Investment trusts have derated since early 2022 with the average investment company currently trading on a 16% discount, according to the Association of Investment Companies (AIC).

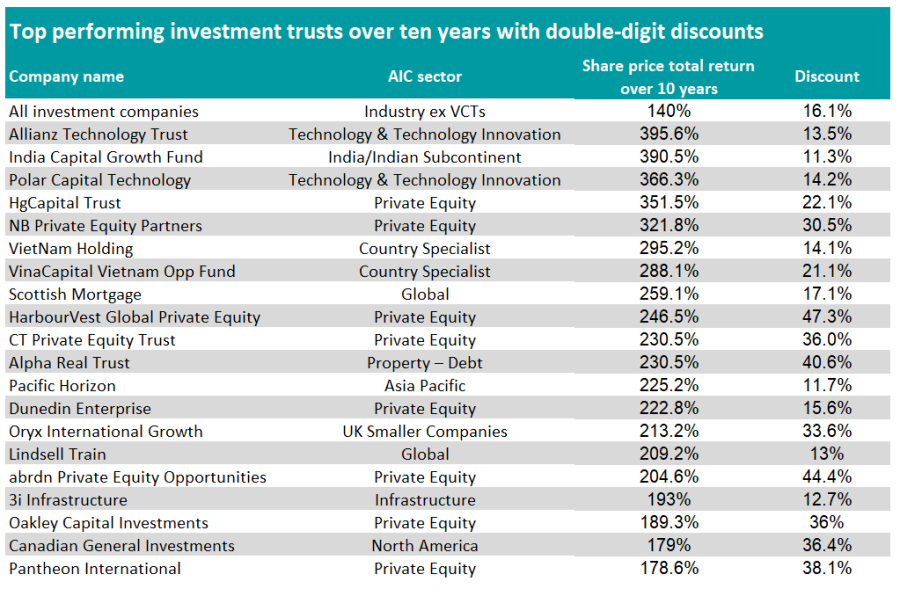

Even top performing trusts have not been spared, with 20 of the best close-ended funds of the past decade now trading on double-digit discounts. Those in sectors such as private equity, technology and Vietnam feature prominently.

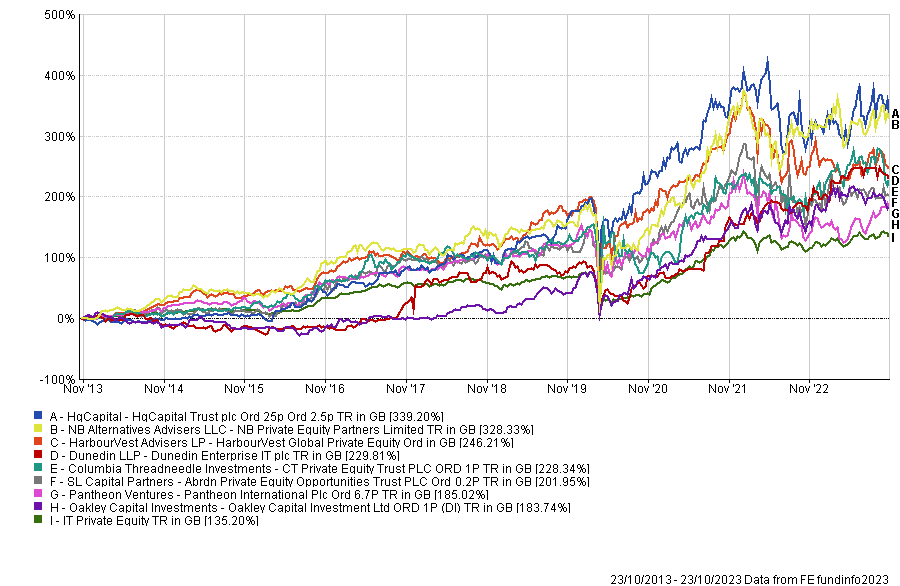

Private equity is the most represented sector, with eight trusts in the list. Moreover, six of them have discounts of more than 30%, with two exceptions: HgCapital* and Dunedin Enterprise are trading on 22.1% and 15.6% discounts respectively.

