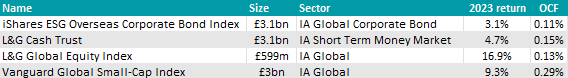

Passive funds were in vogue among Fidelity analysts last year, judging by the funds that made it into its Select 50 best-buy list in 2023.

The platform’s analysts team, headed up by investment director Tom Stevenson and in partnership with research firm Fundhouse, selected four index trackers as last year’s new entrants into the firm’s best-buy list.

It was a good time to do so, as passive funds beat actively managed portfolios in 32 out of the 54 Investment Association (IA) sectors over the past 12 months.

Below, Trustnet takes a closer look at the new Fidelity’s favourites.

We begin with L&G Global Equity Index, which has beaten the average fund in the IA Global sector just by tracking the performance of the FTSE World index, as shown in the chart below.

Performance of fund vs sector and index over 1yr Source: FE Analytics

Source: FE Analytics

In fact, last year, only 101 funds in the IA Global sector out of 543 managed to beat the FTSE World index – just 18.6% of vehicles in the whole peer group.

The L&G fund invests in companies that are listed globally and comprises large and medium-sized companies in both developed and emerging markets.

Stevenson liked it for L&G’s “strong index-tracking capability” and its price, with the ongoing charges figure (OCF) at just 0.15%. He recommended the fund for investors seeking to invest globally who have a long-term horizon and want to keep costs down.

For them, “this is a sensible choice on the riskier side of a portfolio,” he said.

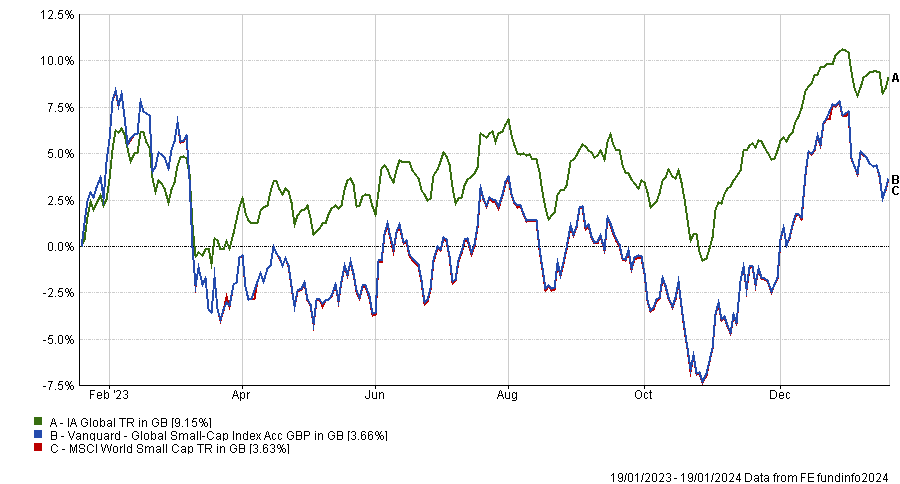

For balancing out the large and mid-cap exposure, Fidelity looked into the smaller-cap of the market too, where Stevenson chose the Vanguard Global Small-Cap Index tracker, which joined its UK sibling, the Vanguard FTSE 250 UCITS ETF, in Fidelity’s Select 50.

In a negative year for smaller companies, tracking the MSCI World Small Cap index through this Vanguard solution would have made investors 3.7%, as the chart below shows.

Performance of fund vs sector and index over 1yr

Source: FE Analytics

Stevenson highlighted it as a well-diversified investment, with approximately 4,000 companies held across many different developed markets.

“Vanguard has a strong index-tracking capability, and this fund is well priced [it has an OCF of 0.30%],” he said.

“As smaller companies tend to be more volatile than their larger counterparts, this fund is on the riskier side of a portfolio, but a sensible choice for investors seeking to invest globally, who have a long-term horizon and are cost-conscious.”

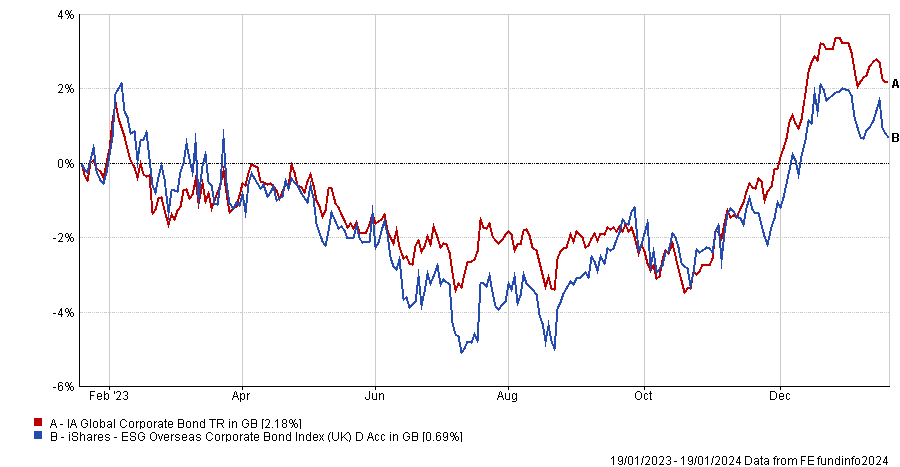

Moving over to fixed-income, Stevenson chose the iShares ESG Overseas Corporate Bond Index fund.

As shown below, it underperformed its sector last year, probably due to its environmental, sustainability and governance (ESG)-conscious approach, as green investments have been out of favour recently.

Performance of fund vs sector and index over 1yr

Source: FE Analytics

The fund excludes a number of industries on ESG concerns.

“BlackRock has shown good skill in being able to track corporate bond indices. The strategy can lend to higher-risk companies, the bulk of its loans are to medium and lower-risk companies, and its costs are low,” said Stevenson, who also appreciated the possibility of making “a modest income” with this strategy, which currently yields 3.7%.

Finally, given the great popularity of money market funds in 2023, L&G Cash Trust was also granted a spot in the list. This type of fund has been a popular way of investing in a cash-like instrument in 2023 in order to profit for the higher-interest-rates environment.

While AJ Bell, in its list of favourite funds, preferred BlackRock ICS Sterling Liquidity Premier, Fidelity went for this L&G solution, which aims to provide a return whilst preserving capital by making very short-term, high-quality bond investments and deposits (typically for only a few months).

“L&G has a strong money market capability and this fund would be a good choice for investors who are seeking a more attractive level of interest or return than they may receive on a traditional savings account,” said Stevenson.

“By lending money on a very short-term basis (under 50 days on average) to a range of high-quality financial institutions, mainly large banks, this is a very conservative investment approach, but likely to carry more risk than a traditional savings account.”

It costs investors 0.15% of ongoing charges, although Blackrock’s equivalent highlighted by AJ Bell is even cheaper, at 0.10%.

Source: FE Analytics