over the past several years and has served to increase, rather than decrease, regulatory burdens, specifically across technology and finance.”

Jain added that the Indian market has historically outperformed China, when looking at cumulative returns over the past 20 years.

Performance of indices over 20yrs

Source: FE Analytics

He said: “In our view, this has a lot to do with fundamentals, with MSCI India exhibiting strong and accelerating earnings growth relative to the MSCI China index combined with generally higher returns on equity (ROEs) across sectors, resulting from a combination of higher-quality businesses and, in our view, superior management teams.

Indonesia

Fiona Yang, manager of Invesco Asia Trust and Emily Fletcher, manager of BlackRock Frontiers were bullish on Indonesia.

For instance, Yang noted that Indonesia “shares similar characteristics with India, such as low credit penetration and a very young demographic”. Yet, Indonesian equities are trading at half the valuation multiples of Indian equities, she added.

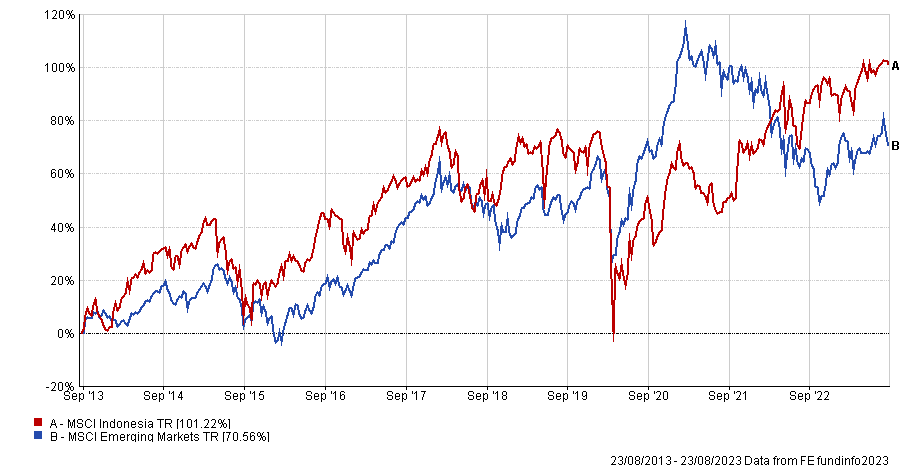

Performance of indices over 10yrs

Source: FE Analytics

The switch to electric vehicles is also a major tailwind for the Southeast Asian archipelago, as it is the world’s largest exporter of nickel, an essential material for the manufacturing of batteries for EV cars. In 2020, the value of Indonesian nickel exports was $12bn and is set to grow to $45bn by 2025.

Fletcher said: “This is an important shift for a country that has historically run a current account deficit. The size of the increase that we are seeing in nickel exports is such that the structural current account deficit of around 3% of GDP that Indonesia saw pre-Covid, has already shrunk by around 1% of GDP and is likely to shrink by a further 1% of GDP by 2025.

“This should have the benefit of making Indonesia less reliant on borrowing from abroad and attracting foreign capital resulting in increased domestic liquidity and higher economic growth. The cost of debt should reduce slightly as should the volatility in currency movements, making Indonesia a more attractive investment destination in our view.”

However, the country is facing a headwind in the short term with the upcoming presidential election in 2024.

Yang said that a risk is that the potential successor could rewind a lot of the work incumbent president Joko Widodo has put in place.

She added: “The current two favourites are on Widodo’s side, so we do think that if either of them get elected, we will see a continuation of the current economic policies supporting the whole country's economic development.”

South Korea

Chetan Sehgal, lead portfolio manager of Templeton Emerging Markets Investment Trust, chose South Korea, which is currently its largest overweight. He particularly liked its companies in the semiconductor, batteries, EVs, engineering and internet industries.

He noted that South Korea is facing the same demographic challenges as China, but offers exposures to similar sector without the geopolitical, demographic and corporate issues holding back Chinese equities.

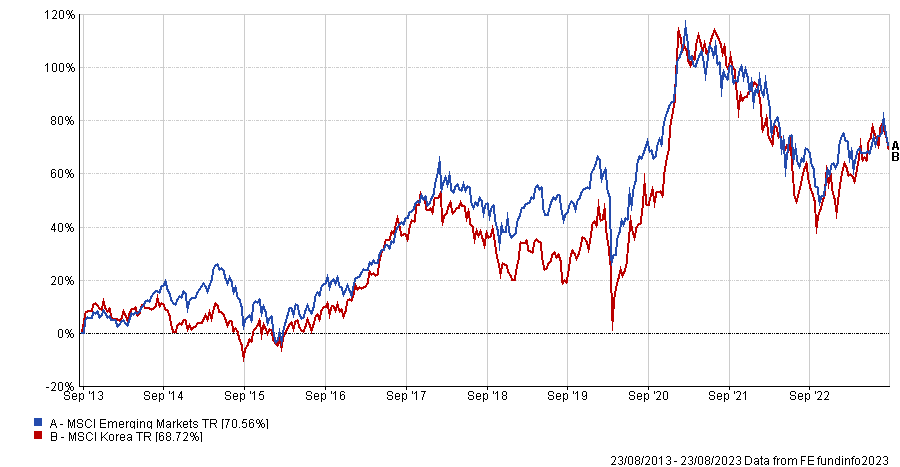

Performance of indices over 10yrs

Source: FE Analytics

The Korean stock market is going through reforms aiming to gain developed market status. A part of the plan is to put an end to South Korean stocks’ tendency to trade at lower valuations compared to emerging markets peers – also known as ‘Korea discount’.