Venture capital trusts (VCTs) are known for entitling investors to an income tax relief of up to 30%. More precisely, investors can pour up to £200,000 into VCTs per tax year and receive tax relief of up to £60,000.

But after the tax break investors are left with portfolios that they need to make gains over time – or they could have been better off investing in other assets that rise by more than the tax saved.

Investors have to hold VCTs for five years to be eligible for the relief (they have to pay it back if sold before this) and, once bought, the secondary market for shares can make it difficult to sell, as the tax break is only offered only newly issued shares, not those bought from other investors.

Many VCTs back early-stage UK businesses that theoretically have a significant growth potential. Investing in that type of companies is, however a high risk bet, as 60% of small businesses go bust within their first three years, according to research from Fundsquire.

In spite of this higher risk, research from Trustnet finds that VCTs have generally not provided better returns than more mainstream investment trusts.

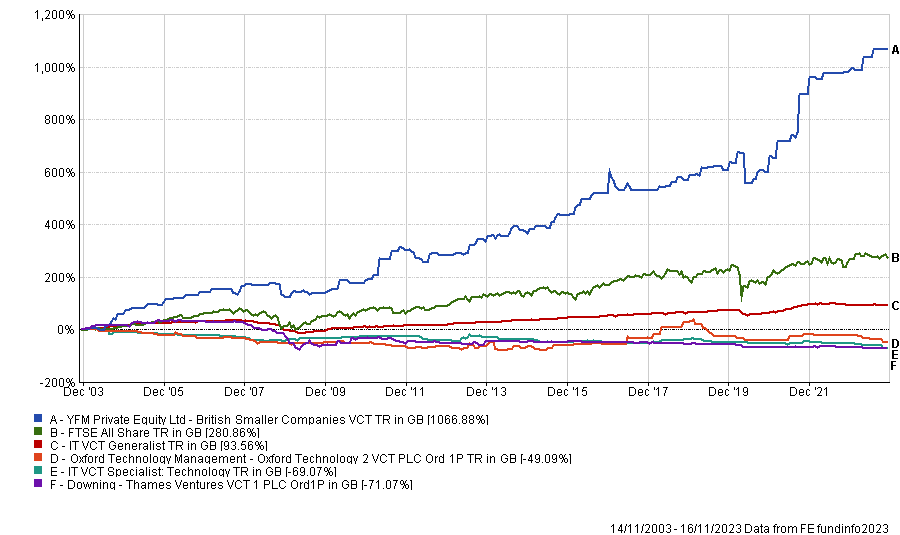

For instance, a vast majority of VCTs are sitting in either the third or fourth quartile in terms of performance over 20 years.

British Smaller Companies VCT is the outlier as it has made a top-quartile performance among all investment trusts, returning 1,066.9% to investors over the period. It is in fact the eight best performing trusts of the past 20 years.

Performance of VCTs over 20yrs vs sectors and index

Source: FE Analytics

Over 15 years, no VCT has been able to make a top-quartile return and there are none among the top 50 investment trusts of the period.

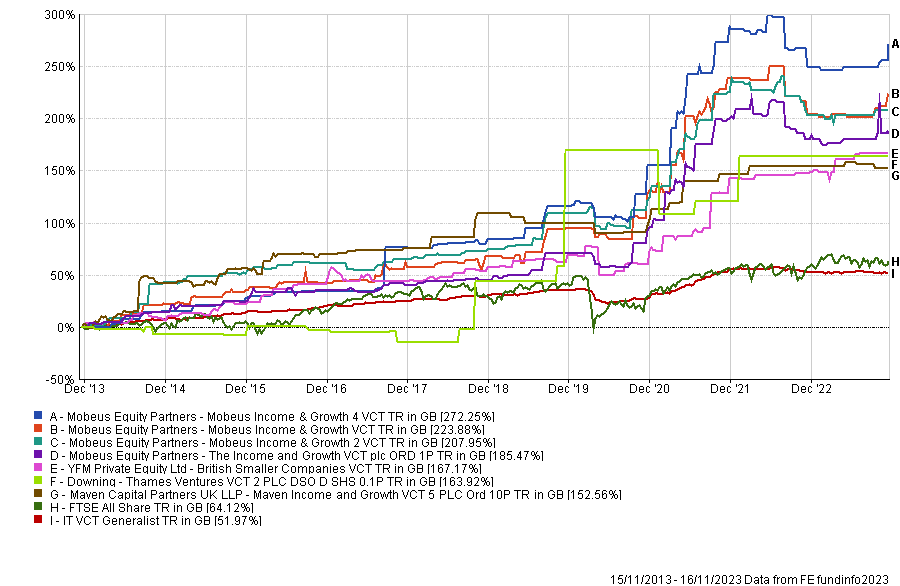

The picture improves over 10 years as seven VCTs made top-quartile returns, including Mobeus Income & Growth 4 VCT, Mobeus Income & Growth VCT, Mobeus Income & Growth 2 VCT, The Income and Growth VCT, British Smaller Companies VCT, Thames Ventures VCT 2 and Maven Income and Growth VCT 5.

