Last year was one of two dominating themes: the rise of artificial intelligence (AI) and the huge disappointment of China.

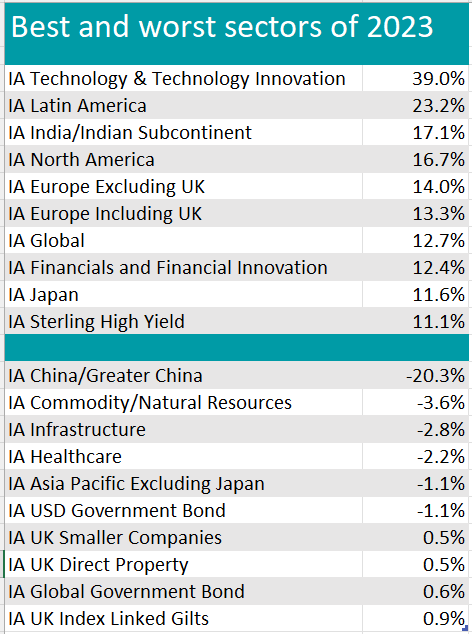

Indeed, data from FE Analytics confirms this, with the IA Technology & Technology Innovation sector as the best of the year, returning 39.2% in 2023, while the IA China/Greater China ended the year with -20.4%, the clear loser of 2023.

Ben Yearsley, director of Fairview Investing, said that these were the only two stories in 2023 that investors needed to pay attention to.

“Tech was great, China dreadful. In what was a surprise to many, the never-never rally of a few years ago has reappeared with Nasdaq reaching an all-time high. This happened despite 5% interest rates,” he said.

“Its return was driven by AI – well not literally driven by AI, although how long before we have fully AI-driven investment funds?”

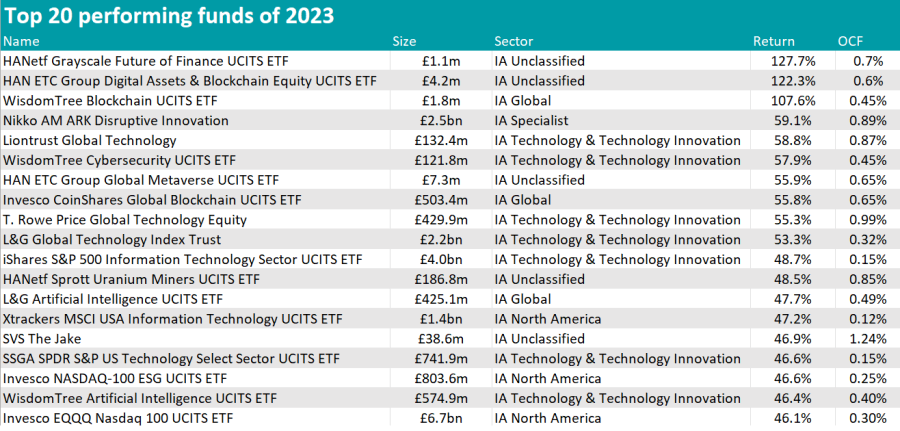

But at fund level, the top funds didn’t belong to this group – they were all focused on cryptocurrencies. Many were exchange-traded funds (ETFs) in the IA Unclassified or IA Global sector.

Leading the table were HANetf Grayscale Future of Finance UCITS ETF, which returned 127.7%, and HAN ETC Group Digital Assets & Blockchain Equity UCITS ETF, at 122.3%. Both had a storming end to the year.

The former aims to provide asset managers with access to the entire value chain of the digital economy, from Bitcoin miners to exchanges, through fundamental analysis; the latter is more focused on blockchain itself.

Source: FE Analytics

The third fund on the podium was WisdomTree Blockchain UCITS ETF, another winner that profited from a very positive December for blockchain strategies.

In fourth position came Nikko AM ARK Disruptive Innovation, which returned 59.1%, although this was less than half the gains made by the top strategies.

Its main contributors were crypto exchange Coinbase (the first holding at 9.4%), US streaming company Roku and US financial services company Block.

WisdomTree Cybersecurity UCITS ETF, HAN ETC Group Global Metaverse UCITS ETF and Invesco CoinShares Global Blockchain UCITS ETF were also of note.

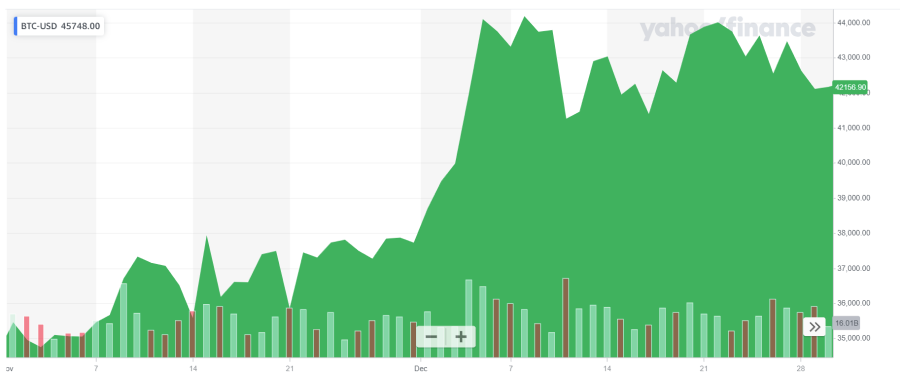

Performance of Bitcoin in November and December 2023

Source: Yahoo! Finance

Moving away from crypto, James Dowey and Storm Uru run the Liontrust Global Technology fund, which returned 58.8% in 2023 and is the first IA Technology & Technology Innovation fund on the list.

