The deadline to use this tax year’s £60,000 self-invested personal pension (SIPP) allowance is fast approaching on Friday 5 April 2024. With days to go, Hargreaves Lansdown has suggested two funds that would suit pension savers’ long-term horizons and deliver capital growth, alongside an income fund for those old enough to access their pension.

Kate Marshall, lead investment analyst at Hargreaves Lansdown, recommended Legal & General Future World ESG Developed Index and Schroder Asian Alpha Plus to grow wealth over the long term, alongside Artemis Income to provide a regular income in retirement.

Artemis Income

There are several reasons to add an income fund to a SIPP portfolio, Marshall said. “You can either take the pay-outs to supplement your income (if you’re old enough to access your pension) or, if you are targeting growth and aiming to build your portfolio for longer, reinvesting dividends can help grow your pot at a faster rate thanks to the effect of compounding.”

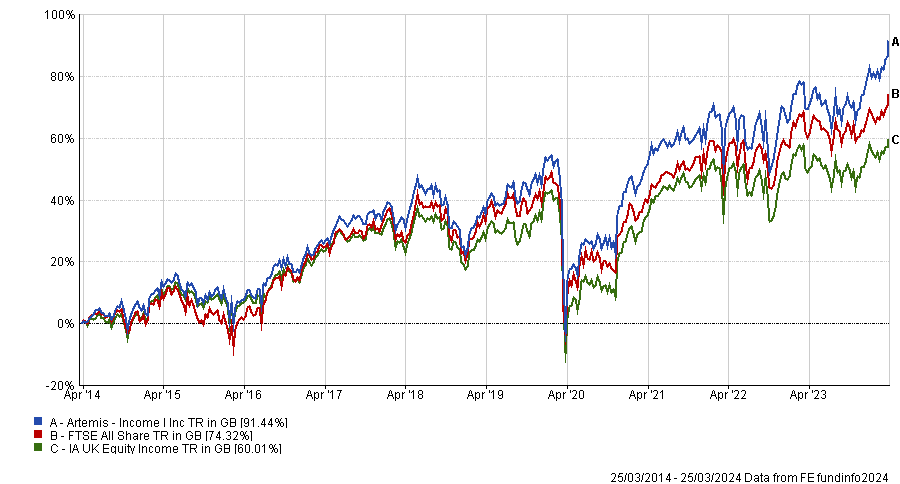

The £4.7bn Artemis Income fund has delivered top-quartile performance over one, three and five years, and is comfortably ahead of its benchmark and sector over 10 years, as the chart below shows.

Performance of fund vs sector and benchmark over 10yrs

Source: FE Analytics

FE fundinfo Alpha Manager Adrian Frost, together with co-managers Andy Marsh and Nick Shenton, focus on UK companies with robust cashflows that can pay a sustainable level of income throughout different economic cycles.

Investors could use this UK-focussed fund as the bedrock of an income portfolio, potentially alongside bond funds and/or a global equity income strategy, Marshall said.

Legal & General Future World ESG Developed Index

The £2bn Legal & General Future World ESG Developed Index fund is a cost-effective passive strategy offering regional diversification across developed equity markets.

It tracks the Solactive L&G ESG Developed Markets index, which incorporates environmental, social and governance (ESG) screens, giving investors a chance to align their SIPP with their values and achieve “long-term growth in a responsible way”, Marshall said.

“It won’t invest in tobacco companies, pure coal producers, makers of controversial weapons or persistent violators of the UN Global Compact Principles. It invests more in companies that score well on a variety of ESG criteria, such as the level of carbon emissions generated and number of women on the board. If companies score poorly on these measures the fund reduces exposure,” she explained.

Performance of fund vs sector over 10yrs

Source: FE Analytics

Schroder Asian Alpha Plus

Multiple factors are driving growth in Asia but the region’s mix of developed and emerging markets can be volatile, “so a long investment horizon is essential,” Marshall said.

“Rapid industrialisation, growing populations and a desire to succeed have helped transform countries in the Asia region. Domestic consumption is set to be a key driver of growth over the coming years, helped by a young and growing population, and rising wealth. Continued innovation from companies at the forefront of technology based there could also provide exciting growth opportunities for investors,” she explained.

Abbas Barkhordar and Richard Sennitt, who manage the £1.3bn Schroder Asian Alpha Plus fund, believe that Asia is “a stock picker’s paradise”, Marshall continued. “Since Asian markets tend to be less researched than developed markets, there is plenty of opportunity to uncover hidden gems.”

Performance of fund vs sector and benchmark over 10yrs

Source: FE Analytics