Investment trusts are trading at discounts not seen since the financial crisis. They now offer the potential for a double kicker if their sector recovers and their discount narrows.

It is always darkest before the dawn and Dr. Niall O’Connor, manager of Brooks Macdonald Defensive Capital, said trusts have hit their nadir. “We believe that investment companies might have reached a point of being ‘maximally unloved’," he said. "Traditional buyers such as open-ended funds and wealth managers have been forced sellers due to redemptions and now that government bonds yield around 5%, income-generating investment trusts have competition.”

The average investment trust traded at a discount of 16.9% on 31 October 2023, the widest month-end disparity since 31 December 2008 (when discounts hit 17.7%), according to the Association of Investment Companies (AIC). That’s just the average: some trusts can be snapped up at half the price of their underlying assets, or even cheaper.

Annabel Brodie-Smith, communications director at the AIC, noted: “When discounts were last this wide at the end of 2008, the average investment company returned 39% over the next year and 119% over the next five years.”

To help investors navigate this opportunity, Trustnet asked experts to select trusts with attractive discounts and solid long-term prospects.

UK equities: Value managers to back in an unloved market

UK equities look cheap compared to their history and to international markets, an environment that should play to the strengths of value managers. As such, Jason Hollands, managing director of Bestinvest, suggested Temple Bar Investment Trust, Murray Income Trust and Fidelity Special Values, all of which are trading at a discount.

Darius McDermott, managing director at FundCalibre, singled out Schroder British Opportunities, which is “strategically positioned to tap into the UK’s unloved status by targeting resilient British businesses poised for growth but trading below their intrinsic value,” he said.

“Schroder’s substantial research capabilities allow the managers to read past market noise and be forensic in selecting the best of British business. Given this, we feel it is well-positioned to tap into the recovery of UK plc at an appealing discount of almost 31%.”

Total return of trusts over 3yrs

Source: FE Analytics

Property: Widespread discounts after a sell-off in recent years

Emma Bird, head of investment trusts research at Winterflood Securities, singled out Tritax EuroBox, whose share price has fallen 55% over the past two years. Its current discount of 41% offers value, she said, with an attractive dividend yield of 8% that is fully covered by earnings.

“We think that the long-term outlook for the trust remains positive, supported by structural sector growth drivers related to the roll-out of e-commerce across Europe,” she said.

Renewable energy: Knock down prices despite structural demand tailwinds

All 22 trusts in the renewable energy infrastructure sector are trading at a discount, with the average being 14%. They are offering an average yield of 7% and targeted dividend growth of 8% for the next financial year.

James Wallace, a research analyst at Winterflood, said renewable energy looks set to benefit from “structural demand tailwinds including the electrification of industries, electric vehicle take-up and the government’s decarbonisation goals”.

For Nick Greenwood, manager of the MIGO Opportunities Trust, his preferred pick in the sector is Aquila European Renewables.

“With a diverse portfolio in solar, hydropower, and wind, Aquila operates across six European power markets and offers diversification beyond UK renewables. Currently trading at a discount of 28%, last year Aquila secured long-term power purchase agreements for two of its solar plants in Spain, providing the trust with a stable revenue stream,” Greenwood said.

Richard Parfect, portfolio manager at Momentum Global Investment Management, highlighted Greencoat UK Wind for its high cash generation and recently-announced capital allocation policy while James Pigott, managing director of Pigotts Investments, tipped Bluefield Solar at a discount of 13% (from nearly 20% last month), down from a premium of around 15%. It currently yields 7.5%.

Total return of trusts over 10yrs

Source: FE Analytics

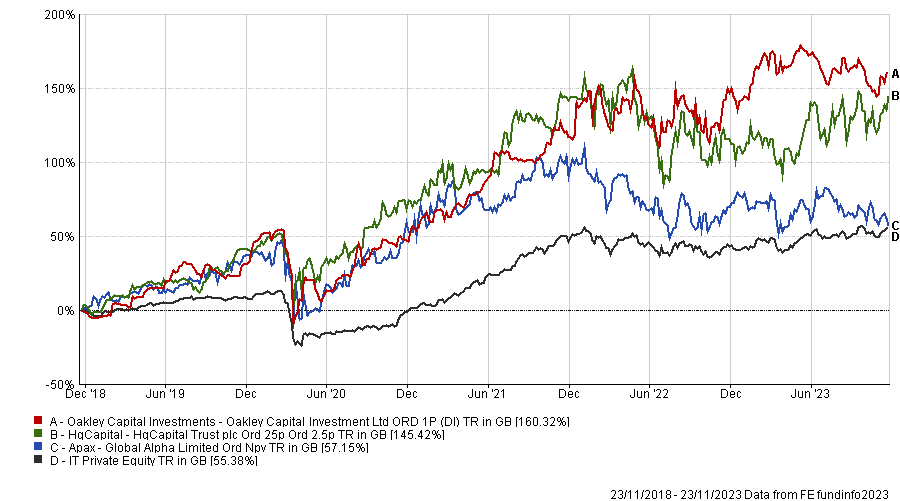

Private equity: Excessive discounts after indiscriminate selling

The investment trust private equity sector has also been widely and indiscriminately de-rated in recent years, said Shavar Halberstadt, an analyst at Winterflood.

“Geopolitical turmoil and the step change in interest rates certainly justified an initial degree of scepticism regarding private market valuations, which tend to be slower to adjust. However, we believe that this has resulted in excessive share price discounts to net asset value, which have persisted in spite of consistent transaction evidence.”

APAX Global Alpha and Oakley Capital Investments have “lingered on discounts of around 30% to NAV,” Halberstadt said, despite APAX selling holdings worth 26% of its NAV at an average 15% above its 2022 value and Oakley selling 20% of NAV at a 70% uplift last year.

Pigott said HgCapital* also looks like a bargain on a discount of about 20% given it usually trades at par. It could provide "exciting returns from a tried and tested model if held for the long term,” he concluded.

Total return of trusts over 5yrs

Source: FE Analytics

Eye-watering discounts

Lastly, Greenwood said Georgia Capital looks like a “substantial mispriced opportunity” with shares on a 55% discount to NAV, noting he is intrigued by its prospects.

“It was spun out of the Bank of Georgia after the entity became too large to manage at 16% of the country’s GDP. The diverse portfolio of Georgia Capital spans wine, motor insurance, education, renewable energy, water supply, and a listed stake in Bank of Georgia,” he said.

“The country has experienced a 55% increase in GDP per capita from 2011 to 2021. Furthermore, as a result of the Russian invasion of Ukraine, many skilled Russians have moved across the border, bolstering the economy.”

Another of his picks is Amadeo Air Four Plus, which manages a portfolio of aircraft with long-term leases to the likes of Emirates and Thai Airways.

“Two catalysts have played a pivotal role in boosting the trust’s thrusters. Firstly, the trust’s airplanes are virtually all back in service amid the recovery in travel, which has ensured a steady revenue stream through lease payments,” Greenwood said.

“Secondly, delays in the production of next-generation wide-bodied planes by major manufacturers Boeing and Airbus have inadvertently benefited the trust. Emirates, for example, has extended leases for Amadeo’s A380s until 2033, providing the trust with guaranteed cash flows for longer than initially anticipated.”

For big discount options, O’Connor went with Riverstone Energy, which invests in North American oil and gas assets and also has a wide discount. “At 720p, the shares are trading on a 47% discount. Its holding in Hammerhead has just been acquired, which will net the company $198m cash, or 380p per share, which is earmarked to be returned to shareholders. The remaining businesses are trading at a 60% discount.”

*HgCapital owns FE fundinfo.