FE fundinfo Alpha Manager Peter Walls manager of the Unicorn Mastertrust has recently been adding to private equity trusts, because they have delivered better long-term returns than their peers focusing on listed equities.

Performance of trusts vs sector over 10yrs

Source: FE Analytics

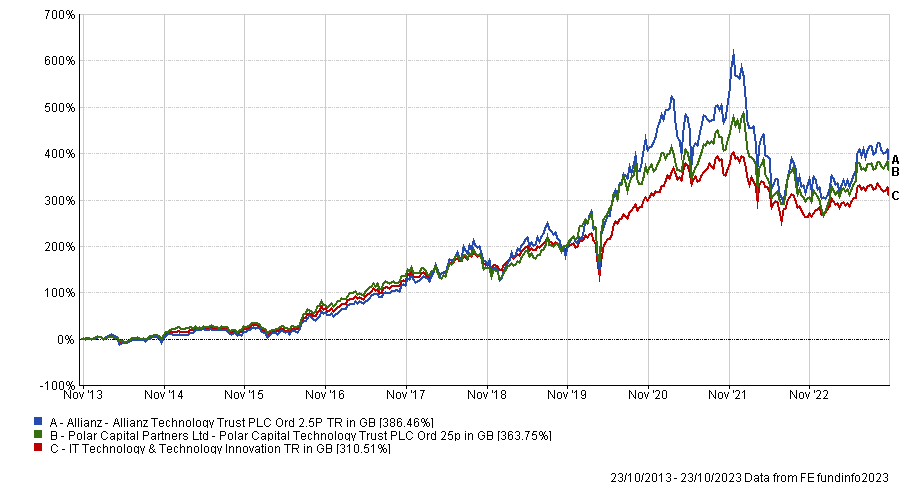

Another long-term standout under the cosh is technology, where the IT Technology & Technology Innovation has been the best performing sector in the AIC universe over the past 10 years.

Nonetheless, Allianz Technology and Polar Capital Technology are trading on 13.5% and 14.2% discounts, despite having returned 386.4% and 363.8% respectively to investors over 10 years.

Both managers are confident that technology will keep shining in the coming decade, with Mike Seidenberg, portfolio manager of Allianz Technology saying that we are living in the “golden era” of tech. It means that companies become relevant of irrelevant depending on their adoption and use of technology.

Ben Rogoff, lead manager of Polar Capital Technology added that we are at the beginning of a new secular cycle of technology-led disruption, which could have a greater economic impact than the previous internet, mobile and cloud transitions.

Performance of trusts vs sector over 10yrs

Source: FE Analytics

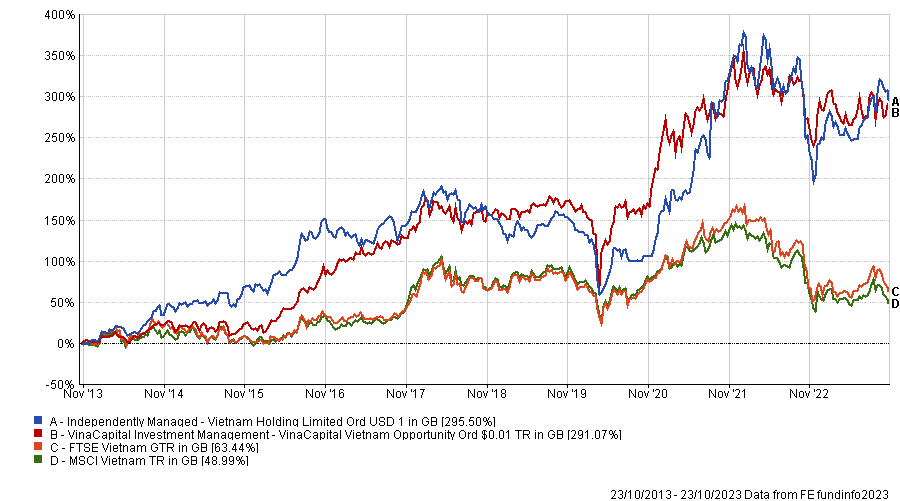

Vietnam has also done well in the past 10 years, with Vietnam Holding and VinaCapital Vietnam Opportunity returning 295.5% and 291.7% respectively. Yet, the trusts are now trading on discounts of 14.1% and 21.1%

Ewan Markson-Brown, manager of the CRUX Asia ex-Japan fund, recently suggested investors with a long-term time horizon to get exposure to this market.