At 55.2%, another standout performer of the year was T. Rowe Price Global Technology Equity fund, managed by Dominic Rizzo, whose first holding changed in December from Apple to semiconductor darling Nvidia, which and now makes up 9.4% of the portfolio.

A close competitor, the passive L&G Global Technology Index Trust concluded the top 10, achieving a 53.3% return by tracking the shares of tech companies within the FTSE World index. Its ongoing charge figure (OCF) is less than half those of the two previous funds (0.32% against 0.99% and 0.87%, respectively).

The second-best sector was IA Latin America, with an average return of 30.3%. According to Yearsley it was possibly a weaker dollar driving this, as there hasn’t been a commodity bull run.

However, the best fund within the sector (BlackRock GF Latin American, which returned 16.5%) didn’t show among the best funds list before the 102nd position.

The same goes for IA India / Indian Subcontinent, with the first fund here (Jupiter India Select) only achieving position 84 in the general ranking of funds, returning 32%.

Source: FE Analytics

Turning to the worst areas, IA China/Greater China ended the year down 20.4%, the clear loser of 2023, as no other sector lost more than the 3.6% of the IA Commodity/Natural Resources sector.

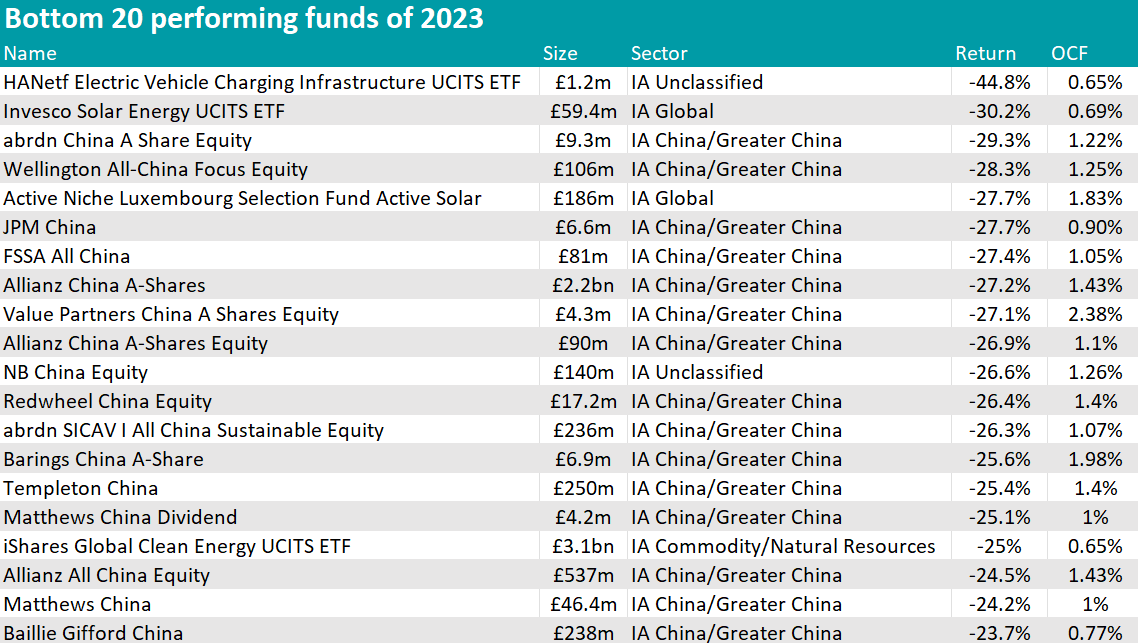

Both these trends are replicated at a fund level, where the China debacle went hand in hand with carnage in environmental, sustainability and governance (ESG)-focused strategies, particularly in the clean energy and solar space.

At the foot of the table is HANetf Electric Vehicle Charging Infrastructure UCITS ETF, whose value almost halved (down 44.6%). Invesco Solar Energy came second, losing 30.2%.

Source: FE Analytics

Setting investors back 29.3%, the worst China fund was abrdn China A Share Equity, followed by Wellington All-China Focus Equity. The latter lost £80m from its peak on 27 January to its trough at £135.1m of assets under management (AUM) on 29 December.

These two trends dominate the bottom 70 positions. After this, new losers emerge, including BNY Mellon Japan Small Cap Equity Focus (-16.7%), Baillie Gifford Health Innovation (-15.8%) and Premier Miton UK Smaller Companies (-15.7%).