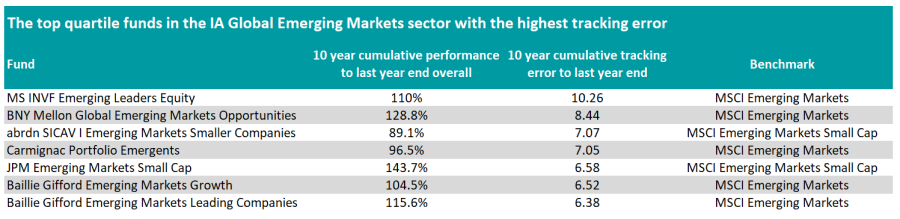

Seven funds have delivered the best returns that emerging markets equities had to offer in the past decade, an era during which the asset class severely underperformed.

Research by Trustnet identified funds with a high tracking error that beat their benchmarks and sit in the top quartile of the IA Global Emerging Markets sector over 10 years (to last year’s end).

The ‘benchmark-agnostic’ fund that would have returned the most money to investors is JPM Emerging Markets Small Cap.

FE fundinfo Alpha Manager Amit Mehta and co-manager Austin Forey seek to identify high quality emerging market smaller companies with superior and sustainable growth potential.

The result of their bottom-up stock picking is a strong exposure to the consumer products, telecom, media and technology, and financial sectors. According to the fund’s latest factsheet, more than 60% of the investee companies have a market capitalisation ranging from $1bn to $5bn.

Another small-cap fund, abrdn SICAV I Emerging Markets Smaller Companies, made it into our list. Unlike JPM Emerging Markets Small Cap, it has a double objective of growth and income, while including environmental, social and governance metrics in its investment process.

MS INVF Emerging Leaders Equity is the top quartile fund in the IA Global Emerging Markets sector that has strayed the most from its benchmark.

Manager Vishal Gupta aims to identify and benefit from future drivers of growth across the emerging markets without reference to the benchmark.

The portfolio is concentrated, with 53.6% of invested in the top 10 holdings. It also runs large overweights to India and Brazil and is significantly underweight China.

Two funds from Baillie Gifford – Baillie Gifford Emerging Markets Growth and Baillie Gifford Emerging Markets Leading Companies – also matched our criteria.

The former, managed by Mike Gush, Andrew Stobart and Ben Durrant, takes a bottom-up approach to picking growth stocks, while staying aware of the macro environment.

Analysts at Rayner Spencer Mills Research (RSMR) said: “The team are long-term growth investors looking for stocks that can grow for a number of years above the market average where the duration of growth is underestimated by other investors. They can and do invest in companies which have a level of cyclicality over the short term and can be in less highly-rated sectors than those favoured by investors with a pure focus on secular growth names.

“As emerging markets can be volatile, the team take into account macro factors when constructing the fund including geopolitics. The strength of the team and the process, and its growth with flexibility approach, together with the results generated over the longer term, make the fund worthy of a rating.”

Source: FE Analytics

They suggested using this fund as a core holding for emerging markets but also stressed that it could be blended with a value strategy.

Other top quartile funds with a high tracking error include BNY Mellon Global Emerging Markets Opportunities and Carmignac Portfolio Emergents.

China & India

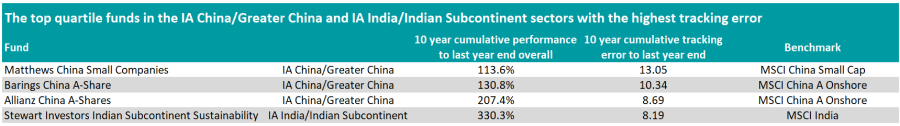

At the country-specific and regional levels, three funds in the IA China/Greater China and IA India/Indian Subcontinent sectors generated top quartile performance over 10 years while having a high tracking error. However, no fund in the IA Latin America has achieved this feat.

Two of the three China funds – Allianz China A-Shares and Barings China A-Share – specialise in China A-shares, which are stocks of mainland China-based companies traded in renminbi on either the Shanghai or the Shenzhen stock exchanges. China A-shares typically exhibit a very low or negative correlation to global markets.

They have historically been the preserve of the citizens of mainland China but are now open to a select number of foreign institutions through the ‘Qualified Foreign Institutional Investor’ system.

The third China fund, Matthews China Small Companies, focuses on Chinese small-caps and has the highest tracking error of the three funds.

Source: FE Analytics

Stewart Investors Indian Subcontinent Sustainability is the only Indian equity fund to have achieved top quartile performance with a high tracking error. While the fund targets capital growth, manager Sashi Reddy and deputy manager David Gait also keep capital preservation in mind.

Analysts at Square Mile said: “We believe this fund's management team should be able to achieve their objectives, but given the nature of this region, the fund can fall short of these at times.

“One could expect that there will be times when the fund is out of favour with the wider market, such as when riskier stocks are in demand or when market participants are chasing certain themes or sectors. It can look and act very differently from the MSCI India index, and as such, it is unlikely to suit investors seeking index-like returns.

“Instead, this is a strategy that tries to address some of the varied risks that investors face in this part of the world, through a process that focuses on the real risks of investing in this region and therefore it might appeal to long-term investors.”