Yet, the best performing VCT of the past decade, Mobeus Income & Growth 4 VCT, lags the likes of 3i Group and Allianz Technology Trust by several hundred percentage points. It has also underperformed cheap and “mainstream” investment trusts such as Scottish Mortgage or JPMorgan American.

Performance of VCTs over 10yrs vs sectors and index

Source: FE Analytics

For Annabel Brodie-Smith, communications director of the Association of Investment Companies, VCTs have provided “solid performance” over the long term but they are risky investments.

She said: “They support the economy by providing finance and support to the UK’s small and ambitious companies.

“These businesses are high risk and the government offers generous tax benefits to compensate for the risks involved. It’s not easy to make money from these companies – otherwise there would be no need for the tax reliefs and people would invest in them anyway.”

Yet, for Doug Brodie, chief executive of Chancery Lane, VCTs are purely a tax relief tool and investors should not expect to see outstanding returns from those investments.

He said: “Over 30 years of watching the market, we've failed to see any great return. In the 1990s, we used VCTs quite a lot with clients who needed income tax relief, but we found in future years that the joy of the income tax relief is soon forgotten.

“All the clients get to see in the next five years following their investment is no return or even a perpetually falling share price. So, they moan about the lack of capital growth and have forgotten everything about the income tax reason.

“Retail investors shouldn't be allowed anywhere near VCTs because they are complex things. They are not designed to produce a five year total return.”

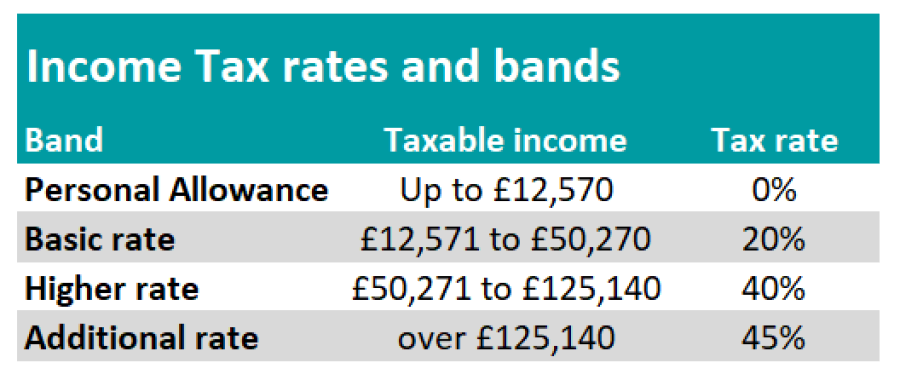

Income Tax rates and bands

Source: gov.uk

Brodie explained, however, that investing in a VCT could be a sound decision for somebody whose incomes are drawing close to £125,140 per annum.

This is because this individual is at risk of falling into the additional rate income tax band if their incomes reach £125,140, which means their income tax rate would go up from 40% to 45%.

Brodie said: “If you have £5,000 to put in an ISA, you might choose to put them in a VCT because that will bring you below the 45% income tax rate.”

Angela Jarvi, financial adviser at Timothy James & Partners, added the tax-free dividends and the ability to sell tax-free as further advantages of the VCT structure.

She said: "Many investors have had more back in dividends that they originally invested. Dividends tend to be higher than other investment trusts as sales of underlying companies often results in special dividend payments."

While Jarvi agreed that VCTs are not suitable for every investor and that the tax relief is often the main driver, she said that some of her clients like the ideas of backing exciting smaller companies and supporting the UK plc.

When picking VCTs for her clients, Jarvi explained that she favours those with proven track records and separates AIM-specialists from generalists when comparing performance.

She added: "We typically select VCTs which already generate dividends and have a clear dividend policy. We also consider the buy-back policy and only support VCTs with a clear and fair policy for this. Whilst we see these investments as long-term holds, the ability to exit is also important."