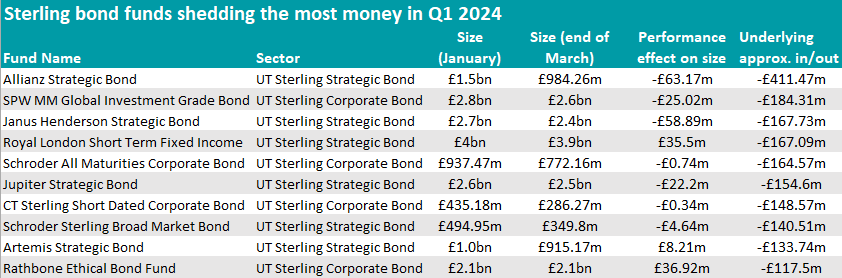

Taking macro views sometimes pays off and at other times is hard to get right. Mike Riddell’s Allianz Strategic Bond fund and John Pattullo's Janus Henderson Strategic Bond fund have been on the latter side of the equation lately, with investors taking money out of the funds and putting it instead into short-duration strategies.

This is what emerged from the latest FE Analytics data on fund flows for the first quarter of 2024.

The largest sum was withdrawn from Mike Riddell’s Allianz Strategic Bond fund, which shed almost half a million in 2024 (£411.5m to be precise, exacerbated by £63.2m in performance-related losses).

Performance of fund against sector and index over 1yr

Source: FE Analytics

The strategy has come down from its heyday in May 2021, when it had amassed a £3.5bn war chest, to today’s £962.4m in assets under management. Part of this decline is down to the manager’s ultra-defensive stance, whose preference for the longer-maturity part of the market hasn’t paid off.

Despite this, FE Investments analysts continue to rate the fund.

“Riddell has been able to time fixed-income markets impressively for the most part, often by implementing contrarian views that have driven superb performance over the long term,” they said.

“More recently the timing of some of the team’s market calls has proven premature, meaning the fund has struggled to maintain pace with the benchmark. Nonetheless, Riddell is able to clearly articulate and justify the ongoing active bets in the portfolio.”

Source: FE Analytics

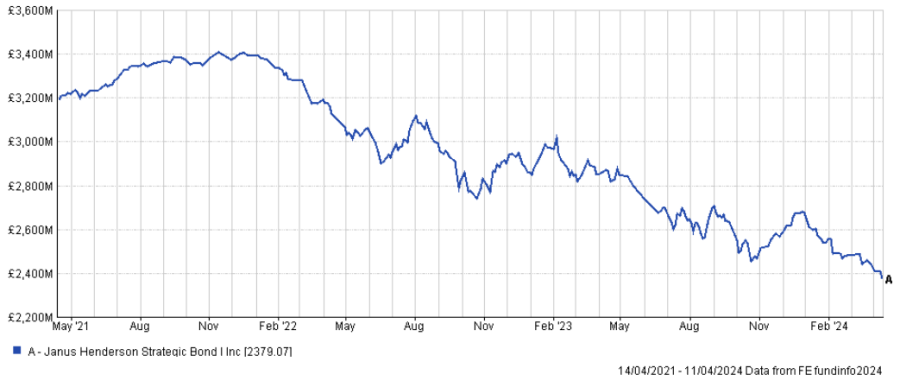

Remaining in the IA Strategic Bond sector, Janus Henderson Strategic Bond was also penalised by investors, who took £167.7m out of the fund. Performance hasn’t helped, and assets under management (AUM) have shrunk from their peak of £3.4bn in November 2021 to the current £2.3bn, as shown in the chart below.

Despite the recent struggles, FE Investments analysts spoke positively of the strategy.

“Accurate economic analysis is key to the fund’s performance. This is something that is hard to get right every year, but the team has a strong track record in market calls, albeit interest rate positioning proving particularly costly over 2022,” they said.

“It is a good option for those who want a manager capable of being flexible with their bond allocation depending on the macroeconomic environment.”

Fund size since peak

Source: FE Analytics

The Royal London Short Term Fixed Income fund also had to part with a similar sum (£167.1m) but was one of the few funds to add some money through performance (£35.5m).

