Terry Smith’s Fundsmith Equity has consistently topped the tables for performance over the past decade making it popular among many types of investor – both DIY and professional.

A common strategy when owning Fundsmith Equity is to supplement it with funds that do other things, such as value or income specialists to gain exposure to different stocks and sectors.

However, Bevan Blair, chief investment officer of One Four Nine Portfolio Management, has sought out equity managers with a quality-growth style tilt who pursue a long-term ownership approach, just like Smith.

He first invested in Fundsmith Equity in the autumn of 2011 (a year after it launched) when he was working at Ingenious as an investment director overseeing model portfolios. “I love Fundsmith because I’ve personally benefitted from them tripling returns in 12 years, so why wouldn’t I?” he said.

In his current role running model and bespoke portfolios for financial advisers within the One Four Nine Group, he is looking for managers that try to preserve and grow wealth, as opposed to focusing on benchmarks.

“We’re not trying to complement Fundsmith, we’re trying to augment it,” Blair said. This leads to a quality-growth style bias but “our fund managers all pick really different companies to express that view”.

At a stock level, One Four Nine’s biggest holdings are Unilever at 3.5% and Microsoft at 3.2%, which are not large positions, demonstrating that the managers Blair has chosen are not clustered around the same stocks.

One Four Nine’s actively-managed range of model portfolios use the following equity funds alongside Fundsmith: Brown Advisory Global Leaders Sustainable and Brown Advisory US Sustainable Growth, CCLA Better World Global Equity, Evenlode Income and Evenlode Global Income, Lindsell Train UK Equity and Lindsell Train Global Equity, and Liontrust Special Situations.

The Brown Advisory Global Leaders Sustainable fund is managed by Mick Dillon and Bertie Thomson, who have a differentiated approach to fundamental research, according to Blair.

They survey customers of the companies in which they invest to ascertain why they buy from a particular brand and its pros and cons. Furthermore, in keeping with One Four Nine’s philosophy, Dillon and Thomson are trying to grow wealth so don’t talk about beating an index.

Stablemate Brown Advisory US Sustainable Growth fund is an “out and out growth fund” and is “a bit more volatile than our other funds”, Blair said.

Both have made strong returns for investors over the years; the former is in the second quartile of the IA Global sector since its launch in 2019, up 44.4%, while the latter has made the third highest return in the IA North America sector since inception (2017), returning 180%.

CCLA Investment Management (which stands for churches, charities and local authorities) has a long history of ethical investing. It pursues an active engagement programme and has focused on how companies deal with mental health. It has also been in dialogue with Amazon over its labour practices.

“It’s not just an exercise in stewardship,” Blair added. “It has done a very good job at generating long-term returns for investors. The sustainable team and portfolio managers are joined at the hilt.”

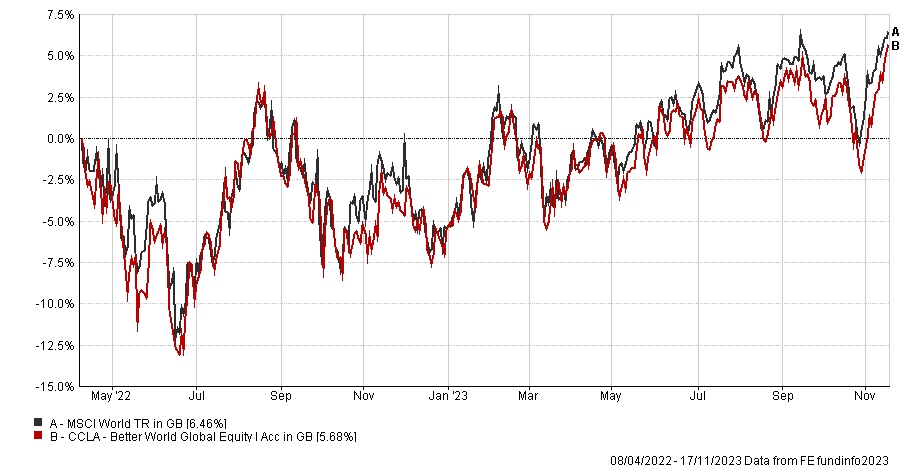

CCLA Better World Global Equity was launched last year and One Four Nine was an early adopter. After conducting quantitative analysis on CCLA’s older funds for institutional investors, Blair was so impressed that he added the new retail fund to all of his portfolios.

Performance of CCLA Better World Equity since launch vs benchmark

Source: FE Analytics

Evenlode may not be badged as a sustainable manager like CCLA but sustainability lies at the core of how the firm’s managers look at risks to earnings, Blair said. For instance, Evenlode avoids oil and gas and extraction industries, which are highly leveraged. It scores higher than some environmental, social and governance (ESG) funds in Sustainalytics’ ratings.

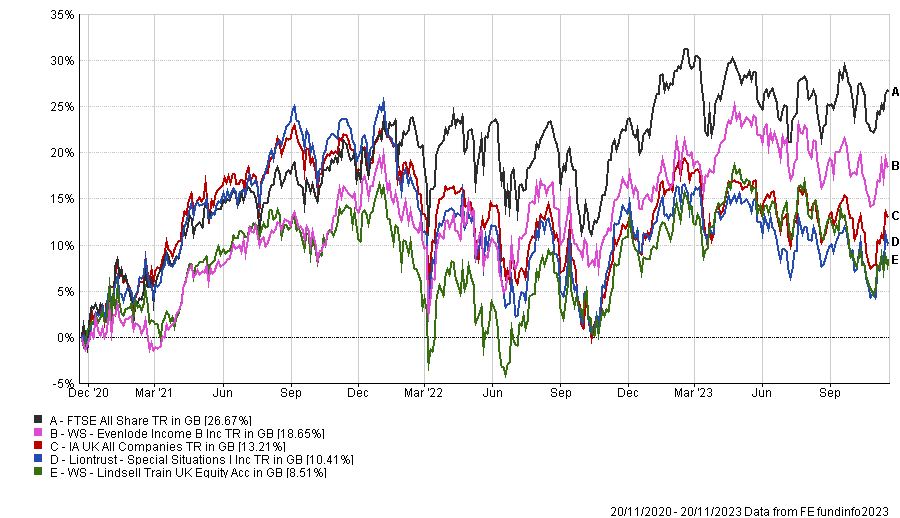

The other two UK equity managers in Blair’s list, Lindsell Train and Liontrust Asset Management, have had a difficult year, which he ascribed to short-term “noise”, but have been strong long-term performers.

Performance of UK equity funds vs sector and benchmark

Source: FE Analytics

Liontrust Special Situations has had a tough time owing to its exposure to UK mid-caps, which have been “taken to the cleaners in the past couple of years,” Blair said, due to negative sentiment regarding the UK economy. Other funds in the portfolio have the option to invest up to 20% abroad but Liontrust is completely invested in the UK.

Blair admires the Economic Advantage team, which runs this fund and is led by FE fundinfo Alpha Managers Anthony Cross and Julian Fosh.