In uncertain times, picking the right stocks at the right price has never been more important. Despite signs of weakness in China’s recovery and the risk of a US recession causing uncertainty in global markets, performance of Fidelity Asian Values Trust has continued to improve. With our absolute return focus and bias towards high quality and value stocks, stock selection has been the main driver of recent performance.

From a style perspective, both value and growth stocks have recently performed well, with value stocks outperforming growth names in the Asian smaller companies’ space. Meanwhile, small-cap stocks have also recently outperformed large-cap stocks. Despite this, small-cap value names continue to trade at a significant discount to small-cap growth stocks.

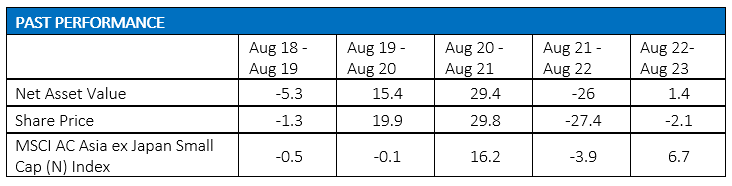

Past performance is not a reliable indicator of future returns.

Source: Morningstar as at 31.08.2023, bid-bid, net income reinvested. © 2023 Morningstar Inc. All rights reserved. The MSCI AC Asia ex Japan Small Cap (N) Index is a comparative index of the investment trust.

We remain focussed on discovering undervalued stocks in the small and mid-cap companies. Given that Asia has more than 19,000 listed companies in the small and mid-cap space*, the opportunity to find hidden gems is immense.

Underpinning our investment philosophy is the idea that if we lose less money during market drawdowns, we should be able to compound money at higher rates in the longer term. The key is to avoid risky stocks. As such we avoid unproven business models, highly geared companies, cyclical businesses on peak margins and stocks trading on high earnings or cash flow multiples.

Overweight in Indian financials

At a sector level, Indian banks constitute one of the portfolio’s biggest sectoral allocations. We hold high conviction holdings in Axis Bank and ICICI Bank. The position in ICICI Bank was added after we recently sold out of our position in HDFC Bank- a stock that has been held over the manager’s tenure of the fund. Following HDFC Bank’s merger with its parent HDFC, we felt the risk reward towards ICCI Bank was more attractive. In our view, ICICI Bank has fully transformed its business and has shown very strong execution over the past few years. With a strong balance sheet, high returns and margin expansion looking attractive over the next three years, we believe the stock represents a compelling opportunity.

We also have a big holding in Shriram Finance which is the largest retail non-banking financial company in India following its merger of Shriram Transport Finance Company, the largest financier of second-hand commercial vehicles, and Shriram City Union Finance, the leading micro financier in the country.

Attractive regional plays

While we are positive about Indian financials, we are underweight India on a relative basis as we believe valuations in this country still look expensive. Elsewhere in the region, we are finding opportunities in markets such as Korea and Indonesia.

While we still have concerns about broader corporate governance in Korea, we have been finding some interesting smaller companies that have market dominant positions in niche markets. One example here is a company called InBody, which offers a more sophisticated way of measuring Body Composite Index (BMI), among other medical equipment. Their machines target different customer segments - from personal trainers at gyms to medical grade machines used in hospitals.

Another Korean company that we have added to is Komico, which provides a cleaning and coating service for semiconductor parts - a play on the broader semiconductor theme.

Our biggest regional allocation remains China, including Hong Kong, where we are finding some exciting buying opportunities. Following the initial exuberance of reopening, China’s recovery has been weaker than expected. Nevertheless, we believe the domestic economy is still healthy and robust, with a vibrant domestic consumption economy and a system which continues to invest heavily in education, health care and R&D alongside world-leading capabilities in manufacturing goods.

At the same time, the disconnect between the market’s expectation and the reality of the current recovery has left Chinese equities trading at the lower end of their historical levels and at significant discount to other key global economies, which in turn, offers an array of risk reward opportunities.

We hold Chinese automobile dealer China Yongda Auto Services which has been hit by weakening auto demand and intensifying price wars from electric vehicle (EV) sales in China. However, we retain our strong conviction on this stock due to its robust balance sheet with solid cash flow and management’s willingness to return capital to investors.

Focus on fundamental analysis

As we have consistently maintained, the core of our approach remains owning good businesses with superior return on capital, that are managed by competent and honest teams, and available at reasonable prices with sufficient margin of safety.

This allows us to select the very best individual stock ideas and to focus on businesses we own - assessing their business models, their vulnerabilities and strengths, judging the competence of management teams and trying to figure out their intrinsic value. Overall, we remain confident in the companies that we hold in our portfolio, which we believe have a dominant position in their industries, earn good returns on capital and are available at attractive valuations.

* Fidelity International, as at Q2 2023

Important information

The value of investments can go down as well as up so you may get back less than you invest. Past performance is not a reliable indicator of future returns. Changes in currency exchange rates may affect the value of investments in overseas markets. Fidelity Asian Values PLC can use financial derivative instruments for investment purposes, which may expose them to a higher degree of risk and can cause investments to experience larger than average price fluctuations. This Investment Trust invests in emerging markets which can be more volatile than other more developed markets. This trust invests more heavily than others in smaller companies, which can carry a higher risk because their share prices may be more volatile than those of larger companies and the securities are often less liquid. The shares in the investment trust are listed on the London Stock Exchange and their price is affected by supply and demand. The investment trust can gain additional exposure to the market, known as gearing, potentially increasing volatility. Reference to specific securities should not be construed as a recommendation to buy or sell these securities and is included for the purposes of illustration only. Investors should note that the views expressed may no longer be current and may have already been acted upon. This information is not a personal recommendation for any particular investment. If you are unsure about the suitability of an investment you should speak to an authorised financial adviser.

The latest annual reports, key information document (KID) and factsheets can be obtained from our website at www.fidelity.co.uk/its or by calling 0800 41 41 10. The full prospectus may also be obtained from Fidelity. The Alternative Investment Fund Manager (AIFM) of Fidelity Investment Trusts is FIL Investment Services (UK) Limited. Issued by Financial Administration Services Limited, authorised and regulated by the Financial Conduct Authority. Fidelity, Fidelity International, the Fidelity International logo and F symbol are trademarks of FIL Limited.

UKM0923/382187/ ISSCSO00133/NA