In a sign that the $18.4trn sustainable investment industry has come of age, wealth managers and fund selectors are adding sustainable global equity funds to their ‘mainstream’ portfolios, choosing to include them over and above broader funds.

Data shows there are some strong arguments for this. Indeed, funds such as Janus Henderson Global Sustainable Equity and Schroder Global Sustainable Growth have outperformed most other funds in the IA Global sector over five and 10 years and feature in the sector’s top 20 return generators for both timeframes.

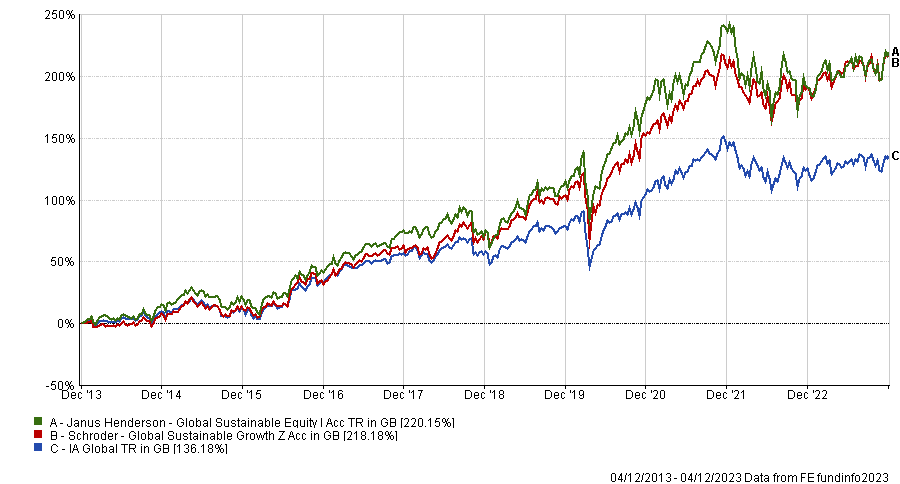

Performance of funds vs sector over 10ys

Source: FE Analytics

Janus Henderson Global Sustainable Equity is managed by Hamish Chamberlayne and Aaron Scully, who invest in companies with high growth potential that are having a positive impact on the environment and society. They think there is a strong link between compounding growth and sustainable development. Microsoft and NVIDIA are the top two holdings.

The £1.8bn fund has returned 15.6% over three years, 77.6% over five years and 220.2% over 10 years, compared to 14.9%, 48.9% and 136.4%, respectively, for the IA Global sector.

The smaller £394m Schroder Global Sustainable Growth fund has returned an even more impressive 26.5% over three years, 78.5% over five years and 218.2% over 10 years. Schroders also offers a £929m Global Sustainable Value fund.

Schroder Global Sustainable Growth is a joint effort; fund managers Charles Somers and Scott MacLennan work with closely the firm’s sustainability team, which conducts thematic research.

Schroders uses its sustainability quotient framework to assess each company’s business model and growth prospects. The top three holdings are Microsoft, Alphabet and Elevance Health, which offers health plans.

One Four Nine Portfolio Management has such high conviction in CCLA Better World Global Equity and Brown Advisory Global Leaders Sustainable that they feature across its actively-managed model portfolios, as well as in its sustainable strategies.

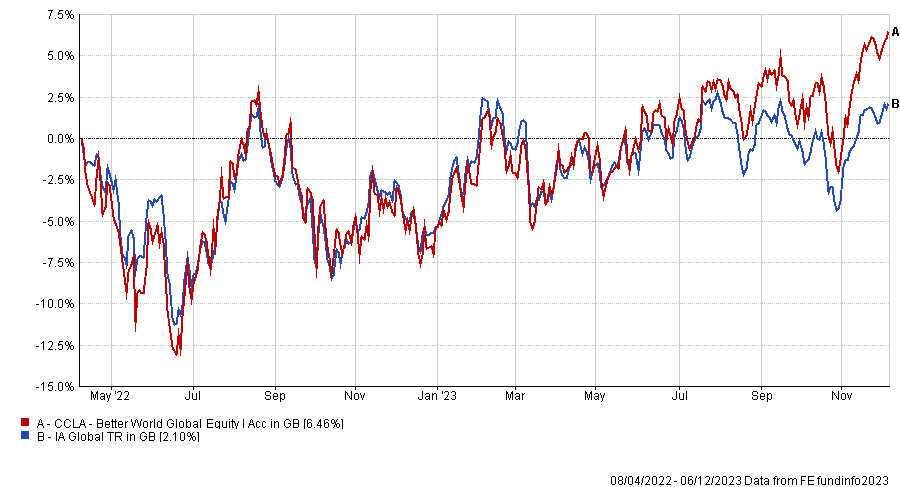

Bevan Blair, chief investment officer of One Four Nine, said CCLA Investment Management has generated impressive long-term returns for institutional investors so when it launched a retail fund last year, he was keen to invest. The fund now has £257m in assets and is managed by Charlotte Ryland and Joe Hawkes.

