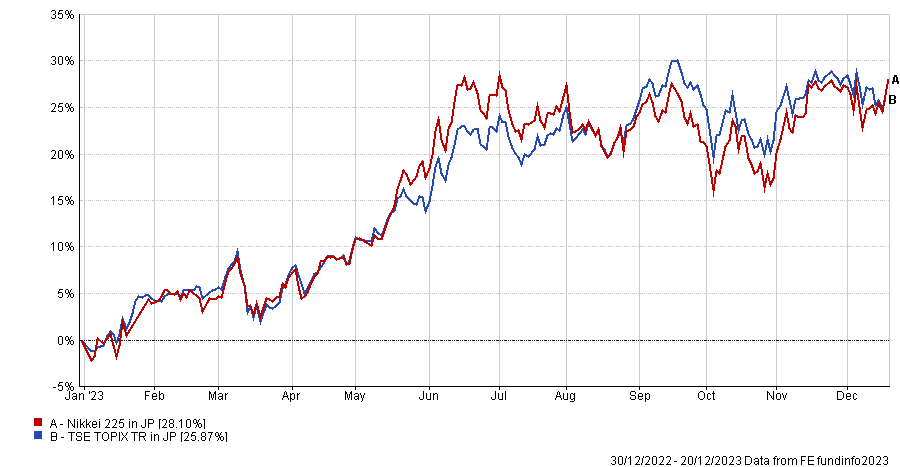

Japanese equities have enjoyed a strong year, up more than 25% in yen terms, and corporate governance reforms are expected to boost shareholder returns going forward.

The likes of Warren Buffett, the renowned US investor, have been backing the country in 2023, propelling it back into the headlines and drawing investors’ attention.

Several multi-asset managers have increased their exposure to Japan tap into the rally. Aviva Investors, BlackRock and Van Lanschot Kempen, to name but three, are overweight Japan.

Scopic Research’s sentiment indicator, which surveys the UK’s multi-asset investment teams, showed they expect a positive return from Japanese equities in 2024 and that sentiment is improving.

Carl Vine, co-head of M&G Investments’ Asia Pacific equity team, said the change in corporate culture since Abenomics came along a decade ago has meant Japanese companies have delivered “impressive earnings growth”, adding that “a repeat in the decade ahead is a very reasonable base case assumption”.

“Strong earnings, strong dividend growth and growing buybacks offer the prospect of mid-teen market returns for many years to come, in a cheap currency no less,” he said.

The Japanese equity rally in yen terms

Source: FE Analytics

But it might not be a case of rising tides lifting all boats. Craig Baker, global chief investment officer of Willis Towers Watson, believes specialist stockpickers are best placed to find opportunities across the capitalisation spectrum amidst this regime shift in corporate governance.

Baker, who manages Alliance Trust, hired Dalton Investments this summer to invest 5% of the £3bn global equity trust’s assets in 20 Japanese companies. Allocating to a specific region is rare for the multi-manager trust, most of whose managers have global briefs.

Sam Perry, senior investment manager at Pictet Asset Management, agreed. “Not all companies will cope equally well in this new normal,” he argued. “Valuations are also a key consideration. For example, while the pharmaceutical sector in Japan offers innovation and growth potential, we see few opportunities there as much of that potential is already largely priced in.”

Corporate governance reforms

Baker’s conviction in Japan was strengthened in early 2023 when the Tokyo Stock Exchange called on companies to address low valuations and improve capital efficiency.

It asked all companies, especially the 1,800 companies that were trading on a price-to-book ratio (PBR) of less than 1x, to provide an action plan aimed at improving their market valuations and return on equity.

Joe Bauernfreund, manager of the AVI Japan Opportunity Trust, pointed out: “What companies and market participants seem to miss is that even companies trading above a 1x price-to-book (PBR) ratio have a responsibility to disclose actions for improving capital efficiency and market capitalisations.

“The Tokyo Stock Exchange noted that the disclosure rate for companies with PBR above 1x was poor. For engaged shareholders this provides a wonderful opportunity to work with the 69% of companies that haven’t responded positively using the force of the TSE to help reform Japanese’ companies attitudes towards their share prices.”

The Japan Exchange Group (JPX) established its JPX Prime 150 index in mid-2023 to “make visible the leading Japanese companies that are estimated to create value”. JPX said it aims “to make the index and its constituent stocks the target of medium to long-term investment by institutional and individual investors in Japan and abroad, thereby contributing to the penetration of value-creating management”.

Baylee Wakefield, a multi-asset fund manager at Aviva Investors, said the Prime index has encouraged companies to make shareholder-positive changes as they compete to be included.

“There is a lot of potential and it’s likely that more positive changes will be made,” Wakefield said. “Some of the low hanging fruit has been delivered such as an increase in share buybacks and better use of cash by companies, but there is still further to go.”

The average age of CEOs in Japan is coming down and the new generation of leaders are less beholden to the approaches of the past and more predisposed towards international capital market models.

In another sign of improving governance that will play out over the longer term, Japanese companies are appointing more women onto their boards. “Developments such as improving board diversity will take time to implement and filter through into higher valuations,” Wakefield noted.

Meanwhile, labour reforms have introduced more flexibility into the jobs market and should eventually result in higher wages, said Reiko Mito, head of Japan strategy and research at Martin Currie.

“The rigid legal requirements for terminating employees and the longstanding belief in life-time employment, even though the latter is not formally guaranteed, have hindered the flexibility of the labour market,” she explained.

“In order to change this, there are increasing initiatives such as the introduction of performance-based pay as opposed to tenure-based pay, the permission of side-jobs and the wide re-skilling programs within companies. These would give a boost to labour mobility, which would eventually also contribute to wage hikes.”

Inflation is reinforcing positive change

The focus on corporate profitability has coincided with the return of inflation, which has enabled companies to raise prices – not merely to pass on higher costs but also to improve their margins – and is discouraging management from hoarding cash.

Perry said: “Japanese companies amassed some 258trn yen of funds that can be put to more productive use and we expect to see companies loosening their purse strings. According to the Tankan survey, Japanese companies are intending to invest faster than they have at any point in the past 40 years and this momentum will only strengthen as domestic economic activity picks up.”

Fostering an investment culture

Individuals, as well as corporations, are being encouraged to move out of cash and invest in the stock market. Japanese households hold more than half (55%) of their assets in cash and deposits so they have plenty of capacity to move up the risk spectrum.

In January 2024, Japan will make changes to its Nippon Investment Savings Account (NISA) program. The annual NISA investment quota will triple to 3.6m yen (£20,000) and the tax-free period will become indefinite (up from five years). Households will be able to use both types of NISA (general and instalment) together, rather than having to choose between them.

June-Yon Kim, head of Japanese equities at Lazard Japan Asset Management, said: “We believe the enhanced NISA program could help create a foundation for an equity culture in Japan.”