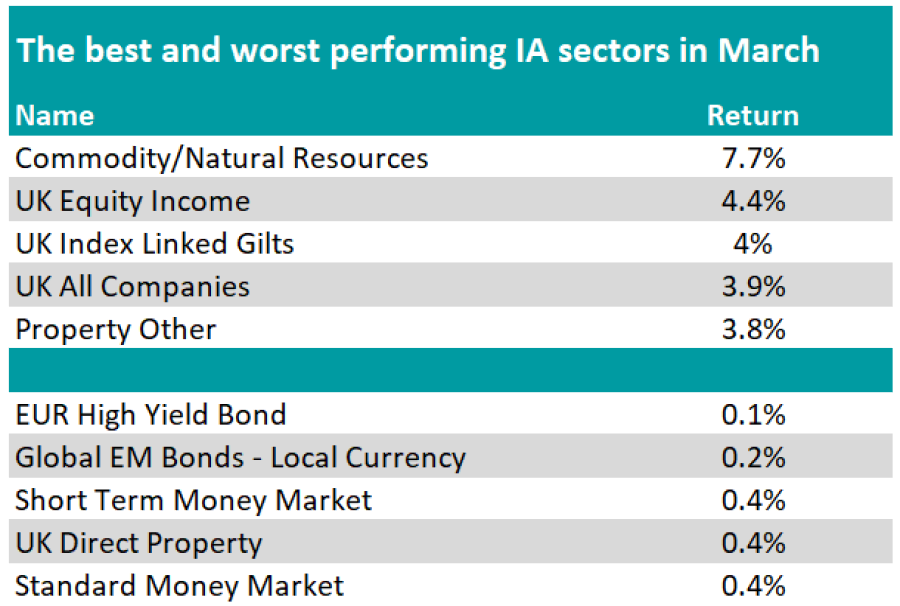

IA Commodity/Natural Resources was the best performing sector in March, as it returned 7.7%, thanks to precious metals. For instance, the price of an ounce of gold rose almost 10% last month.

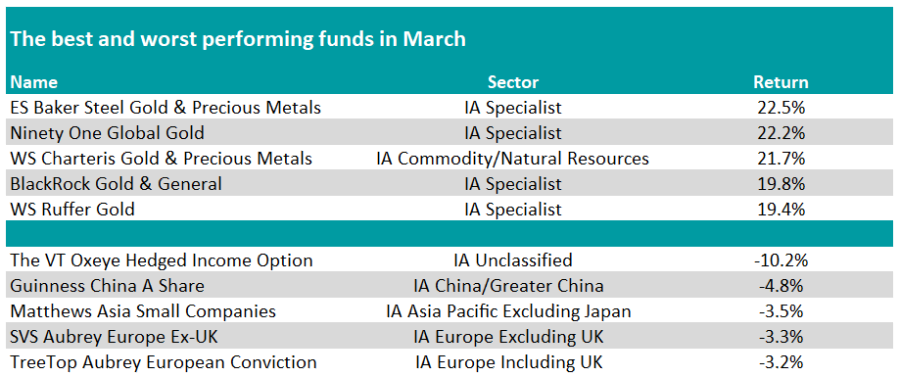

As a result, eight out of the 10 best performing funds were related to gold and precious metals, with Baker Steel Gold & Precious Metals, Ninety One Global Gold and Charteris Gold & Precious Metals topping the table.

Despite the outperformance, Ben Yearsley, director at Fairview Investing, noted that most of those funds are flat since the beginning of the year.

Source: FE Analytics

IA UK Equity Income was the second-best-performing sector in March, as both the FTSE 100 and FTSE All Share gained almost 5%, although it struggled to break out and set a new all-time high like many other markets did.

Yearsley said: “After a strong FTSE showing last month with banks and insurance doing well alongside commodities, it isn’t much of a surprise seeing the UK Equity Income sector coming a creditable second in March gaining 4.4%. Bumper dividends are helping alongside numerous buybacks.”

According to FE Analytics, JOHCM UK Equity Income, Vanguard FTSE UK Equity Income Index and WisdomTree UK Equity Income UCITS ETF were the three best-performing funds in the sector.

The strong display of the FTSE All Share also benefited IA UK All Companies, with the sector sitting in the top five in March.

Although all IA sectors were profitable last month, IA EUR High Yield Bond was the weakest one, as it only returned 0.1%.

IA UK Direct Property also did poorly, picking up 0.4%. As the sector has faced tremendous issues in recent years, Yearsley questioned whether the sector will still exist in a year.

Source: FE Analytics

In terms of funds, Oxeye Hedged Income was the worst-performing one, as it fell 10.2%.