In that, it was only outdone by the Rathbone Ethical Bond Fund, which focuses on corporate bonds and returned £36.9m between January and March this year.

In the IA Corporate Bond sector, Schroder All Maturities Corporate Bond and CT Sterling Short Dated Corporate Bond also suffered similar outflows.

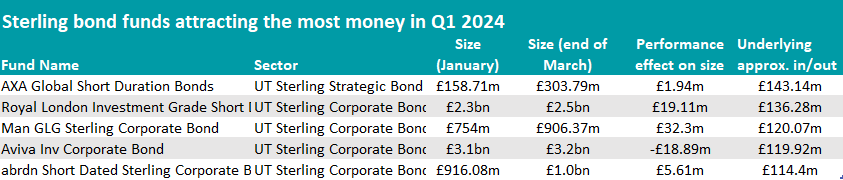

While 10 funds lost more than £100m, only five managed to do the opposite and added the same amount or more.

Most of them were short-duration strategies, which have been going through a renaissance, profiting from anticipated rate cuts.

Here, the AXA Global Short Duration Bonds fund attracted the most buyers.

The portfolio can now count on an extra £143.1m of investors’ money, which almost doubled the fund’s AUM, taking it from £158.7m to £303.8m.

It is run by FE fundinfo Alpha Manager Nicolas Trindade and Nick Hayes and was highlighted by Square Mile analysts as an “attractive fund for investors seeking some income and the potential diversification benefits that investing in fixed income can bring without the volatility of a full duration product.”

Source: FE Analytics

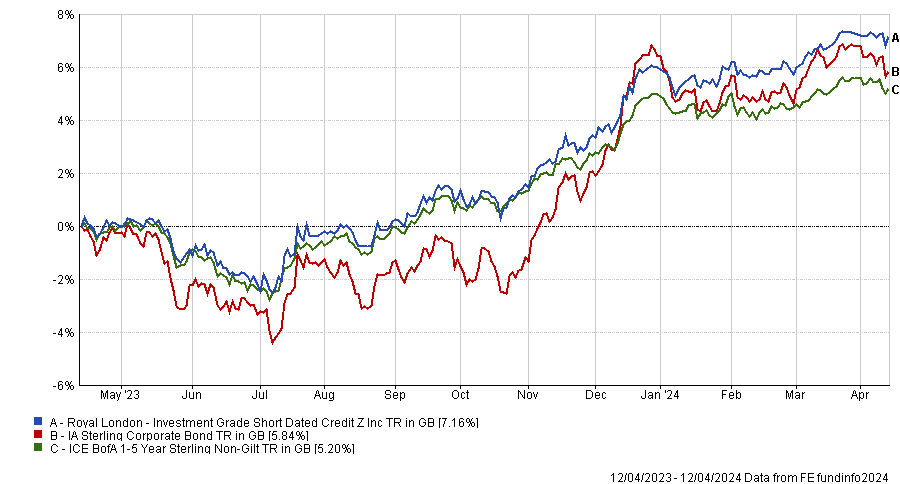

The largest and most popular fund in the list was Royal London Investment Grade Short Dated Credit, which added £136.3m to the £2.3bn it had at the beginning of the year.

It has been growing consistently since 2021, when its portfolio was worth £1.4bn. In the past 12 months, it returned 7.2% against the sector’s 5.8%, as the chart below shows.

Performance of fund against sector and index over 1yr

Source: FE Analytics

The best returns, however, were made by the Man GLG Sterling Corporate Bond fund, which gained £32.3m from investment performance and attracted £120.1m in inflows between January and March.

It is managed by FE fundinfo Alpha Manager Jonathan Golan, a “young, talented fixed income manager, passionate about credit selection”, as Square Mile analysts described him, who moved to Man GLG and launched this fund in September 2021.

“Different from many other funds in the sterling corporate bond space, this fund's edge lies in its bottom-up focus on smaller issuers and the team's ability to extract alpha from undervalued credits which are overlooked by larger scale investors,” they said.

“This fund is for those investors looking to access strong returns from the sterling corporate bond market but are willing to endure periods of elevated volatility.”

Aviva Inv Corporate Bond also attracted more than £100m of inflows, as did the passive abrdn Short Dated Sterling Corporate Bond Tracker fund.