GQG Partners US Equity, Blue Whale Growth and the Scottish Mortgage Investment Trust are among the funds and trusts that benefitted most from Nvidia’s strong results last week, data from FE Analytics has revealed.

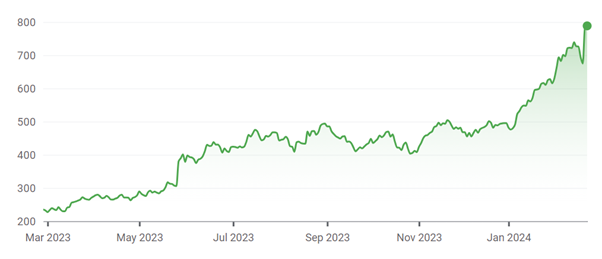

Nvidia’s shares soared more than 14.5% last Thursday alone after Wednesday night’s euphoric earnings, propelling the chip maker’s shares – and global indices – to record highs.

Performance of Nvidia’s share price over 1yr

Source: Google Finance, data to 23 Feb 2024

Nvidia’s fourth quarter numbers included a 265% increase in sales compared to the same period last year and the chip designer forecasted another substantial revenue gain for the current quarter. Stephen Innes, managing partner at SPI Asset Management, went so far as to call Nvidia “the world's most important stock and, increasingly, the market's most crucial wealth-generating company”.

Anyone with passive global or US equity exposure in their savings accounts or pension funds will have reaped rewards, given that Nvidia is now the third largest stock in the MSCI World index.

Many active managers and their investors have also ridden the artificial intelligence (AI) boom, and those who chose to go overweight Nvidia will have made more money than most.

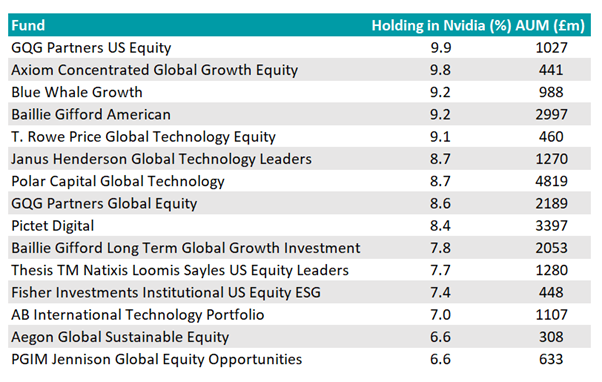

To that end, Trustnet investigated which actively-managed funds in the Investment Association’s universe have the largest stakes in the chip designer. We restricted our search to funds with more than £300m under management that count Nvidia among their top 10 holdings.

Technology, growth, US and global equity funds have the highest allocations to Nvidia. GQG Partners US Equity and Axiom Concentrated Global Growth Equity led the way with almost 10% of their portfolios in the chip designer.

They were followed by three funds with just over 9% in Nvidia: Blue Whale Growth, Baillie Gifford American and T. Rowe Price Global Technology Equity.

Actively-managed funds with the highest allocations to Nvidia

Source: FE Analytics

The GQG Partners US Equity fund is run by three FE fundinfo Alpha Managers: Brian Kersmanc, Sudarshan Murthy and Rajiv Jain (who is GQG Partners’ chief investment officer). They look for high-quality, attractively priced companies that possess competitive advantages. In particular, they focus on assessing companies’ financial strength, the sustainability the of earnings growth and the quality of management.

Nvidia is the £1bn fund’s largest position and the top 10 holdings also include Meta Platforms, Microsoft, Amazon and Alphabet.

Meanwhile, Axiom Concentrated Global Growth Equity focuses on growing companies that are undergoing significant change and that are exceeding expectations. Nvidia is its largest position too, followed closely by Microsoft.

The £441m fund’s top 10 holdings include several other technology companies – Amazon, Meta, Taiwan Semiconductor Manufacturing Company, Cadence Design Systems, ASML (a supplier to the semiconductor industry) and cyber security protection company, Palo Alto Networks.

Trustnet also looked at the largest funds that have gone overweight Nvidia, using size as a proxy for popularity.

Funds with more than £1bn under management and between 5% and 6.5% of their assets in Nvidia (meaning they were missed from the list above) include the £6bn AB American Growth Portfolio, the £4bn Brown Advisory US Sustainable Growth fund, the £3.6bn JPMorgan US Select Equity Plus fund, the £1.9bn T. Rowe Price US Large Cap Growth Equity fund, ClearBridge US Large Cap Growth (£1.5bn) and the £1bn Sanlam Global Artificial intelligence fund.

The extent of all these funds’ overweight positions depends somewhat on the benchmarks they are measured against. To put these position sizes into context, Nvidia is worth more than 4% of the S&P 500 index, 7% of the tech-heavy Nasdaq Composite and 2.5% of the MSCI World.

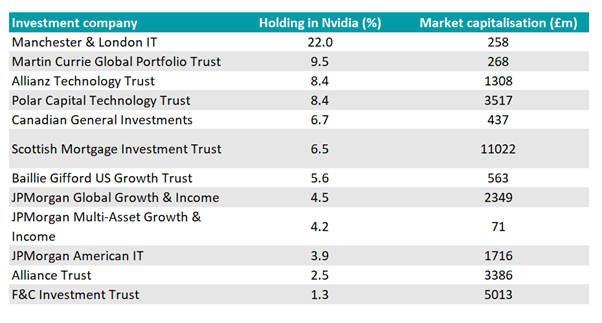

Meanwhile, 12 investment trusts count Nvidia among their top 10 holdings, according to FE Analytics. The trust with the largest position – a 22% stake – is Manchester & London.

Next in line is Martin Currie Global Portfolio, with a 9.5% position in Nvidia, followed closely by Allianz Technology and Polar Capital Technology. The £11bn Scottish Mortgage Investment Trust has a 6.5% position in Nvidia.

Investment companies with Nvidia among their top 10 holdings

Sources: FE Analytics, providers’ own factsheets

Beware concentration risk

Jason Hollands, managing director of Bestinvest, warned investors against rushing out to buy funds and trusts with large exposures to Nvidia because they may already own more of the chip maker’s shares than they realise through any passive funds they hold.

“While it may be tempting for investors to pour their savings into specialist AI-themed or technology funds, anyone holding a bog-standard US or global tracker fund will already have significant exposure to the theme and may not need to double up,” he said.

Hollands warned of the “inherent risks of becoming too heavily exposed to the prospects of a relatively small number of companies if, at some point, there is a reversal in bullish enthusiasm.”