Investing in the wrong sector this January cost investors a lot of money. Average losses in the worst sector were almost twice the size of the average gains in the best sector.

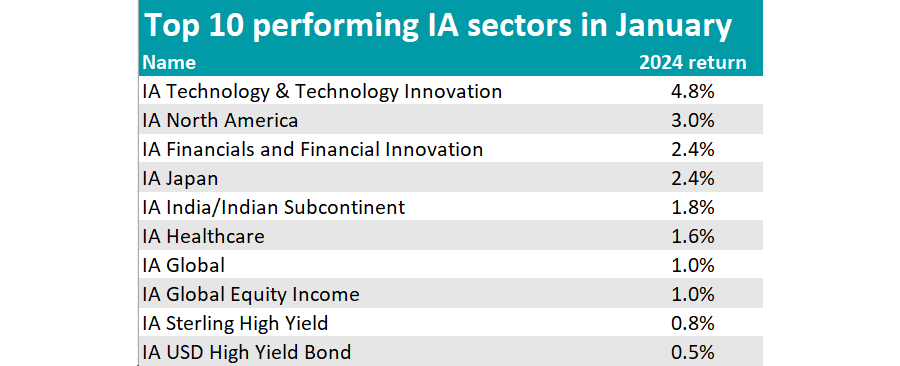

The IA Technology & Technology Innovation sector led the pack, rising 4.8% last month, carrying the whole IA North America sector with it (3%). The worst sector was IA China/Greater China, which lost 9.2% and dragged down much of the rest of the emerging markets.

Source: FE Analytics

Director of Fairview Investing Ben Yearsley said: “Technology and North America are so intertwined that it does distort the picture of US equities”.

“Microsoft is again the world’s largest company with a value just under $3trn, but with Apple, Alphabet, Amazon etc. also in the top 10, a tech fund, a Nasdaq tracker, an S&P tracker and a MSCI World tracker look very similar and perform in tandem.”

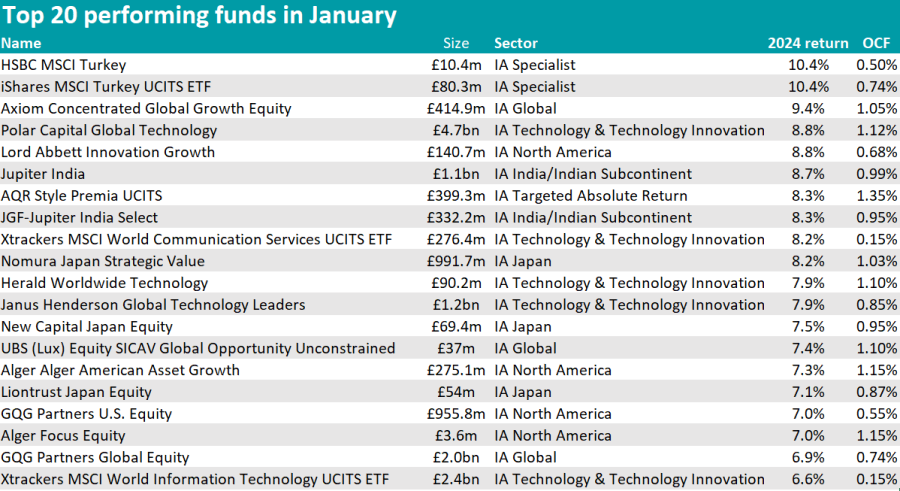

US trackers were overshadowed, however, by two unexpected high flyers – HSBC MSCI Turkey and iShares MSCI Turkey UCITS ETF, both of which returned 10.4% in January.

Source: FE Analytics

Carlos Hardenberg, manager of the Mobius Investment Trust, recently said that “Turkey seems to be turning the corner”, having appointed a new central bank governor and finance minister who follow “more orthodox monetary policies”.

“The country has taken a repair path and has a long way to go from here and we are overweight Turkey,” said Hardenberg. “However, I would always stay slightly sceptical about Erdogan and his gang, as there's a good chance that they will make yet another mistake going forward.”

The best tech fund was a good 1.6 percentage points behind Turkish equities – Polar Capital Global Technology made 8.8% last month. Its top 10 stocks include six of the Magnificent Seven (excluding Tesla), together with global semiconductor plays.

Elsewhere, Japan and India also made the top five sectors last month, as Yearsley noted.

