The market seems to have unanimously decided that Nvidia is the best way to invest in the artificial intelligence (AI) trend. The stock grew 294.6% in the past year and many think it’s in an unrivalled position in the semiconductor industry.

But FE fundinfo Alpha Manager Matthew Benkendorf made another choice for the Vontobel Global Equity portfolio he co-manages. He doesn’t own Nvidia and the only ‘Magnificent Seven’ stocks he holds are Amazon, Alphabet and Microsoft.

The choice, he said, cost him 350 basis points of relative performance and the price tag was even higher (600 basis points) for the other fund he manages, Vontobel US Equity.

AI appears to be revolutionary but no-one knows yet who the beneficiaries and the losers will be long term. "Everybody's very excited about AI, but very generically", he said, "and herein lies the danger".

Below, he explains why Microsoft is “one of the best AI plays right now” and reveals the most common mistake people make when investing in the AI theme.

Can you sum up your process?

We take a high quality growth approach with both growth and value characteristics.

Our portfolio is benchmark-agnostic and made up of a concentrated selection of the best businesses around with superior, enduring long-term economics and a lot of predictability.

Critically, we look first to preserve and then to steadily compound capital over time.

How critical is it to preserve capital first?

We don't target a specific protection element and we don't hedge. However, we also understand that you should protect your capital as best as you can in difficult market periods, because every incremental percentage point of performance makes your longer-term compounding mechanism much easier over time.

If you're down 50%, you need to make 100% to break even. That gets lost on most people and it’s one of the lessons the burst of the dotcom bubble taught us.

Why didn’t you keep up with the rising market last year?

Typically, we do better when market bubbles burst or when we enter slowdowns, recessions or periods of negative GDP growth. We can outperform in up-markets, but it depends on the nature of that market.

A big piece of why we didn't outperform last year really came down to the Magnificent Seven stocks we didn't own. Not owning just a couple of names like Nvidia, Meta, Apple and Tesla cost us 350 basis points of relative performance.

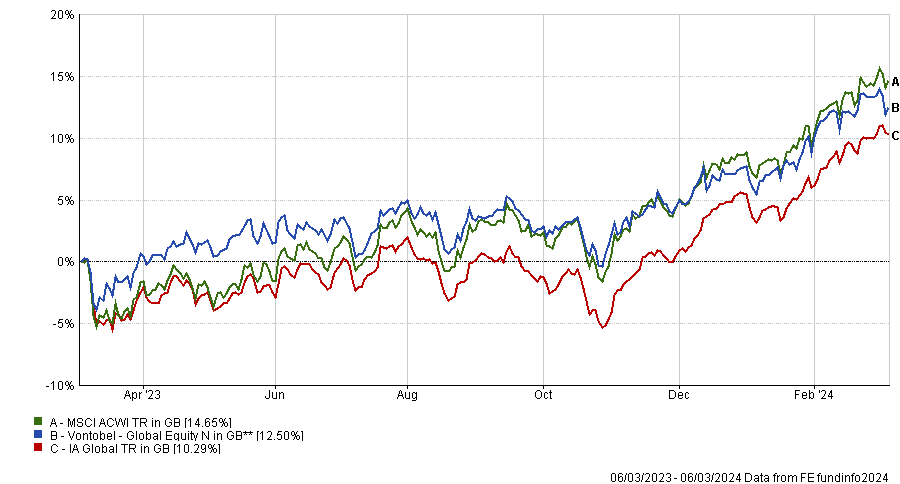

Performance of fund against sector and index over 1yr

Source: FE Analytics

The euphoria around these businesses is unsustainable, which will help us to overcome and outperform more strongly in the future.

Everybody's very excited about AI, but very generically – and I think here's the danger.

Just like in 1999 everybody knew the internet would be great but couldn’t quite tell what it meant for businesses, today AI is exciting, but there’s great uncertainty in terms of how it actually manifests positively or negatively for businesses. The timeframe is a bit more elongated than people realise.

Your largest holding is Microsoft, why do you prefer it to the other Magnificent Seven?

Microsoft is an exception to what I just said about AI and quite frankly, one of the best AI plays right now.

It is extremely well positioned because you can see very tangibly the business that Microsoft's already in and what it can add to it with AI. It has a dominant product like the Office suite that’s already here in front of us, and arguably you could add the generative AI assistant Copilot and sell that as an additional product to your customer base.

Contrary to other AI plays, here there’s something real and tangible, and Microsoft’s core business is great even without any AI.

What were your best calls of the past 12 months?

Unsurprisingly, Adobe was among the best performers. Going into 2023, the market got quite pessimistic around the stock because of anticipated competitive threats and the effect of AI on its business.

But then it was up over 80% last year because it’s an amazing business: it has long compounded earnings, 90% of its revenues are subscription-based and through its long history, it has consistently navigated difficult environments. But the market got impatient.

A similar case was Amazon – yes, their cloud business had slowed, but they were still the dominant, largest provider. Quality can hide in plain sight, it doesn't necessarily have to be secretive, and great businesses can reward greatly. But you need patience.

And the worst?

Consumer companies were weak in general and Coca Cola was down 7% last year. The market will go through periods where earnings growth is negative, however, and even though the stock was weak, it still can consistently compound at a low-teens rate. In fact, we think it’s one of the most exciting opportunities out there, because it's an area that's been left behind despite the fact that the underlying business is doing great.

Medical technology company Becton Dickinson was also down 4% last year. Healthcare is seen by the market as too boring, but boring isn't a bad thing and these falls gave us the opportunity to add more to both positions.

What do you do outside of fund management?

This is a pretty time-intensive job and when you're in the market, you’re always thinking about the market. Even when you’re skiing or traveling with family, you’re always thinking about businesses, observing businesses. That's what makes you better over time. I’m also a reader of both non-fiction (I typically like history) and fiction including science fiction.