Jonathan Simon, one of the managers of JPMorgan American, will retire in early 2025 after 44 years in the industry.

He has been leading the value portfolio of the investment trust since 2019 when the investment strategy shifted to a higher-conviction approach.

This new approach combines the best ideas from JPMorgan Asset Management's growth and value investment teams, along with a small allocation to US small-caps.

His successor has not been named yet, but JPMorgan Asset Management will make an announcement regarding that matter “in due course”.

While no changes are expected to be made to the investment approach, broker Deutsche Numis noted that some investors may be concerned with the timing of this announcement, as the manager of the growth portfolio, Timothy Parton, also recently retired.

Gavin Trodd, a research associate at Deutsche Numis, highlighted that the transition process has been well flagged, as Parton’s departure was announced in July 2022, but not effective until February 2024.

“His successor, Felise Agranoff, was appointed in August 2022, initially alongside Parton, and is now the lead manager on the large-cap growth portfolio. Similarly, Simon will not retire until early 2025, providing ample time for a replacement to be found and we anticipate an announcement in the coming months,” Trodd said.

“There is no specific deputy for Simon, therefore no obvious successor, but JPMorgan is a well-resourced house, with significant experience in the value team from which to find a replacement.”

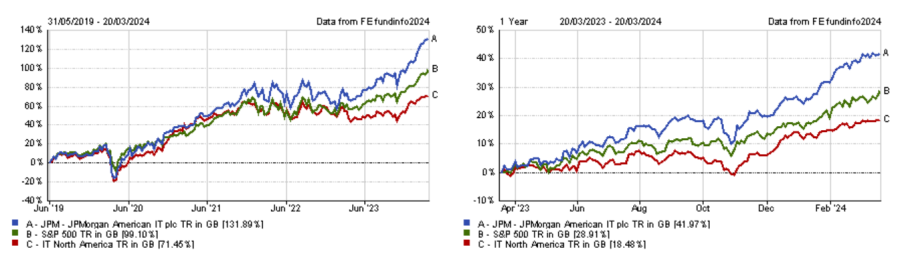

The investment trust has performed strongly since Simon’s appointment in June 2019, comfortably beating the S&P 500 by 32.8 percentage points, according to FE Analytics.

Performance of fund since Simon’s appointment and over 1yr vs sector and benchmark

Source: FE Analytics

Trodd also stressed that JPMorgan American outperformed the index in 2023, despite its broadly equal allocation to both growth and value and the narrow rally dominated by the ‘Magnificent Seven’.