Investing for the long-term gives savers the advantage of compound interest and parents in particular can benefit from this by filling up their children’s Junior ISAs (JISA). Fund selectors recommended investing in equities to maximise returns, with the luxury of time to ride out periods of volatility, yet, despite this, some 42% of all JISA accounts are held in cash, according to statistics from HMRC.

By opening and using a stocks and shares JISA, parents have the opportunity to consider what trends they expect to play out over a decade or more, and which investment strategies might profit from them.

Long-term trends to look at include ageing populations and increasing demand for healthcare; the growth of emerging market economies; and the potential for companies with superior environmental, social and governance (ESG) practices to outperform. Below, experts give some options for parents who might be nervous about investing their children’s savings more adventurously in the hope of higher returns.

ESG strategies

Planning for a child’s financial future goes hand-in-hand with wanting to make the world a better place for the next generation, suggested Rosie Cook, an investment analyst at One Four Nine Portfolio Management.

“As well as striving for a better future, I truly believe companies which operate with a sustainable focus will face fewer headwinds over the coming decades and will in turn be able to generate stronger earnings growth than those companies facing greater sustainability and ESG risks,” she explained.

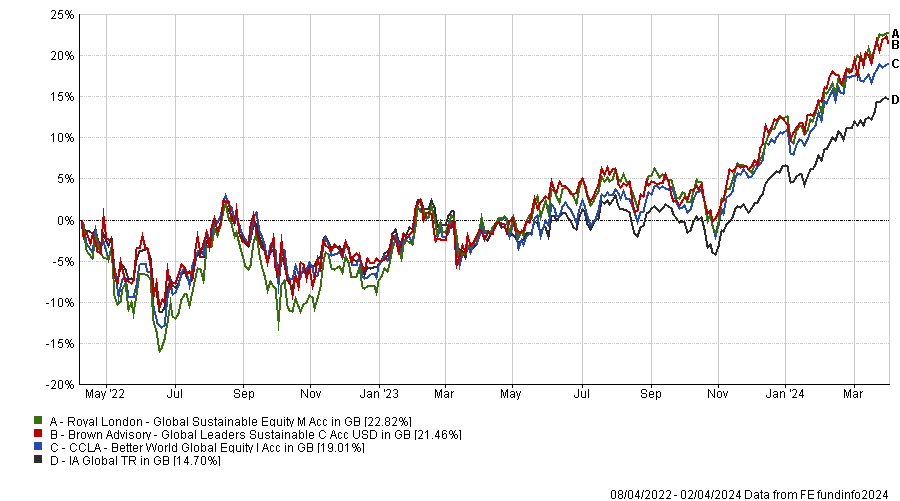

With that in mind, Cook chose CCLA Better World Global Equity, Brown Advisory Global Leaders Sustainable and Royal London Global Sustainable Equity.

CCLA Investment Management “utilises stewardship and engagement with their portfolio companies to produce positive change through the ethos ‘better work, better health and a better planet’,” she said. The £295m Better World Equity fund was launched in April 2022 but CCLA has a long track record running sustainable equity mandates for institutional investors.

The $643m Brown Advisory Global Leaders Sustainable fund is managed by Mick Dillon and Bertie Thomson, using the same investment process as their Global Leaders strategy, but with a back-end negative screening process.

Brown Advisory “seeks out companies using sustainability considerations, typically environmental or social, in a positive way to compound a competitive advantage,” Cook said.

Royal London Asset Management invests in “companies pursuing value creation for shareholders by encouraging good corporate behaviour and providing cleaner, safer and more inclusive products and services,” she continued. The £313m Global Sustainable Equity fund is managed by FE fundinfo Alpha Manager Mike Fox, George Crowdy and Sebastien Beguelin.

Performance of funds vs sector since April 2022

Source: FE Analytics

Emerging markets

For parents seeking exposure to the compelling growth trajectory of emerging market economies, Darius McDermott, managing director at Chelsea Financial Services, suggested FSSA Global Emerging Markets Focus and Invesco Global Emerging Markets.

“Emerging markets have accounted for 66% of global GDP growth in the past 10 years and boast a burgeoning middle class. This translates to attractive long-term growth potential for a JISA,” he explained.

Naren Gorthy and Rasmus Nemmoe at FSSA Investment Managers “whittle down a universe of over 35,000 stocks to just 40-45 quality companies which, in their view, can demonstrate sustainable and predictable growth over the long term,” McDermott noted.

With Invesco Global Emerging Markets, “we like the managers’ flexible investment approach, allowing the fund to capitalise on shifting market dynamics and uncover inefficiencies effectively,” he said. The £347m fund is run by Alpha Managers Charles Bond and William Lam, alongside Matthew Pigott and Ian Hargreaves.