“Japan remains one of the most interesting stories with corporate change and more shareholder awareness helping drive markets,” He said.

“The Nikkei index hit a 34-year high in January breaking through the 35,000 level – only another 10% to break the all-time record set in 1989. India’s Nifty Fifty index also reached a new all-time high during the month.”

Here, the best choices were Jupiter India (8.7%) and Nomura Japan Strategic Value (8.2%).

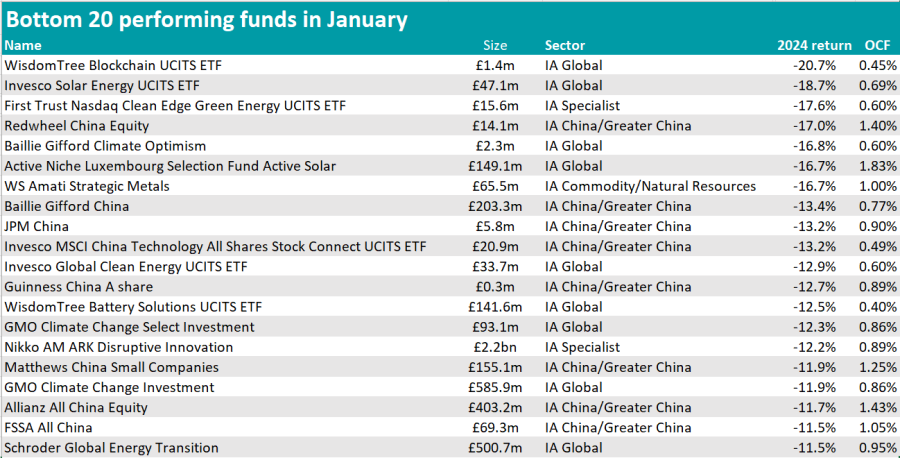

China-focused funds languished at the foot of the tables in what Yearsley called a “very disappointing” start to 2024. China’s woes can be pinpointed to its troubled property sector, which is dragging on the economy.

Source: FE Analytics

“China is an interesting one as there was a brief period in January where markets regained some confidence after Beijing announced stimulus measures, then the confidence evaporated,” Yearsley said.

“According to many fund managers, Chinese equities have never been this cheap compared to the wider Emerging Markets. China also dragged the Asia Pacific ex Japan sector into the bottom five performing sectors last month.”

The worst vehicle here was Redwheel China Equity, which lost 17%.

The absolute worst performer belonged to the IA Global sector, however. WisdomTree Blockchain UCITS ETF lost 20.7% despite the Bitcoin rally after the US Securities and Exchange Commission approved Bitcoin Spot ETFs in early January.

Source: FE Analytics

There’s more gloom for climate-related funds, which have been in the doldrums for about six months already.

The two strategies that suffered the most were the Invesco Solar Energy UCITS ETF and the First Trust Nasdaq Clean Edge Green Energy UCITS ETF (-18.7% and -17.6%, respectively).

Baillie Gifford Climate Optimism fell 16.8%, with Yearsley suggesting the team “drop the optimistic tag, with the fund performing so poorly”.

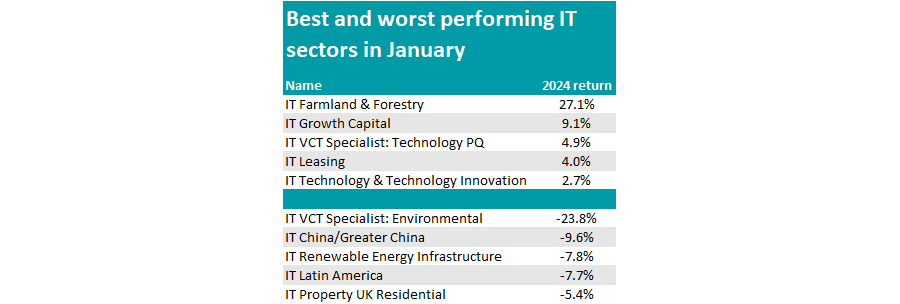

In the eclectic investment trusts universe, the differences to the open-ended groups were significant.

The top performing sector was IT Farmland & Forestry – although there is only one trust in that sector and it gained 27.1% last month.

The top spot from an individual trust perspective went to Seraphim Space, with Yearsley singling out its “stratospheric rise (pun intended)” of 49%.

Source: FE Analytics