“This fund is either feast or famine and clearly not for the fainthearted,” Yearsley said.

There were also a few funds from the IA Asia Pacific Excluding Japan and IA China/Greater China sectors among the worst performers, including Guinness China A Share, Matthews Asia Small Companies and Aubrey China.

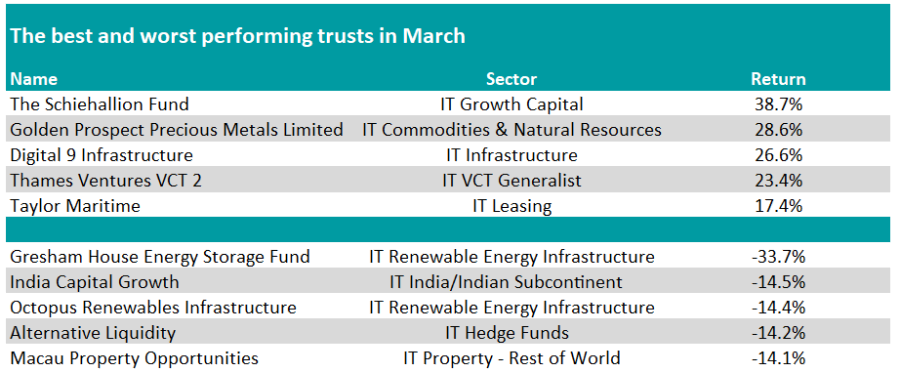

In the world of investment trusts, Baillie Gifford’s Schiehallion Fund claimed the top spot, as it made 38.7%.

Source: FE Analytics

Stablemate Scottish Mortgage also featured in the top 10. The trust’s performance was propelled after activist investor Elliott took a 5% stake, although its intentions remain unknown.

Yearsley also highlighted the performance of Digital 9 Infrastructure and Hipgnosis Songs Fund, which rank in the third and 11th positions respectively.

He said: “Both trusts are a long way from their highs, but at least both had a modicum of good news for their suffering shareholders.”

The other way around, Gresham House Energy Storage Fund, India Capital Growth and Octopus Renewables Infrastructure were the worst-performing investment trusts last month.

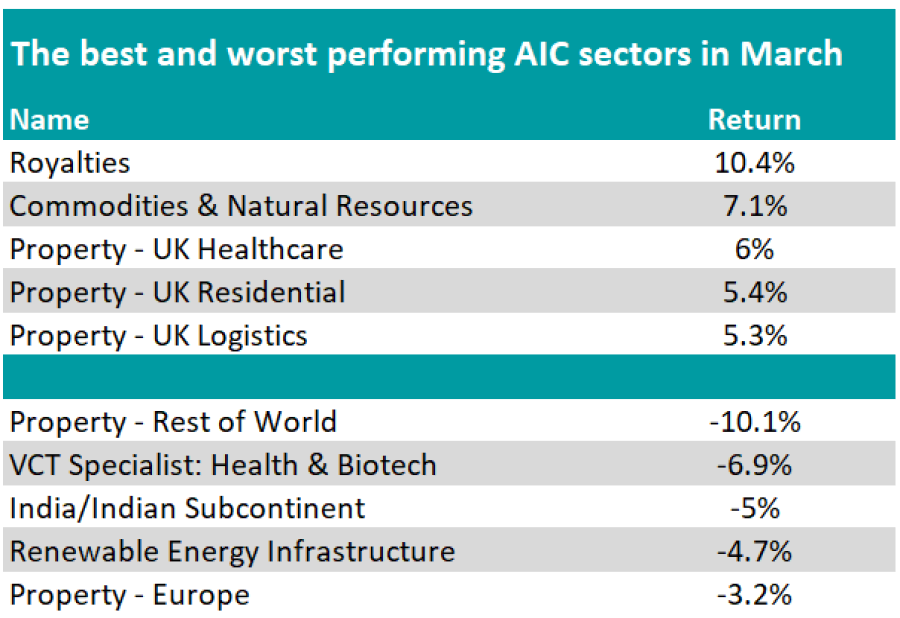

From a sector perspective, IT Royalties, IT Commodities & Natural Resources and IT Property - UK Healthcare are leading the table, while IT India/Indian Subcontinent, IT VCT Specialist: Health & Biotech and IT Property - Rest of World sit at the bottom.

Source: FE Analytics

Yearsley concluded: “Optimism is the name of the game – well if you’re a fund manager it is. Not always known for their forward thinking, fund managers are at their most optimistic for two years – all we need now is those well-known mystic megs, economists, to come to the party.

“On a serious point, the hard landing scenario seems to have gone now with soft or no landing the emperor’s new clothes.”