Paying high fees is one of the easiest ways for investors to hamper their long-term returns, as charges can stack up over time.

Passives are the cheapest option around, but some prefer active management as it provides the potential to beat an index and make supersized returns.

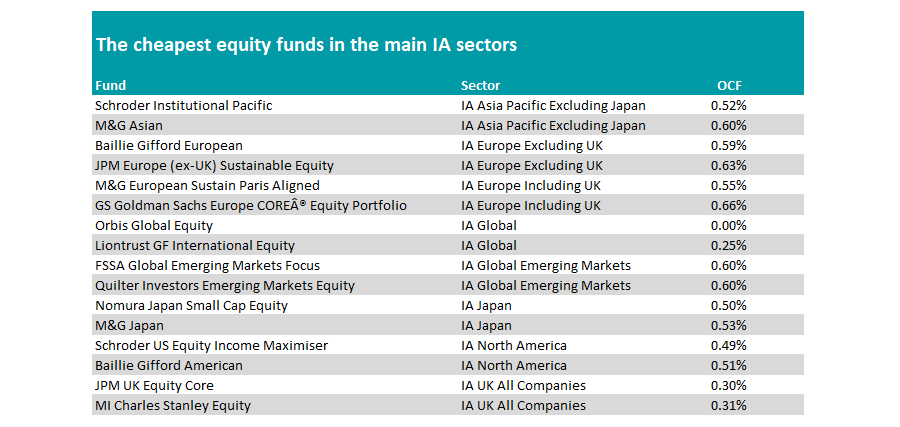

Getting the best of both worlds could be a good strategy. As such, below Trustnet has highlighted the cheapest active funds in each of the main Investment Association (IA) equity sectors.

We have excluded any funds that are benchmark aware (such as those that largely replicate the index or hold vast numbers of stocks), focusing solely on those funds that pick stocks.

The cheapest option among all funds is Orbis Global Equity, which has a unique fee structure.

An ongoing charges figure (OCF) of 0% may imply the fund is free to own, but this is not quite the case. If the fund fails to beat the MSCI World index, it does not charge a fee. In fact, 40% of this underperformance is paid back, with refunds offered to investors. When it does beat the index, 40% of the outperformance is taken as a performance fee.

The next cheapest option is also in the IA Global sector. Liontrust GF International Equity charges 0.25% and has a global ex US approach, having a maximum net allocation to US stocks of 10%.

This has been a headwind in recent years, with the fund in the bottom quartile of the sector since its launch in 2019. It is a reminder that cost should not be the only metric considered when picking a fund.

Source: FinXL

The next-cheapest options are in the UK where the JPM UK Equity Core and MI Charles Stanley Equity funds are competitively priced at 0.3% and 0.31% respectively.

Investors wanting US exposure – but unwilling to pay up for it – typically choose passive options, but for the active-minded investor, Schroder US Equity Income Maximiser and Baillie Gifford American are the cheapest options.

Conversely, the costliest of the cheapest funds above comes from Europe, where the least expensive options will set investors back around 0.55%-0.69%.

IA Global Emerging Markets is also one of the most expensive areas, however, as managers have a much wider remit and may therefore require more analysts around the word. The cheapest funds here – FSSA Global Emerging Markets Focus and Quilter Investors Emerging Markets Equity – charge double the cheapest UK funds at 0.6%.

Schroder Institutional Pacific and M&G Asian are the most cost-effective option among Asia funds, while Nomura Japan Small Cap Equity and M&G Japan are the cheapest in Japan. All range between 0.5% and 0.6% OCFs.

The cheapest and most expensive overall sectors

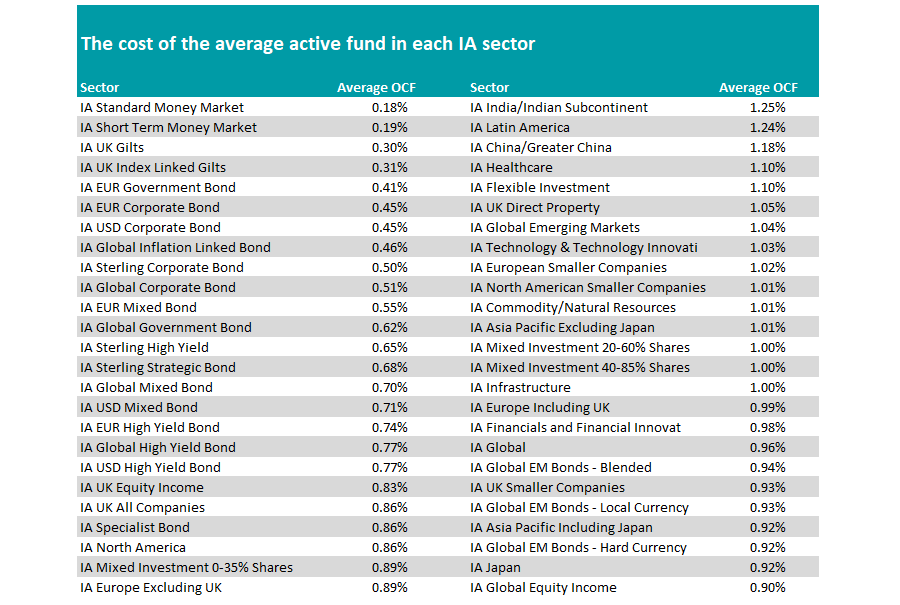

We also broadened out our research to the entire IA universe, looking at the cheapest and most expensive average active funds. Here we kept all active funds in the sector – including those that are benchmark aware.

However, we excluded some such as the IA Targeted Absolute Return Sector, the IA Volatility Managed sector and the IA Unclassified and IA Specialist sectors, where the broad scope of funds makes comparisons difficult, as well as those where there were no active funds.

Source: FinXL

Overall, money market funds are the most cost effective, with the average active fund setting investors back 0.18% for the IA Standard Money Market sector.

Among equity sectors, IA UK Equity Income and IA UK All Companies house the cheapest average active funds, with costs of 0.83% and 0.86% respectively.

Conversely, specialist country and sector funds are the most expensive, with portfolios in the IA India/Indian Subcontinent and IA Latin America sectors costing 1.25% and 1.24% on average.