Listed asset managers have had a torrid time lately, with savers pulling their money out of funds and gravitating towards cash. This does not mean stock pickers should abandon the sector, according to analysts at Peel Hunt, who noted that several firms have been cutting costs to improve profit margins and should be well positioned when sentiment eventually turns.

Average outflows from asset managers amounted to 3% of their total assets between July and September with Ashmore, Liontrust and Premier Miton having a particularly tough quarter, enduring outflows of more than 5%. Market conditions deteriorated after the summer with outflows increasing in September.

The chart below shows asset and wealth managers’ inflows and outflows as a percentage of their assets under management during the first nine months of this year.

Inflows and outflows amidst challenging market conditions

As a result, Peel Hunt has downgraded its earnings per share estimates for listed asset managers by an average of 15% because it expects their assets under management (AUM) to be about 7% lower than its previous estimates.

Analyst Stuart Duncan said firms’ third-quarter updates “highlighted how difficult market conditions have been, characterised by a complete lack of investor confidence and increased outflows given cost-of-living pressures and the more attractive returns now on offer from cash.

“For those [managers] exposed to the UK retail consumer, the trend has been generally resilient inflows but higher outflows. It is difficult to say when investor confidence will return, but there is little sign that conditions are improving at present.”

Despite the negative sentiment, Peel Hunt has retained its ‘buy’ ratings for Ashmore, Impax, Liontrust, Man Group and Polar Capital, and has given an ‘add’ rating to Premier Miton, which is the equivalent of a ‘moderate buy’. It has placed a ‘hold’ rating on Jupiter and Ninety One.

The sector’s “bright spots” are hedge fund specialist Man Group, whose performance fees are higher, and Tatton Investment Management, which enjoyed inflows of 7.1% for the third quarter (all other managers suffered outflows or stayed flat).

Man Group is the only firm where earnings estimates are increasing due to “its focus on risk-adjusted performance with uncorrelated returns,” Duncan said. Man’s assets have been stable through difficult market conditions and it grew further by acquiring Varagon Capital Partners in July, a US middle market private credit manager with $11.8bn under management and $15.4bn in client commitments.

Emerging market specialist Ashmore has a strong balance sheet and is “well placed for when sentiment turns,” Duncan said. “The yield is now close to 10%, based on an unchanged dividend.”

Peel Hunt has given buy ratings to Liontrust and Premier Miton because it expects cost cutting measures to improve profitability.

At Liontrust, “we expect revenue headwinds will trigger cost reduction measures, as management remains focused on operating margins and profitability. Although market conditions are not improving, controllable factors (especially costs) remain positive, and the gearing into improving markets is high,” Duncan explained.

At Premier Miton, “lower-than-expected assets under management in September 2023 led management to reduce discretionary expenditure and restructure distribution and marketing teams, which should yield cost benefits in future periods. Interest income has also risen, as UK base rates have increased,” he said.

“Management is taking positive, proactive steps to counteract negative market conditions, and the business appears well positioned for market recovery. Current multiples are depressed (e.g. the current year price to earnings ratio of 7x) and allow for significant potential share price upside when the environment improves.”

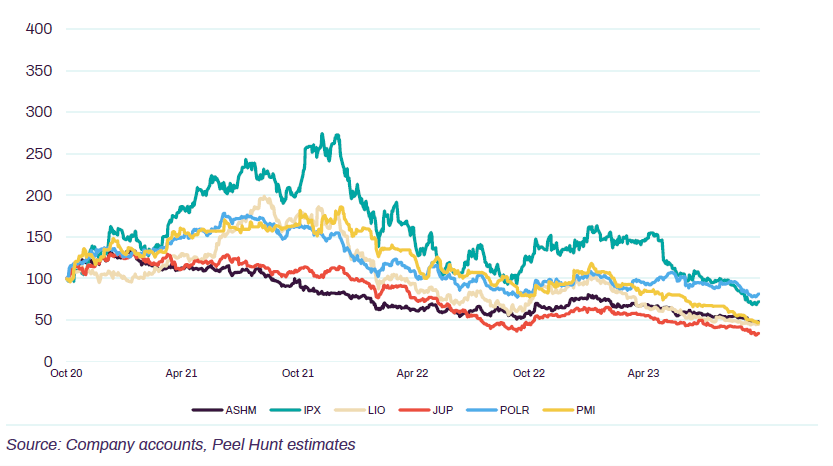

Asset managers’ share prices have fallen a long way from their peak near the end of 2021, as the chart below shows. The sector is now trading on an average price to earnings multiple of 12x next year’s earnings, with a yield of 8%.

Asset managers’ share price performance