Investment platform TILLIT is considering removing seven funds and trusts from its buy list because they have underperformed, with Alexander Darwall’s European Opportunities Trust among those on the block alongside three sustainable investment strategies.

Most of the 79 actively-managed funds and investment trusts in the TILLIT universe have beaten their benchmarks and peer groups over five and 10 years, but 26 funds and trusts underperformed.

TILLIT has investigated the reasons behind their underperformance – be it style bias, a change in process and philosophy, the market environment or even the composition of their benchmark – and has decided to conduct a formal review into seven funds to ascertain whether to exclude them.

Alquity Future World, First Sentier Responsible Listed Infrastructure and AXA ACT Carbon Transition Sterling Buy and Maintain Credit have all failed to live up to TILLIT’s expectations in what has been a difficult couple of years for clean energy and sustainable investing. TILLIT is also considering jettisoning International Public Partnerships, Jupiter Strategic Bond and The Biotech Growth Trust.

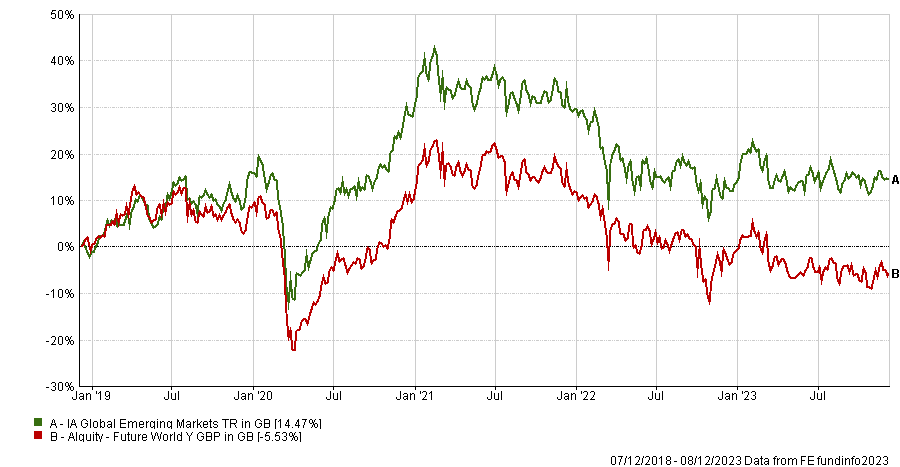

Alquity Future World

Alquity Future World focuses on emerging market companies with a sustainable competitive advantage that should benefit from cyclical tailwinds or structural growth. Alquity avoids fossil fuels and has a bias towards companies exposed to domestic growth and consumption.

The fund does not have a specific benchmark but it has underperformed the IA Global Emerging Market sector over five years and has also lagged an IA Emerging Market peer group with sustainable investment criteria, according to TILLIT.

Performance of fund vs IA Global Emerging Market sector over 5yrs

Source: FE Analytics

AXA ACT Carbon Transition Sterling Buy and Maintain Credit

Sheridan Admans, TILLIT’s head of fund selection, said AXA ACT Carbon Transition Sterling Buy and Maintain Credit takes “a low maintenance approach of holding bonds to maturity instead of frequently trading them. The saving on trading costs is passed through to the end investor”.

The fund invests in bonds issued by stable and well capitalised companies with predictable cashflows. Furthermore, it aims to keep its weighted average carbon intensity lower than the carbon emissions benchmark.

Fees are very low at just 0.14%, which should make it easier for the £224m fund to outperform but it has nonetheless lagged its peer group over five and 10 years, so is being put under review.