Performance of trusts vs indices over 10yrs

Source: FE Analytics

Another single country trust featuring in the list of the top 20 investment companies of the past 10 years trading on double digit discounts was India Capital Growth. It has returned 367.7% to investors in that period but is trading on a 11.3% discount.

The manager, Gaurav Narain, believes that Indian equities are well positioned to keep performing in the next 10 years.

He said: “With an increasing proportion of the population moving up the wealth ladder to a point of greater consumption, a theme that has been and will remain central to the portfolio, we believe the opportunity in small and mid-sized companies remains strong with plenty of room to grow.”

Performance of trust vs sector over 10yrs

Source: FE Analytics

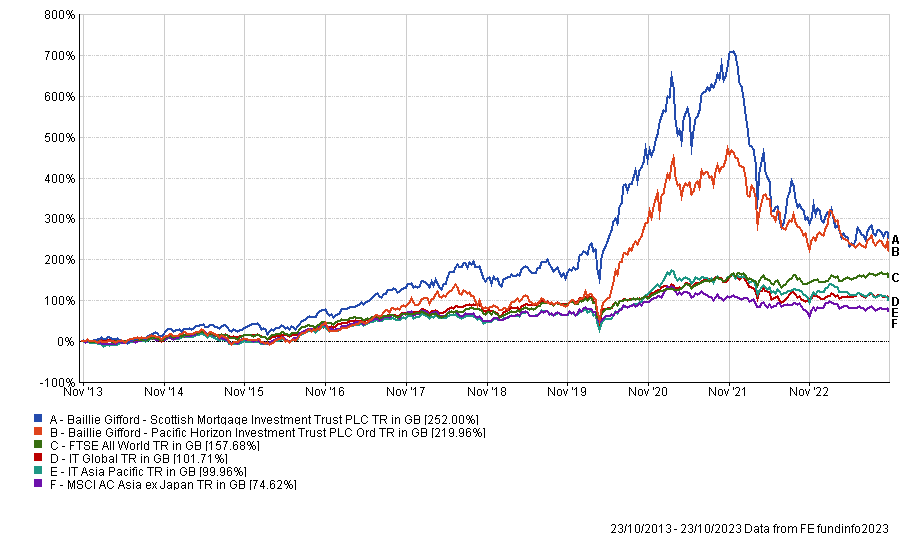

Two trusts from Baillie Gifford appear on the list, including the company’s flagship Scottish Mortgage as well as Asia ex-Japan specialist Pacific Horizon.

Scottish Mortgage has returned 252% to investors over 10 years and is now trading on a 17.1% discount, while Pacific Horizon has made 220% over the same period but is trading on a smaller discount (11.7%).

The global trust came under scrutiny earlier this year following a clash among board members and worries around the portfolio’s exposure to private companies.

Yet, Peter Hewitt, manager of the CT Global Managed Portfolio, said that Scottish Mortgage is the best place to start when investing for the long term

Performance of trusts vs sectors and benchmarks over 10yrs

Source: FE Analytics

Another global equity trust, Lindsell Train, is trading on a 13% discount but has made 203.8% over 10 years.

Top performing investment trusts over 10 years with double-digit discounts

Source: FE Analytics, AIC

While wide discounts and solid track records may look enticing, Annabel Brodie-Smith, communications director of the AIC, warned investors that they also need to consider further factors.

She said: “Investors shouldn’t rely on discounts when researching investment trusts. It’s vital that they look under the bonnet and understand why a company is trading at a discount to its assets and why that discount might narrow.

“They also need to consider all the factors which make up the investment case, including performance, portfolio, charges and gearing.”

*HgCapital Trust is an investor in FE fundinfo.