The engagement team led by Amy Browne has been working with companies on their approach to mental health and has been in dialogue with Amazon over its labour practices.

Rosie Cook, an investment analyst at One Four Nine, added: “CCLA seeks to be a catalyst for positive change for both the companies it owns but also for the wider investment universe and is well known for spearheading industry-wide initiatives to drive changes towards a better world.”

Performance of fund vs sector since inception

Source: FE Analytics

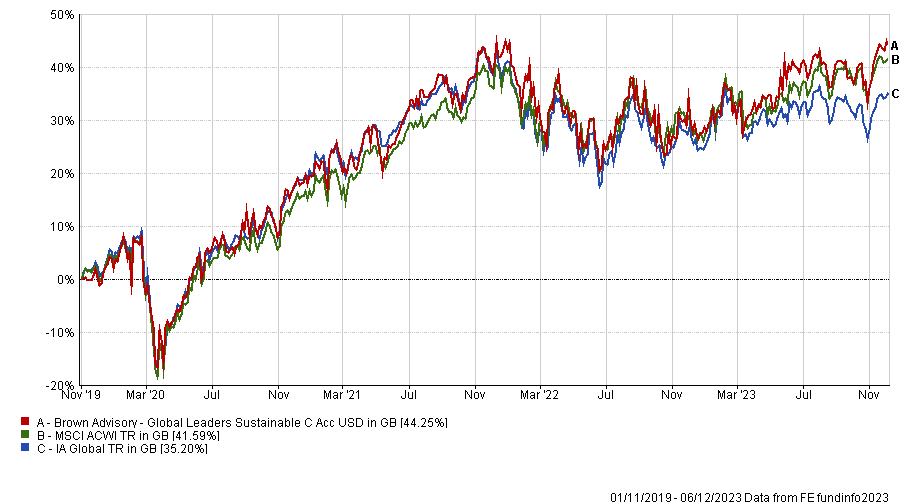

One Four Nine also invests in the $544m Brown Advisory Global Leaders Sustainable fund, which was launched in November 2019. Performance is top quartile over one year and second quartile over three years.

The fund’s managers, Mick Dillon and Bertie Thomson, conduct extensive fundamental research. They even survey customers to find out why they buy from a particular brand and the pros and cons of its products, Blair said.

Performance of fund vs sector and benchmark since inception

Source: FE Analytics

One Four Nine Portfolio Management is not alone in backing sustainable funds in portfolios with wider remits. Darius McDermott, managing director of Chelsea Financial Services, has added Ninety One Global Environment to the VT Chelsea Managed Aggressive Growth model portfolio because “it’s a really good global growth fund” and the transition to carbon neutral is a megatrend.

Ninety One Global Environment is managed by Deirdre Cooper and Graeme Baker who invest in companies involved in decarbonisation. The £1.8bn fund has three themes – renewable energy, electronification and resource efficiency. The concentrated portfolio of 22-27 companies has little overlap with broad global equity indices, so offers diversification.

The fund was launched in December 2019 and had a stellar first year, up 47.8% in 2020 versus 15.3% for the IA Global sector. More recently, the fund has faced a tough market for growth stocks and renewable energy, and its exposure to China was a headwind.

McDermott said the fund has performed as expected and continues to do its job in the diversified portfolio. “We still know why we own it,” he said.

Performance of fund vs sector and benchmark since inception

Source: FE Analytics

Meanwhile Louis Selby, investment research associate at Square Mile Investment Consulting and Research, said WHEB Sustainability deserves consideration. It is one of three impact funds run by WHEB Asset Management’s specialist team, which invests in companies that address environmental and social challenges.

WHEB Sustainability is managed by Ted Franks, supported by Claire Jervis, Ty Lee and Victoria MacLean. They take a thematic approach, linking critical environmental and social challenges to megatrends, Selby explained.

“For example, growing global populations alongside rising living standards are driving increased resource use, which ultimately leads to the depletion of critical natural resources and a breach of planetary boundaries,” he said.

To be included in the £702m portfolio, companies must derive more than 50% of their revenues from one of nine themes including clean energy, environmental services, resource efficiency, education, health and well-being.

Performance has lagged the broader IA Global sector recently, but Selby said WHEB Sustainability has the potential to offer meaningful financial returns. “It is an excellent example of a specialist fund group that specifically targets investments into positively impactful companies whilst at the same time delivering solid performance,” he said.

Performance of fund vs sector over 10yrs

Source: FE Analytics