Now could be a good time to start building an allocation to fixed income, as central banks are expected to cut interest rates this year. However, it might be daunting for investors to build an exposure to the asset class given its complexity.

Therefore, Trustnet has asked experts to build comprehensive bond portfolios that should hopefully do well once the time will come for central banks to lower rates.

They all included government bonds and investment grade corporate credits in their respective portfolio as a starting point, but more adventurous investors might also want to look at high yield and emerging markets debts to try to get even higher returns.

Vanguard UK Government Bond Index, TwentyFour Absolute Return Credit and Artemis Corporate Bond

Jason Hollands, managing director at Bestinvest, built an exposure to fixed income aiming to provide attractive yields but with relatively defensive positioning that would suit a more cautious investor. This bond allocation should also act as a ballast to the equity exposure in the overall portfolio.

The funds he picked to achieve those goals are Vanguard UK Government Bond Index, TwentyFour Absolute Return Credit and Artemis Corporate Bond.

Vanguard UK Government Bond Index is a low-cost option to access 82 gilts across the maturity spectrum. Hollands said it is the fund he would prioritise in the list.

He explained: “Gilt yields are compelling in real terms given the diminishing inflation outlook, but have been in retreat since their peaks last autumn given growing expectations of interest rate cuts.

“Unless there is a surprise renewed uptick in inflation (which is unlikely given the new energy price cap), the window to lock in current attractive yields is therefore probably quite limited.“

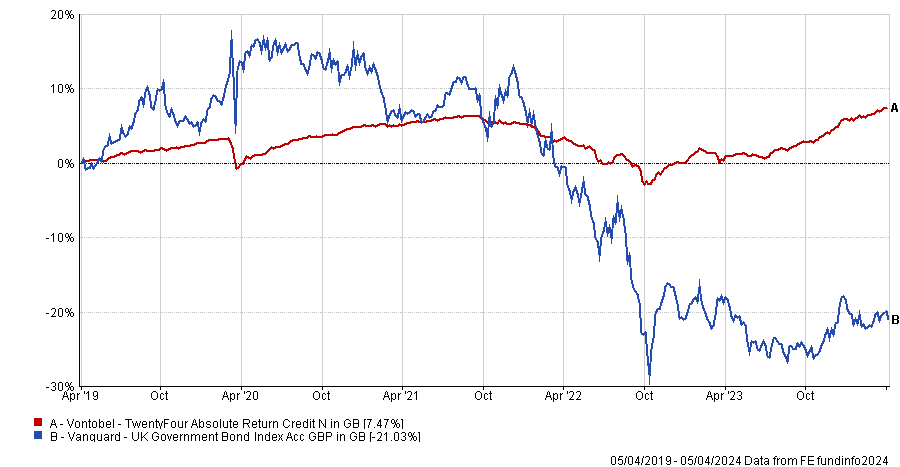

Performance of funds over 5yrs

Source: FE Analytics

TwentyFour Absolute Return Credit, managed by Chris Bowie, aims to provide a defensive allocation to short-dated credits.

The fund invests a minimum of two thirds of the portfolio in investment grade bonds with less than five years until maturity.

Hollands said: ”Unlike many funds that carry ‘absolute return’ in their names and deploy derivatives as part of their strategies, this fund has a simple but effective strategy of focusing on short-dated bonds to minimise volatility.”

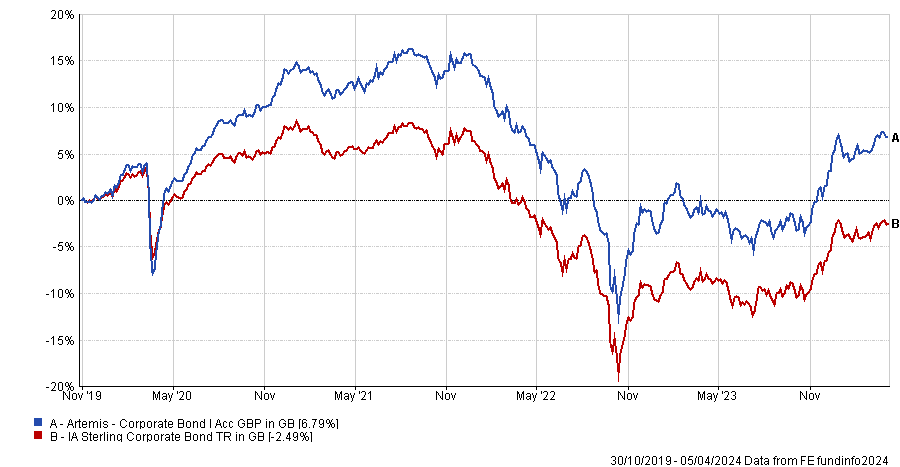

Performance of fund since launch vs sector

Source: FE Analytics

Finally, Hollands chose Artemis Corporate Bond, run by Stephen Snowden and Grace Le, to get exposure to corporate bonds from high quality issuers.

iShares UK Gilts ETF, Artemis Corporate Bond, Invesco High Yield and M&G Emerging Markets Bond

Paul Angell, head of investment research at AJ Bell, suggested to build the core of a fixed income portfolio with both a government and a corporate bond fund. Investors may then want to add high yield and emerging markets bond funds as satellites to boost the overall level of income.