Performance of fund vs sector over 10yrs

Source: FE Analytics

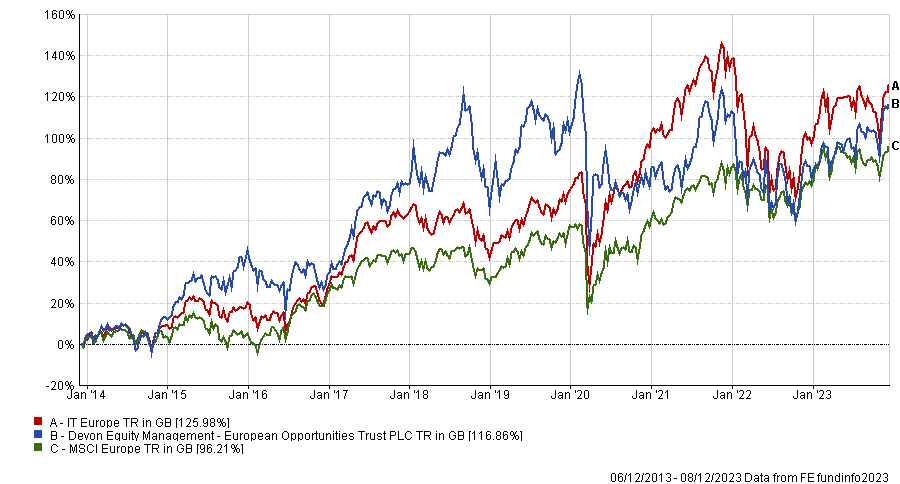

European Opportunities Trust

Devon Equity Management’s European Opportunities Trust is underperforming its peer group on a 10-year view. “Some of this underperformance can be traced back to a couple of significant stock picking mistakes a few years ago, but performance has continued to struggle and arguably worsened in more recent years,” Admans observed.

The trust had a significant position in Wirecard, the now insolvent German payments company whose CEO Markus Braun is currently on trial for fraud and market manipulation alongside two former Wirecard managers. About 10% of the trust’s assets were held in Wirecard in May 2020, a month before the fintech’s auditors raised concerns about potential fraud.

The £819m trust, which is managed by well-known European stock picker Darwall, passed a continuation vote last month, although 15-25% of shareholders voted against its continuation and its directors’ remuneration policy.

Performance of trust vs benchmark and sector over 10yrs

Source: FE Analytics

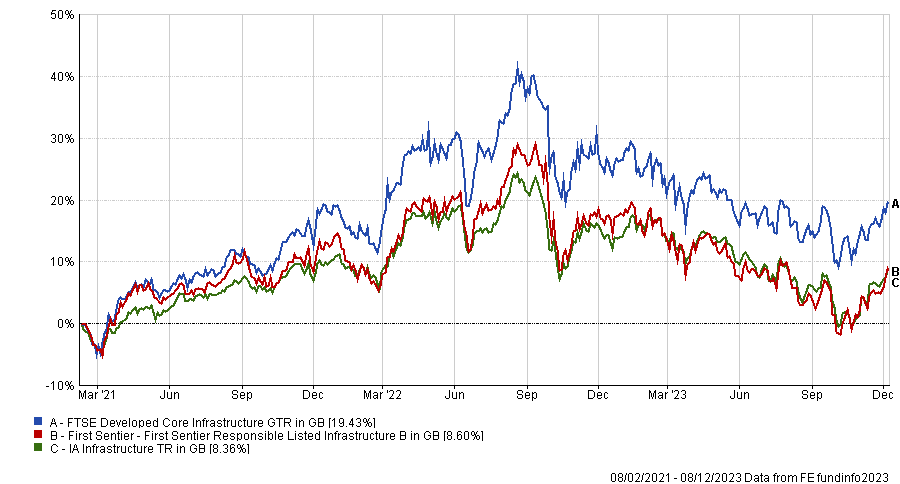

First Sentier Responsible Listed Infrastructure

First Sentier Responsible Listed Infrastructure has been negatively impacted by rising interest rates and its low exposure to midstream energy assets (which have performed well). Its bias towards renewable energy assets (which have struggled) was a further headwind.

TILLIT’s platform uses a relatively-new OEIC version of this fund, which was launched in 2021, but the investment team has been running an offshore sister fund since 2017 with the same philosophy and process. As the offshore version has also underperformed its peer group since launch, TILLIT is revisiting its recommendation.

Performance of OEIC vs benchmark and sector since inception

Source: FE Analytics

International Public Partnerships

International Public Partnerships is a £2.5bn Guernsey-domiciled investment trust focussing on public and social infrastructure projects in the UK and other developed markets.