McDermott believes that India in particular merits investors’ attention. “India is shining bright amidst a global slowdown and is a top performer in emerging market portfolios. While valuations are trading on a premium to historical averages, the market’s eye-catching run is far from over thanks to its significant demographic and structural tailwinds, making it a potentially powerful long-term driver of growth in a JISA,” he said.

“We currently like UTI India Dynamic Equity, which offers exposure across the market-cap spectrum to leverage the long-term prospects of this economic powerhouse.”

Performance of funds vs IA Global Emerging Markets sector over 5yrs

Source: FE Analytics

Biotechnology and healthcare

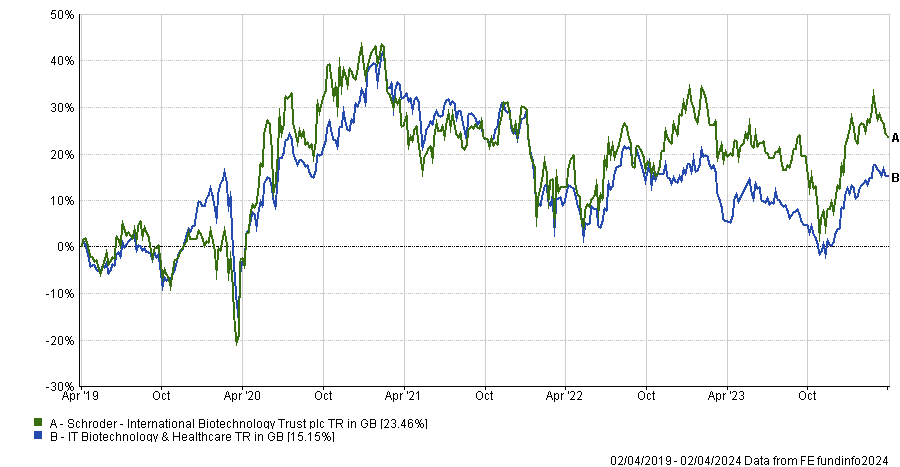

Ryan Lightfoot-Aminoff, investment trust research analyst at Kepler Trust Intelligence, said: “One of the perks of a JISA is that the timescales are so much longer, so the usual risk concerns and behavioural biases that come with investing are much reduced. As such, investors have the freedom to look towards the top of the risk spectrum knowing they have the time to let volatility play out and hopefully capture higher returns.

“Biotechnology is a good example of this. Companies in the asset class have binary outcomes which can mean high risk, but when they get it right can also deliver high returns.”

Lightfoot-Aminoff selected the International Biotechnology Trust (IBT), managed by Ailsa Craig and Marek Poszepczynski. The trust has a market capitalisation of £245m and invests primarily in quoted companies – “complemented by a small of portfolio of private investments, which broadens the investment universe and offers exposure to early-stage companies that peers may not be able to access,” he explained.

The trust also pays a dividend worth 4% of the previous year-end’s net asset value, “which improves the total return prospects and is a key differentiator for a sector primarily focused on capital growth,” Lightfoot-Aminoff continued.

“Long-term performance has been excellent, and while the sector as a whole has seen a pullback due to higher interest rates and recessionary concerns, IBT has comfortably outperformed. As such, not only does IBT offer great long-term potential, but now could prove a very timely entry point.”

Performance of trust vs sector over 5yrs

Source: FE Analytics

Private equity

Another investment company with an impressive long-term track record in a high risk asset class is HgCapital Trust.

Jonathan Moyes, head of investment research at Wealth Club, said: “Investments in a junior ISA benefit from the most valuable investment commodity, time. However, that means you ideally want to pick investments that can be relied upon to quietly do their thing for 10 years or more.

“HgCapital Trust has been a great example of that for decades. Its focus on the core private equity markets of B2B software and services has delivered reliably impressive returns for over 30 years.”

Hg* is one of the world’s largest private software and services investors, backing businesses providing mission critical services such as human resources, compliance, payroll and accountancy services. It has a team of around 130 investment professionals and manages $65bn.

“Its specialist expertise and scale provide it with a real competitive advantage when sourcing and backing private software businesses,” Moyes said.

The trust’s top 20 underlying companies (76% of the portfolio by value) grew revenues by 25% on average and earnings by 30% in 2023. In the past 15 years (to February 2024) the trust has delivered an annualised NAV total return of 23.5%.

“While many private equity trusts are trading at discounts of between 20-40%, HgCapital currently trades on a more modest 10% discount – although that is by no means expensive, in our view,” he noted.

Performance of trust vs sector over 5yrs

Source: FE Analytics

*Hg is an investor in FE fundinfo, Trustnet’s parent company.