Artificial intelligence (AI) has been a source of great enthusiasm among investors this year, keeping the US equity market afloat almost single-handedly.

But this might change very soon with the next wave of AI, which will be different, underwhelming and ultimately “boring”, according to Steve Wreford, co-manager of the Lazard Global Thematic Focus fund.

He has been learning about AI by talking to companies rather than by reading the headlines, and what came out of his conversations with managers might not sound very exciting, but has shaped his way of investing in the sector.

“It turns out that the next wave of AI is going to be in companies that do something boring, but better,” he said.

With early adoption of AI, we have seen problems emerging, including what people refer to as ‘garbage in, garbage out’, which refers to the fact that the model can’t distinguish between a truth and a lie in the data it’s fed, and the tendency to hallucinate, making up an answer to please the user instead of admitting ignorance.

The next wave of AI developments will be about fixing these problems – which some companies are already working on. The main example, said Wreford, is legal data.

“You cannot hallucinate on legal data – you get sued for it. RELX is working on an AI system that can be used by law firms for study cases, with curated data inputs and 100% accuracy,” he explained.

“It usually takes five days for a junior lawyer to go through case studies, with this technology they will be able to do that much faster.”

The AI will be able to process every case in the world, recommend a legal approach for each case, reference relevant documents and similar.

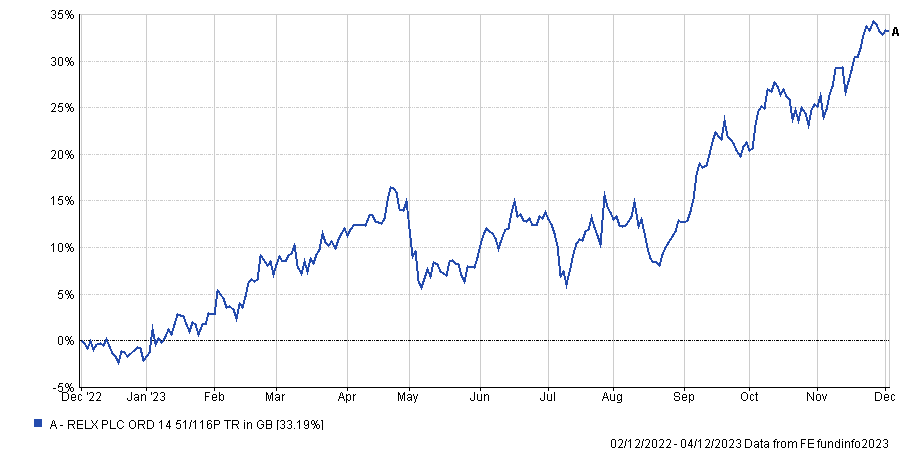

“If you're a law firm anywhere in the world, this is a must have. And we were there three years ago, with RELX’s stock doing very well.”

Performance of stock over 1yr

Source: FE Analytics

Tom O’Hara, co-manager of the Henderson European Focus didn’t go as far as to call it “boring”, but said AI is a “mixed basket” in terms opportunities, overhyped and predominantly a business-to-business story.

“AI is a great tool for software companies like SAP trying to sell or offer services to other companies,” he said. “A lot of it is going to be about sales of AI services by the large software groups. IPOs of bad AI companies which will ultimately go bankrupt is another risk and a thing to avoid.”

There was also fear that AI was going to leave a trail of destruction at companies such as Universal Music Group, one of the trust’s holdings whose share price tanked 20% in May this year over the debate around music-making AI systems. The stock, which made up 1.31% of the Henderson portfolio in September last year and was 1.5% as of 31 March 2023, has recovered since then.

Performance of stock over 1yr

Source: Yahoo! Finance

“People expected a graveyard of victims, but what will happen is many companies will simply adopt it and deploy it as an integrated system,” O’Hara concluded.

Someone who is expecting victims from the technology is Andy Merricks, co-manager of the IDAD Future Wealth fund, who predicted a humbling disruption, especially for some professions.

“There is a lot of complacency in some professions about how vulnerable they are. I remember seeing a list of the top 10 professions most at risk from AI and four of the top five were accountancy, legal, journalist and fund manager,” he said.

“There is a lot of arrogance and self-importance amongst some practitioners of these vocations as AI is very good at doing what has always been considered by humans to be very complex and ‘clever’. What AI is not good at is manual tasks such as to be found in nursing, hospitality, building etc.

“Many well paid practitioners will be surprised by what is coming. It won’t happen tomorrow, but seems to me to be inevitable in the next wave.”