The exposure to UK government bonds is gained through iShares Core UK Gilts ETF, which is another low-cost option investing across the maturity spectrum.

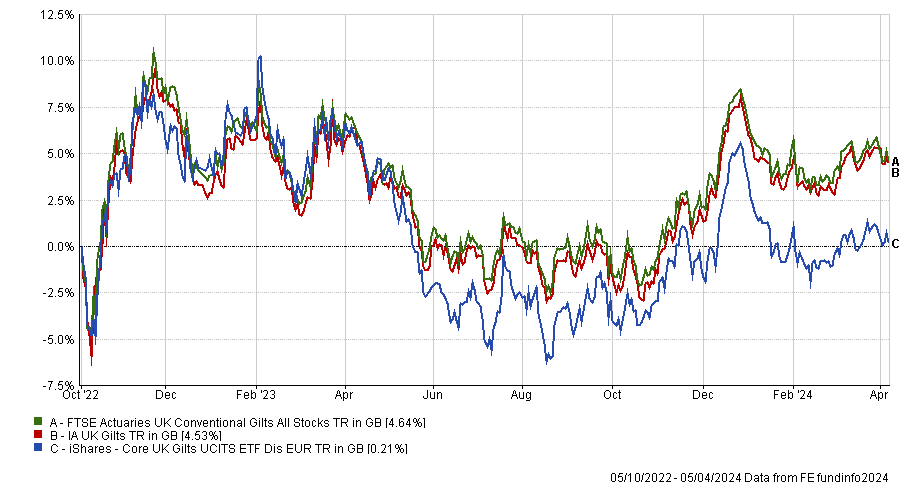

Performance of fund since launch vs sector and benchmark

Source: FE Analytics

For corporate bonds, Angell also picked Artemis Corporate Bond. He said: “The fund is typically run with a higher beta than the index, with tracking error contribution fluctuating between duration and credit positioning.

“That said, the managers have kept the fund’s duration within 1.5 years of the index since launch, ensuring its return profile has remained equivalent to that of wider fixed income markets.”

Moving on to the satellite part of the portfolio, Angell chose Invesco High Yield to get exposure to higher risk bonds.

The manager, Tom Moore, invests across a combination of higher quality bonds, subordinated financials and more speculative special situations.

Angell explained: “Given the volatility of the latter two components, the fund is typically at the higher beta end of its market. Moore’s positioning in financials has been particularly beneficial to relative returns over the years, and he continues to seek good opportunities in the sector.”

Finally, Angell selected M&G Emerging Markets Bond to get access to the emerging market debt space.

He said: “The neutral split across emerging markets government (two third) and emerging markets corporate (one third), alongside developed market currency (two third) and emerging markets currency (one third), results in a nicely diversified portfolio of risk factors.

“The team’s bottom-up credit selection typically generates a higher yield than the index, given the team’s preference for both high yield issuers, as well as peripheral country bonds.”

Performance of funds over 5yrs vs sectors

Source: FE Analytics

Colchester Global Bond, M&G Corporate Bond and JPM Global High Yield Bond

To get an exposure to government bonds from developed markets, Tom Stevenson, investment director at Fidelity International, picked Colchester Global Bond, which should provide “useful insurance against global crises or recession risk”.

He explained: “The purest interest rate play is a government bond because these have almost no credit or default risk. A developed world government is extremely unlikely to default on its obligations to bondholders.”

To get a higher income, investors can add an exposure to corporate bonds in their portfolios. However, it comes with greater risk, as companies are more likely to default than governments, which is why investors get a better compensation.

Performance of funds over 10yrs vs sectors

Source: FE Analytics

As a result, Stevenson suggested M&G Corporate Bond for more risk-averse investors, as this fund focuses on lower-risk companies.

For investors prepared to take on even more credit risk in the pursuit of an even higher income, he also pointed to JPM Global High Yield Bond.

“The investment team is based in the US, where the majority of high yield bond issuers are located,” Stevenson added.

Performance of fund vs sector and benchmark over 5yrs

Source: FE Analytics

Finally, Stevenson also mentioned M&G Global Macro Bond for investors who would rather hand over all the decision making to an expert.

He concluded: “This is a flexible fund that can invest across multiple regions and lend to a range of borrowers across the risk spectrum. It is run by one of M&G’s most experienced managers who is supported by a strong team of analysts.”