The Labour Party’s decision to abandon its green spending plan has attracted criticism from all sides. Its stance is that it was a plan born in a time of lower borrowing rates that is not feasible now.

However, there is an awful lot of investment needed if we are to meet our climate pledges and ensure that our crumbling infrastructure is updated and refreshed. The obvious solution is to use government money and policy creatively to encourage private investment.

A couple of decades ago, the main route for encouraging infrastructure investment was public/private partnership (PPP) and private finance initiative (PFI) type models. The oldest of the listed infrastructure funds were set up to invest in these.

HICL Infrastructure (originally HSBC Infrastructure) and International Public Partnerships (INPP, originally Babcock and Brown Public Partnerships) are both about 17 years old.

The projects that they acquired in the first few years tended to be availability-based assets. Ones that generated an income as long as the asset was available for use and in good order. The counterparty was usually a government entity and the revenue was often inflation-linked.

These PPP/PFI contracts usually had a life of about 25 years. Consequently, many of the PPP/PFI projects acquired by these funds are approaching the end of their contract life.

In October 2018, the UK government said that it would no longer use the PFI model. At that time, there were about 700 of these contracts. There are far more counterparties than large investors in PFI. For the most part, these counterparties do not have the in-house expertise to take over the management of these assets. Some may seek to extend the life of the contract.

BBGI Global Infrastructure still has all of its portfolio in availability-based projects, but for the most part these are overseas where the model is still being used. Only one-third of its portfolio is in the UK.

In its end March 2023 accounts, HICL said that it owned 29 projects, equivalent to 11% of the portfolio, that were due to be handed back over the next 10 years. That is a relatively low percentage, but this reflects the work that HICL has been doing to refresh its portfolio – using cashflows generated from the PFI assets as well as the substantial amounts of capital that it has been raising over recent years.

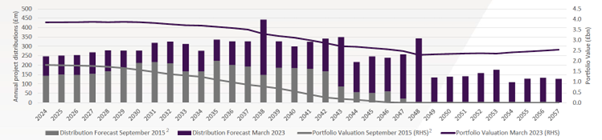

This chart from its results presentation shows the extent to which it has transformed its portfolio and extended its average asset life over the past eight years.

Source: HICL Infrastructure

In summary, the weighted average asset life has been extended from 21 years in September 2015 to 32 years in March 2023. However, that necessitated a change of emphasis within the portfolio.

At that time, the proportion of contracted revenues in the fund had fallen to about two-thirds. Assets with demand-based revenues were 19% of the portfolio and assets with regulated revenues made up the balance.

Demand-based investments in HICL’s portfolio include toll roads and HS1 (the St Pancras – Channel Tunnel rail link). Within the regulated revenue bucket sits Affinity Water, which as a water supply company, does not have exposure to the sewage problem that besets many other water companies, but still has to invest billions over coming years.

INPP has more exposure to regulated assets than HICL does. These include Cadent (the gas transmission network), Tideway (the Thames super sewer, where tunnelling completed in 2022 and the target operational date is 2025), and a number of OFTOs – the land-based connections between offshore power generation and the national grid.

In December, it rejigged its OFTO portfolio – selling some assets to free up capital to invest in a new project – the Moray East OFTO.

The regulated asset base model works quite well for really big projects such as these but is a bit cumbersome when it comes to smaller ones.

The arguments around the RAAC (dodgy concrete) problem exposed the woeful lack of new investment in infrastructure in recent years. There have been calls for a new Building Schools for the Future programme in the UK, but the problem affected hospitals too and money earmarked for new hospitals has been diverted into rebuilding five hospitals instead.

If the vast investment needed here is not to be funded by the government’s balance sheet, revamping PFI may be the answer and the listed infrastructure funds may be there to help fund it.

Then there are even smaller projects – one of the policies drastically scaled back in Labour’s green plan was £6bn per annum for the Warm Homes Plan, now slashed to about £1.3bn. Tackling energy efficiency is an essential part of meeting net zero commitments. Trusts such as SDCL Energy Efficiency Income would no doubt love to get behind funding for this, if the risk/reward looks right.

However, as we know, at the moment the infrastructure and renewable infrastructure sectors are trading on big discounts. Fundraising for new projects is not practical currently. Adapting to an environment of higher interest rates has been part of the problem for these funds.

However, many of them including HICL and INPP have been selling assets recently and are achieving valuations in line or in some cases above NAV. In addition, it seems likely that rates have peaked and future falls in rates could mean that NAVs bounce later this year.

The other main issue has been the misleading cost disclosure issue that has affected the whole investment trust sector. Fortunately, there are encouraging signs that the government is realising that it needs closed-ended funds to play their part and is trying to fix problem.

It does not seem too fanciful that infrastructure funds trading at discounts of about 20% now and offering yields in the high sixes (covered by cash flows that are often government-backed and inflation-linked) could be back trading at net asset value by the end of the year. The yields and discount narrowing opportunities available on many of the renewable energy funds are even greater.

James Carthew is head of investment companies at QuotedData. The views expressed above should not be taken as investment advice.