Picking a veteran name to run your money can be a solid strategy. With years of track record to pour over, having the knowledge that their funds have performed well over the long-term can be of comfort to investors who want to make their cash work hard.

But it also comes with risks. Some experienced managers may lose their mojo after several decades at the helm of their fund and live off their reputation at the expense of returns for their investors.

As such, below, Trustnet looks at funds managed by the same person since at least 2004 that have produced top-quartile returns over the past three years – showing they remain at the top of their game.

Only one fund made the list: JPM UK Equity Core. Christopher Llewelyn has been co-manager of the fund since January 2000 and was joined by James Illsley in 2013, Callum Abbot in 2017 and Zach Chadwick in 2021.

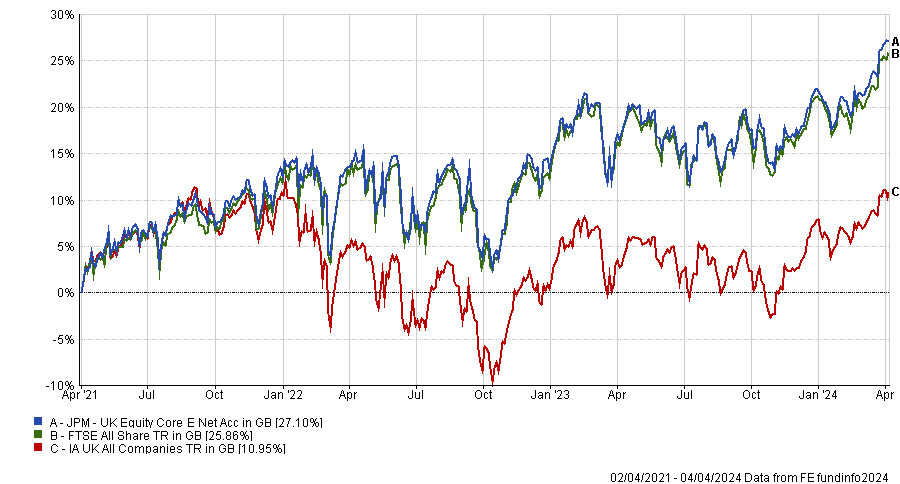

Over the past three years, Llewelyn and his colleagues have made 25.9%, which places JPM UK Equity Core as the 34th best-performing fund in a sector comprising 224 constituents.

The fund is not purely active. It aims to provide consistent returns moderately ahead of the FTSE All-Share Index, meaning it is benchmark aware. The managers use a quantitative model, which forms the stock selection part of the portfolio, using factors to determine a stock’s quality, value and/or momentum characteristics. They then moderately overweight or underweight stocks to gain an edge on the market.

Analysts at RSMR, who rate the fund, noted it can be 1% higher or lower in both stock and sector active holdings, however the internal limit for this is currently 30bps. “This is due to 30bps being enough to meet the risk budget of the fund, which is a tracking error of 1% relative to the FTSE All Share on a time-adjusted basis,” they said.

Over the past three years, the fund has marginally outperformed the FTSE All Share – achieving its stated objectives. But investors should be aware that it will perform similarly to a UK tracker fund. Indeed, over three years the correlation with the FTSE All Share is 0.98, a figure that only drops slightly to 0.97 over 10 years.

Performance of fund vs sector and benchmark over 3yrs

Source: FE Analytics

Analysts at interactive investor included the fund on the firm’s Super 60 best-buy list. They said: “The process may find market inflection points difficult to navigate, but has shown its ability to produce consistent excess returns over time, particularly when all three of its broad alpha factors have been favoured by the market, such as in 2013 and 2015.”

During the past three years, both the market and the JPM UK Equity Core fund had their strongest year in 2021 when the value style of investment started to outperform the growth approach.

Yet its benchmark-aware approach should not diminish its achievement. Over the past three years just 19% of the IA UK All Companies sector has managed to beat the FTSE All Share index.

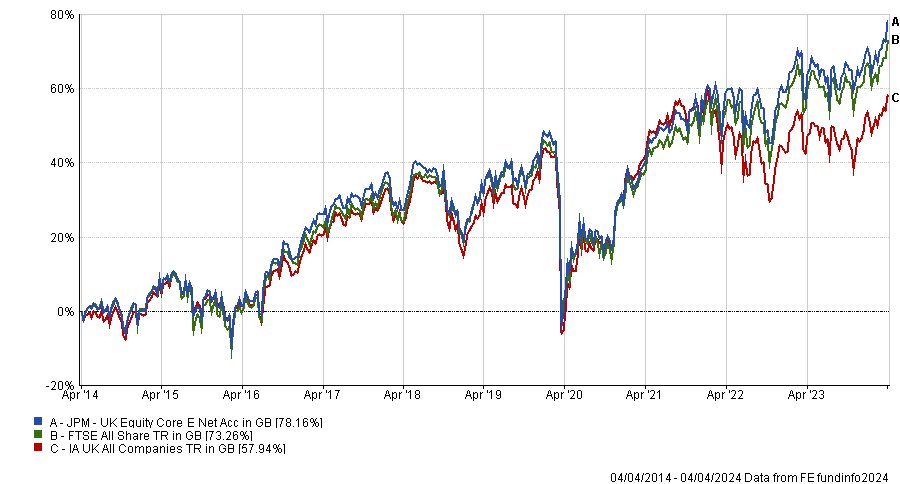

Looking over the longer term, in the past decade the fund has made top-quartile returns once again, up 78.2%, around 5 percentage points ahead of the FTSE All Share index.

Moreover, it has also been one of the least volatile funds over the past decade as well as over three years, while Llewelyn and his team have been among the best at managing bear markets with one of the lowest maximum drawdowns among its peers. It is also one of the cheapest funds in the sector, with an ongoing charge figure of 0.30%.

Performance of fund vs sector and benchmark over 10yrs

Source: FE Analytics

Analysts at interactive investor added that the fund is well diversified, given the nature of benchmark-aware portfolios, but warned the active share will be much lower than concentrated funds.

“The fund is clearly managed as a core UK equity offering, with deviations from the FTSE All-Share Index closely monitored, and should not therefore be expected to produce high levels of outperformance. However, the process has shown its ability to deliver relatively consistent alpha over time, net of the competitive fund-level fees,” they concluded.