All eyes are on NVIDIA this week ahead of the chip designer’s results on Wednesday. Investors will either be raising their glasses (having earned an incredible 251.6% in the year to 16 February 2024) or kicking themselves for not having bought the stock.

‘Fear of missing out’ (FOMO) – when a share you don’t own excels – affects professional and private investors alike. It can be so agonising that Brown Advisory enlists the help of behavioural consultants to coach its portfolio managers and analysts.

Susanne Reisch, an investment director in Brown Advisory’s global equity team, described not owning NVIDIA as “an emotionally painful experience”. “That classic FOMO is something you need to control so you don’t have those emotional overwhelming moments,” she said.

“We’d love to own it from a quality perspective but the valuation is not conservative enough.”

The firm’s investment style is global, quality and long term, as well as being “very valuation focused”. “We only buy a company when we can see a minimum 10% average return over the next 10 years,” Reisch explained. Attractive valuations also provide a margin of safety.

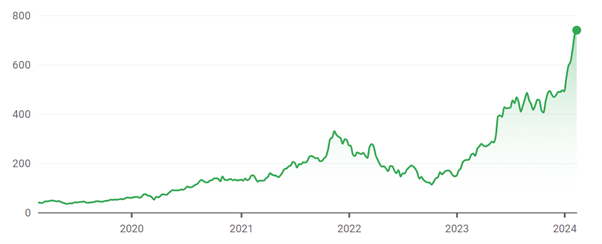

Brown Advisory calculates an entry price for each stock. NVIDIA has never hit its entry price – not even when it nosedived during 2022.

NIVIDIA’s share price over 5yrs

Source: Google Finance

Nonetheless, Brown Advisory owns two of the ‘Magnificent Seven’ technology stocks: Microsoft and Alphabet are the largest positions in the $2.9bn Brown Advisory Global Leaders fund, worth 8.6% and 4.4% of the portfolio, respectively, as of 31 December.

Brown Advisory also has exposure to artificial intelligence through ASML, whose lithography technology is used by microchip manufacturers, Taiwan Semiconductor Manufacturing Company (TSMC) and Marvell, a data infrastructure and semiconductor technology specialist.

At the end of 2022, all three companies – as well as NVIDIA – were in a valuation trough.

If a portfolio company’s share price falls by 20% or more, or if it underperforms the benchmark for 12 months, Brown Advisory has a rule where it completely “underwrites” the investment process, Reisch said.

Portfolio managers and analysts do a forensic deep dive into the company and revisit their original investment thesis to see if it still stacks up. They investigate whether the share price is getting clobbered due to supply-side or demand-driven factors and whether these factors are serious or temporary.

At the end of this process, the investment team makes a decision: to treat the dip as a buying opportunity; or to get out before things get worse.

“That moment when the share price drops 20% is often very emotional,” Reisch said. “A lot of mistakes are made in stressed situations.”

It is important not to blame anyone, for instance the analyst who recommended the stock, Reisch pointed out. The formalised investment process and the underwriting rule help, as does access to behavioural coaches.

Reisch said she has never seen an analyst get stressed at Brown Advisory when a stock they recommended falls because it could be a buying opportunity. The underwriting review could result in topping up the position.

In late 2022, Brown Advisory performed this underwriting process for ASML, TSMC and Marvell, and included NVIDIA into the mix to analyse whether to invest in the chip designer. The firm decided to increase its exposure to ASML, TSMC and Marvell but concluded that NVIDIA was still too expensive.

Alongside the technology theme, analysts have been busy in other areas of the market too. For instance, in May 2023 Brown Advisory invested in Ferguson Industrial, a plumbing company with exposure to the US commercial real estate sector, which “no-one wanted to touch” back then.

Ferguson is an “excellent business” that was “underappreciated by the market” and available at a good price, Reisch explained.

In a similar vein, the firm increased its position sizes in several travel and leisure companies in the middle of the Coronavirus pandemic when valuations plummeted. They include hotel site Booking.com, jet engine maker Safran, German ticketing company Eventim, as well as Visa and Mastercard, whose credit cards people use when they travel abroad. “Those opportunities don’t come along very often,” Reisch said.

Eventim sells tickets for events in Germany, Austria and Switzerland, so during lockdown Brown Advisory contacted people who organise concerts for rock stars to ask about their expectations. These conversations gave the firm confidence to increase its exposure.

Extensive bottom-up research – as in Eventim’s case – is a hallmark of Brown Advisory’s investment process. The firm employs an investigative team to find out information that analysts can’t access.

For instance, analysts wanted to know why customers of Allegion, which makes mechanical and digital locks, choose its products instead of competitor ASSA ABLOY. By talking to customers, the investigative researchers found out that Allegion provides a consulting service to help its clients figure out what kind of locks they need, which was key to it retaining its loyal patrons.