“The managers look for projects where they can be an early-stage investor with attractive rights and access,” Admans noted. “This is a well-diversified portfolio offering access to a unique set of assets. The underlying assets (the NAV) should do well in an inflationary environment, but the share price of the trust may be more volatile depending on stock market sentiment.

“A key objective of this fund is to ‘provide our investors with stable, long-term, inflation-linked returns, based on growing dividends and the potential for capital appreciation’ and in absolute terms, it has arguably done so (4.8% annualised and income growth of ~2.5% year-on-year since 2007).”

Nonetheless, TILLIT plans to conduct a formal review of the fund because it has trailed its peer group over 10 years.

Performance of trust vs sector over 10yrs

Source: FE Analytics

Jupiter Strategic Bond

Jupiter Strategic Bond has a core of high quality government bonds but beyond that, the £2.5bn fund is well diversified across corporate and government bonds in emerging as well as developed markets. It is run by FE fundinfo Alpha Manager Ariel Bezalel.

“Not dissimilar to fellow underperforming fund, Janus Henderson Strategic Bond, the manager admits to getting the positioning of the fund wrong recently which has had a negative impact on relative performance,” Admans said.

Performance of fund vs sector over 10yrs

Source: FE Analytics

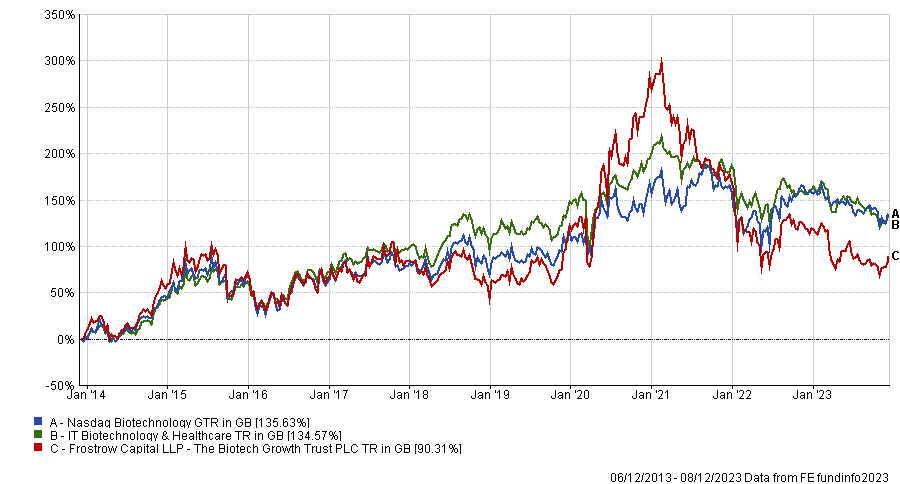

The Biotech Growth Trust

TILLIT is reviewing whether to keep The Biotech Growth Trust on its buy list due to the “scale and persistence” of its underperformance over five and 10 years, Admans said. The £283m trust owns more small-cap stocks than its benchmark or peer group, which has been a headwind recently.

Performance of trust vs benchmark sector over 10yrs

Source: FE Analytics

Tech funds lead TILLIT’s top performers

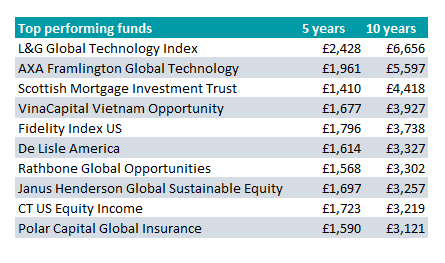

At the other end of the spectrum, the best performing funds on TILLIT’s open architecture platform over five and 10 years include two technology funds, three US equity funds and a Vietnam strategy, among others.

Best performing funds in TILLIT’s universe, based on £1,000 invested

Sources: TILLIT, FE Analytics

The majority of actively-managed funds and trusts in TILLIT’s universe with a decade-long track record beat their peer group (82%) and benchmark (74%). Among the funds and trusts with a track record of at least five years, 74% exceeded their peer group and 65% beat their benchmark.